Wealth Management

|

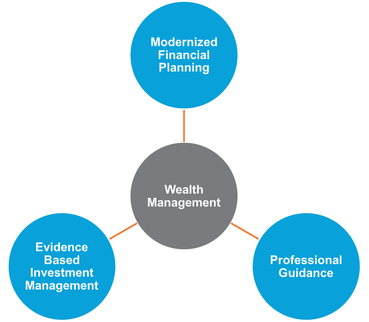

Our Wealth Management Services unite evidence based investing with customized financial planning and professional guidance. We have the ability to serve clients from anywhere, utilizing our powerful modernized financial planning software and leading-edge security encryption.

The cornerstone of our approach is a Nobel Prize winning investment management philosophy and an ongoing partnership with a CERTIFIED FINANCIAL PLANNER™ professional. As a Fee-Only fiduciary we only make recommendations that are in your best interest and never sell commissioned products. It’s a promise to do what's right for you and you alone. |

All Wealth Management Clients Receive

|

Ongoing Portfolio Management

Institutional grade portfolio design & management based on the real world application of over 60 years of academic and Nobel Prize winning research. |

Customized Financial Planning

Pro-active guidance on all financial matters including tax planning, saving for retirement, 401(k) advice, saving for college, debt and risk management, insurance needs, and estate planning strategies. |

Unlimited Access to your CFP® Professional

We're here whenever you need us. Face-to-face, web-meeting, phone, email – whatever works best for you. |

24/7 Access to your entire Financial Picture

View all your investments, goals and progress in one easy to understand, secure location at any time. |

Low Transparent Fee Structure

|

0.55% - 0.85%

Annual fee based on total assets under management

|

In 2019 the average annual fee charged by financial advisors for accounts below 1 million dollars was in excess of 1.00%.* Fees matter because every addition dollar spent on them, is one less that could be earning potential return. Over time fees can have a great impact on investment performance. Our innovation, ongoing advice and advanced portfolio design is all-inclusive and made available at a fraction of the average advisory fee.

|

We believe in complete transparency and pay very close attention to additional costs associated with trading and internal fund expenses. We aim to keep these costs as low as possible while maintaining our discipline to the advancement of investment design.