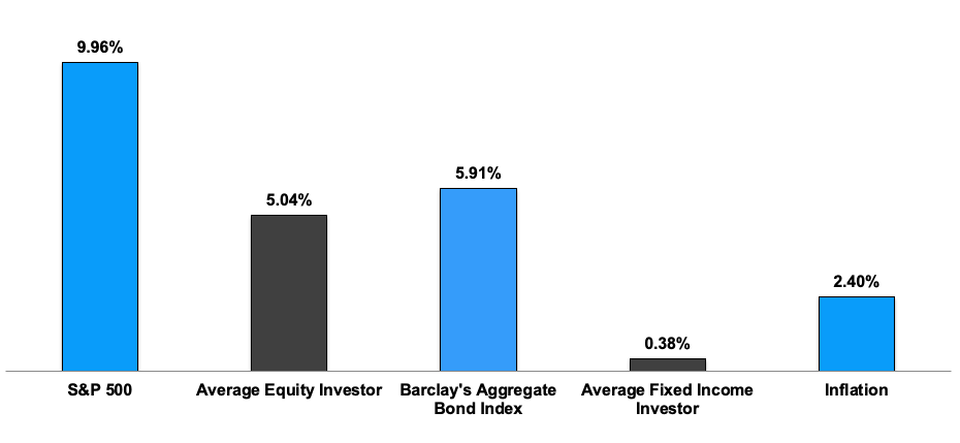

The Behavioral Impact On Investing

WealthShape adheres to a long-term, disciplined investment approach that is grounded in market efficiency and an understanding of human nature. To achieve long-term goals, we believe that investors must avoid reaction to short-term investment cycles. DALBAR, Inc.'s “Quantitative Analysis of Investor Behavior” study looks back at the previous 30 years to evaluate actual investor returns, as well as the behaviors that produce those returns. The results of the study, conducted from 1990 through 2019, showed the average investor earned approximately 5.04% of the 9.96% that the U.S. equity market (measured by the S&P 500 Index), and just .38% of the 5.91% that the U.S. bond market (measured by the Barclays Aggregate Bond Index) returned during the same time.

30 Year Returns through December 2019

Source: DALBAR, Inc.'s “Quantitative Analysis of Investor Behavior”

2020

2020