Our goal is to amplify wealth by the most logical means available.

We combine modernized financial planning from CFP® professionals with scientific portfolios designed to reward investors based on factors that historically drive return.

We combine modernized financial planning from CFP® professionals with scientific portfolios designed to reward investors based on factors that historically drive return.

Ongoing Advice and Investment Management

Built on Three Powerful Ideas

Built on Three Powerful Ideas

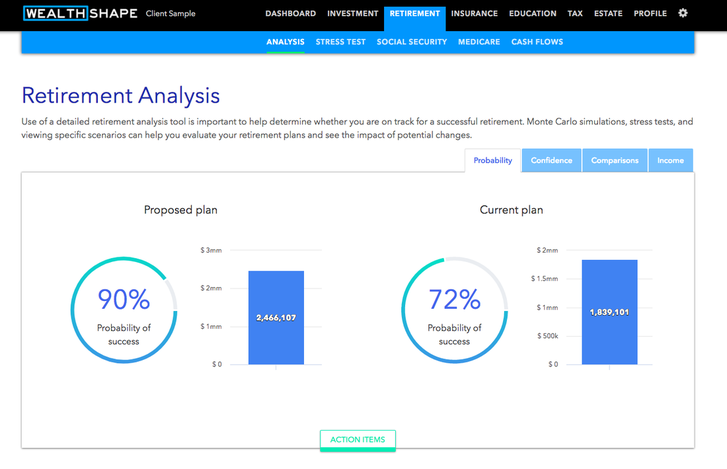

1. Financial planning should be modern and more accessible.

Financial planning shouldn’t be static. It should be vibrant and ongoing. We provide comprehensive access to all your investments, goals and progress in one easy to understand, secure location. We recognize that the critical role of a financial advisor is to become the guidance a client needs. At WealthShape we make CFP® professionals available to all our clients, not just the ultra wealthy.

Financial planning shouldn’t be static. It should be vibrant and ongoing. We provide comprehensive access to all your investments, goals and progress in one easy to understand, secure location. We recognize that the critical role of a financial advisor is to become the guidance a client needs. At WealthShape we make CFP® professionals available to all our clients, not just the ultra wealthy.

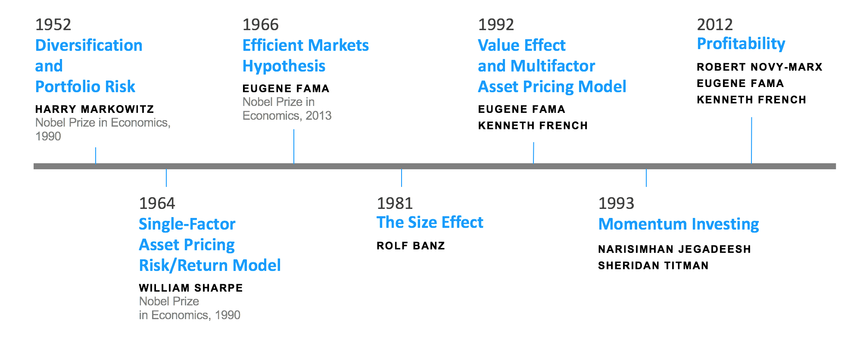

2. Investing should be based on empirical evidence.

We specialize in the real world application of academic and Nobel Prize winning research. Our foundation is built on data; independent thinking; adaptively; and making adjustments as we discover more. As students of capital markets, we believe that there are smarter ways to compensate investors for taking risk. It’s a commitment to over 60 years of financial science, based on the factors that drive investment returns.

We specialize in the real world application of academic and Nobel Prize winning research. Our foundation is built on data; independent thinking; adaptively; and making adjustments as we discover more. As students of capital markets, we believe that there are smarter ways to compensate investors for taking risk. It’s a commitment to over 60 years of financial science, based on the factors that drive investment returns.

3. Services should be responsibly delivered as a fiduciary.

Our culture isn't about focusing on what’s best for the firm, but what’s best for the client. We uphold the highest legal standard to act in an investor’s best interest. WealthShape doesn’t recommend solutions that are simply suitable. Instead, we only recommend investments that are right for your unique situation. There is a difference.

Our culture isn't about focusing on what’s best for the firm, but what’s best for the client. We uphold the highest legal standard to act in an investor’s best interest. WealthShape doesn’t recommend solutions that are simply suitable. Instead, we only recommend investments that are right for your unique situation. There is a difference.

It starts with a conversation and a simple purpose.

We ask questions, discuss ideas and see if our services can help you meet your long-term financial goals.

We ask questions, discuss ideas and see if our services can help you meet your long-term financial goals.