Portfolios

Our Process: Evaluate Research > Collect Data > Select Investments

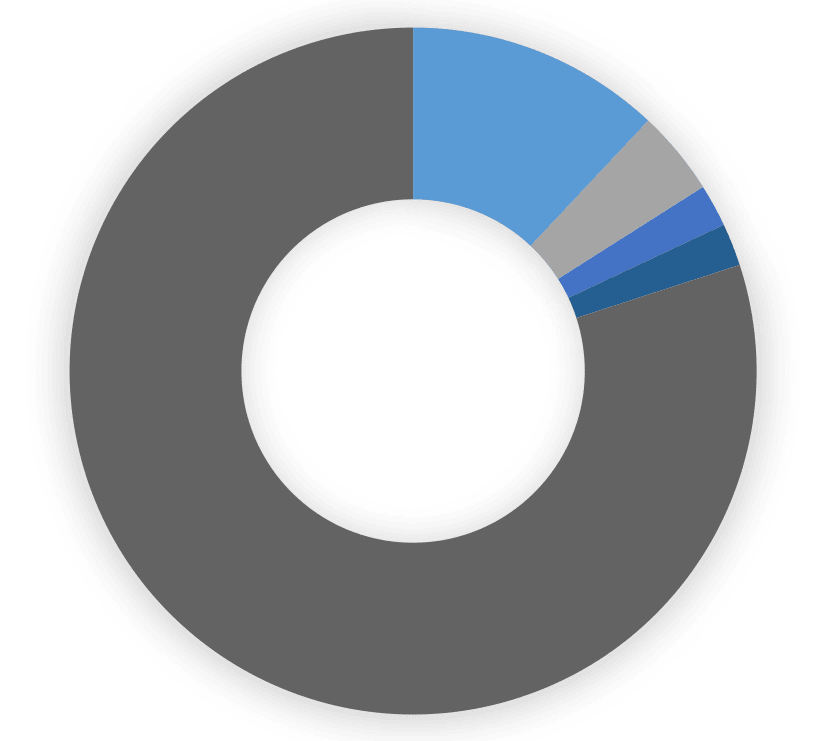

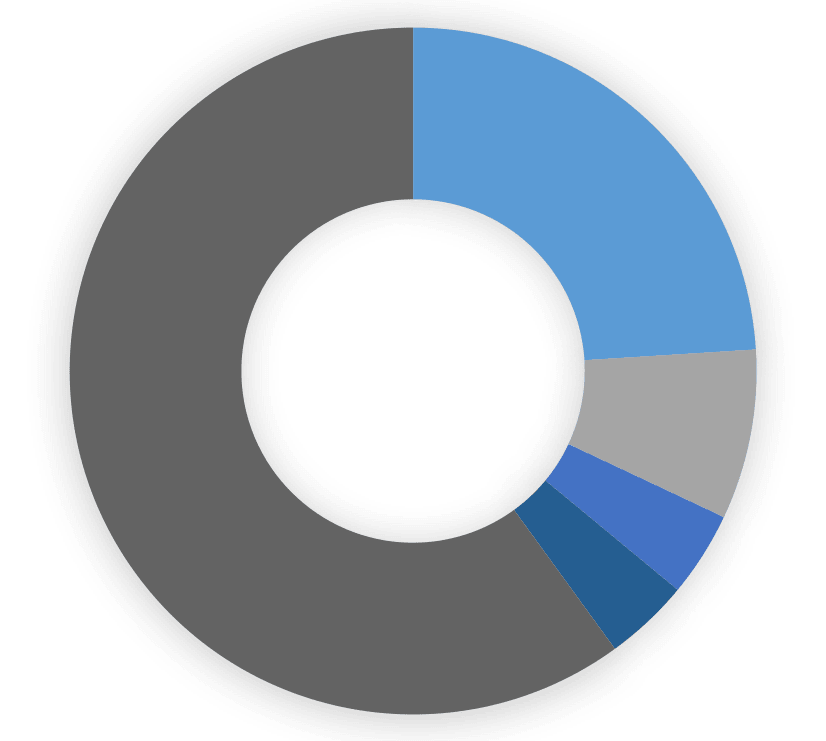

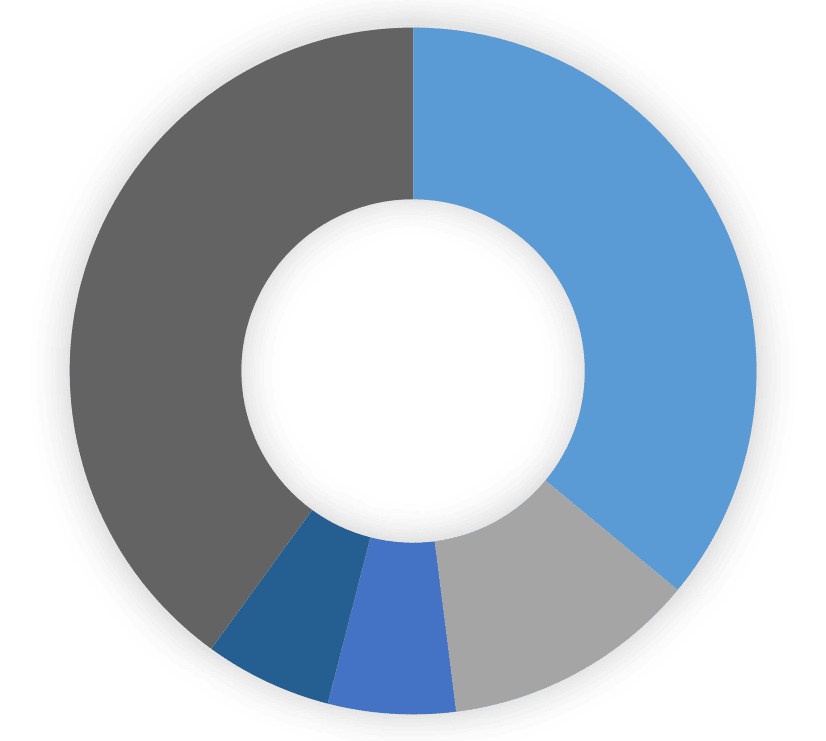

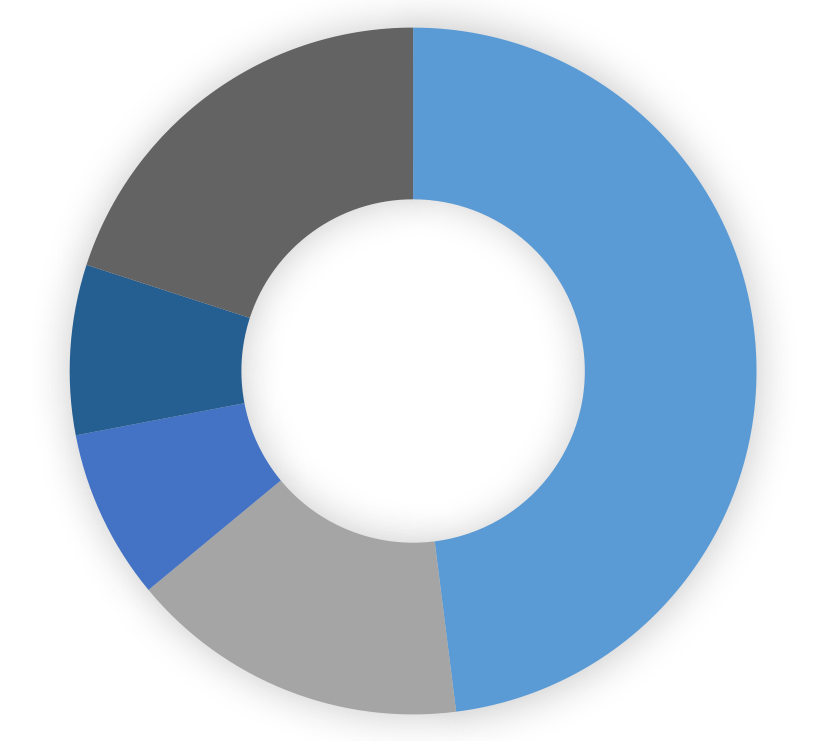

We start by evaluating over 90 years of investment research, identifying the strongest ideas backed up by empirical evidence. Next, we carefully collect data by sorting through thousands of indices to determine the best way to capture research for real world application. The final step is to select investments by filtering the universe of funds to determine the best representation of both research and data. The result is broadly diversified portfolios that capture the power of naturally efficient markets and the factors that historically explain investment returns. Our strategies are built to serve investors across the spectrum from conservative to aggressive.

We start by evaluating over 90 years of investment research, identifying the strongest ideas backed up by empirical evidence. Next, we carefully collect data by sorting through thousands of indices to determine the best way to capture research for real world application. The final step is to select investments by filtering the universe of funds to determine the best representation of both research and data. The result is broadly diversified portfolios that capture the power of naturally efficient markets and the factors that historically explain investment returns. Our strategies are built to serve investors across the spectrum from conservative to aggressive.