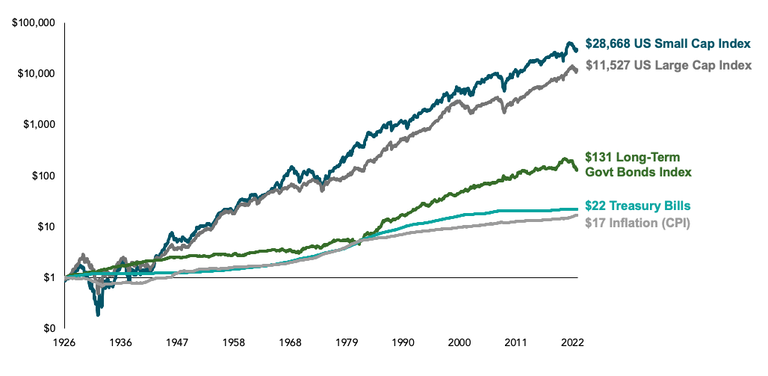

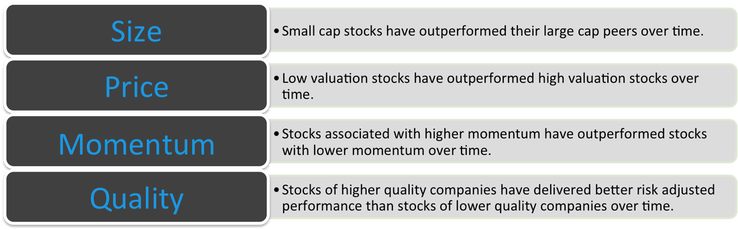

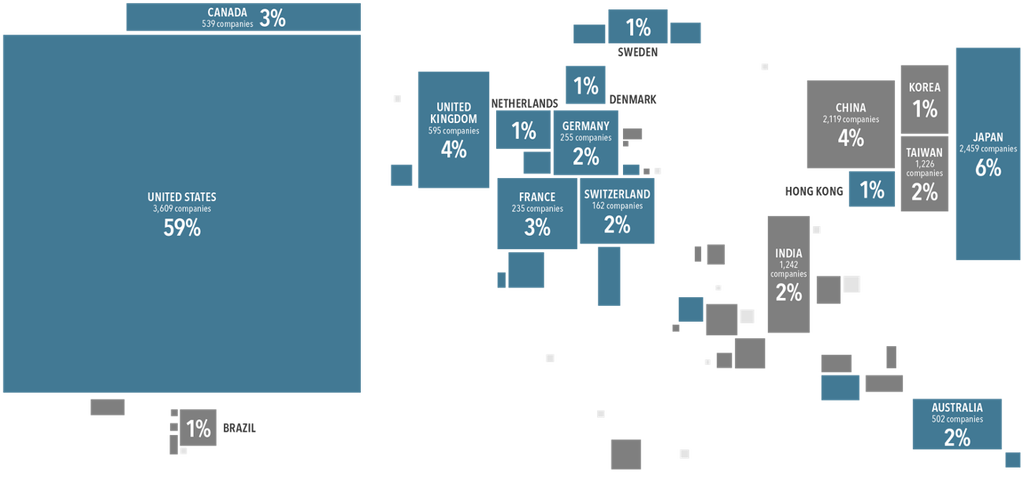

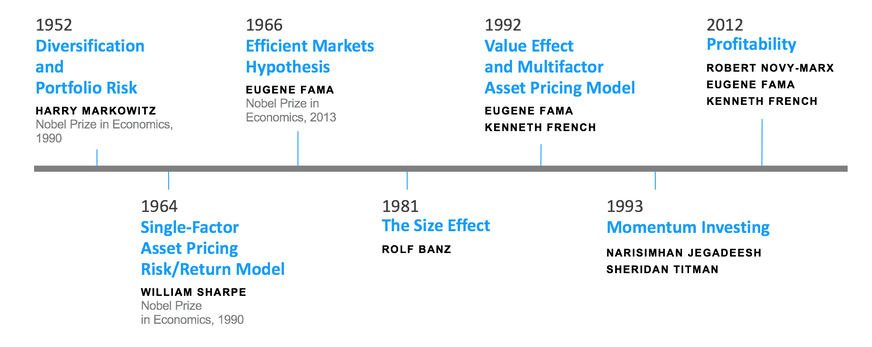

Our evidence driven approach puts over 90 years of financial science to work for clients by translating compelling research into best-of breed investment portfolios. The result is broadly diversified, tax efficient solutions that capture the power of markets and the factors that historically explain investment returns.