|

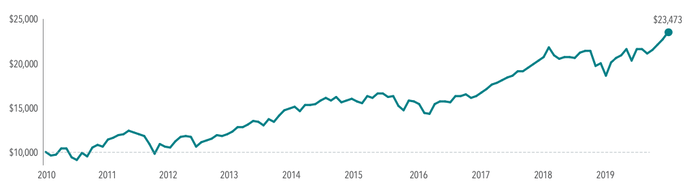

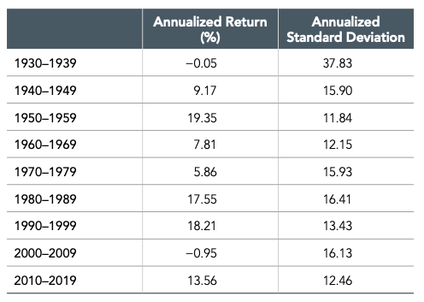

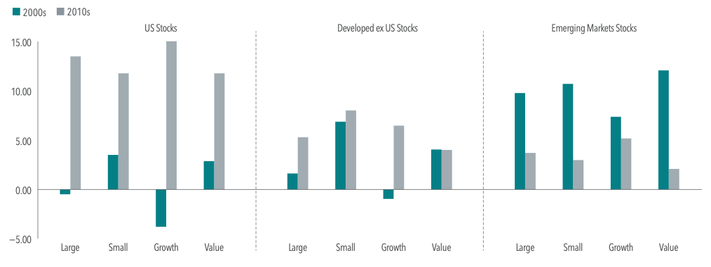

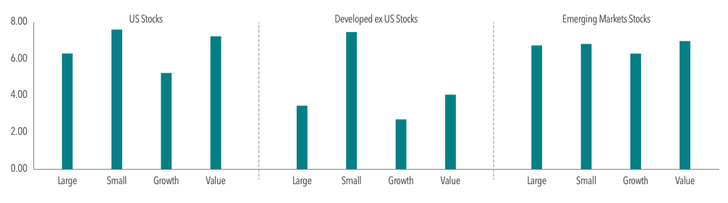

Imagine it is early January 2010 and you are reading a review of the financial markets. Investors have been on a roller coaster over the past three years, living through the stress of the global financial crisis and market downturn of 2008–2009, then experiencing the recovery that began in March 2009 and is still going strong. Investors who rode out the market’s slide are beginning to be rewarded. But the rebound is 10 months old, and markets have a long way to go to reach their previous highs. Opinions are mixed about what might unfold in the coming year. A December 2009 headline in the Wall Street Journal underscored the uncertainty: “Bull Market Shows Signs of Aging.”1 The publication pointed out that, although stocks have rallied and indices are on the rise, worries are mounting in some quarters that the market is running out of steam. From the vantage point of early 2010, you may be wondering whether to stick with your investment plan or move into cash and wait for more evidence that the markets have recovered. Now, fast forward to today and consider what the global equity markets delivered to investors who stayed the course. On a total return basis, global stocks more than doubled in value from 2010–2019, as Exhibit 1 shows. The MSCI All Country World IMI Index, which includes large and small cap stocks in developed and emerging markets, had a 10-year annualized return of 8.91%. From a growth-of-wealth standpoint, $10,000 invested in the stocks in the index at the beginning of 2010 would have grown to $23,473 by year-end 2019. Exhibit 1: Growth of Wealth MSCI All Country World IMI Index, January 2010–December 2019 Despite positive annual market returns during most of the decade, investors had to process ever-present uncertainty arising from a host of events, including an unprecedented US credit rating downgrade, sovereign debt problems in Europe, negative interest rates, flattening yield curves, the Brexit vote, the 2016 US presidential election, recessions in Europe and Japan, slowing growth in China, trade wars, and geopolitical turmoil in the Middle East, to name a few. The decade also brought technological advances in electronic commerce and cloud computing, the global embrace of the smartphone and social media, increased automation and enhanced artificial intelligence, and new products like electric cars and early iterations of self-driving ones. Looking back, you could conclude that the decade had its share of uncertainty—just like the decades before. But overall, the US equity market experienced moderate volatility compared with previous decades. Exhibit 2 displays this by looking at returns and standard deviation, where a higher standard deviation reflects wider market swings during that decade. BENEFITS OF DIVERSIFICATION Exhibit 2: Volatility in Perspective S&P 500 Index annualized returns grouped by decade (1930–2019) Investors who committed to global diversification and to areas of the market associated with higher returns—small cap stocks and value stocks (i.e., stocks trading at low relative prices)—were challenged over the past decade. As shown in Exhibit 3, during the 2000s, investors were generally rewarded for holding emerging markets stocks and developed ex US stocks. During the 2010s, the US market outperformed developed ex US and emerging markets. The performance of value stocks vs. growth stocks (i.e., stocks trading at high relative prices), and small vs. large cap stocks, also varied between decades. Exhibit 3: The Past Two Decades—2000s vs. 2010s Annualized returns (%) Exhibit 4: The Longer View 2000–2019: Annualized returns (%) Small cap and value stocks outperformed large cap and growth stocks in the 2000s, while the 2010s produced mixed outcomes. Small caps underperformed large caps in the US and emerging markets but outperformed in the developed ex US market. Value underperformed growth in all three market regions. Despite underperforming large cap and growth in the US, small cap and value delivered 11.83% and 11.71%, respectively, for the decade. Exhibit 4 shows the cumulative investment experience over both decades, with small cap and value stocks outperforming large cap and growth stocks, respectively, across the US, developed ex US, and emerging markets. The annualized 20-year returns illustrate how diversification can help investors ride out the extremes to pursue a positive longer-term outcome. Over the past decade, global fixed income also posted returns that may have surprised some investors. In 2010, investors looking at historically low interest rates may have expected rising rates as financial markets and economies recovered from the crisis. But over the decade, short-term rates increased while long-term rates decreased. Realized term premiums were positive, as long-term bonds generally outperformed shorter-term bonds. Realized credit premiums were also positive, as lower-quality bonds generally outperformed higher-quality bonds.2 ENDURING PRINCIPLES That brings us to now—January 2020. Stocks and bonds in the US, and in many other developed markets and emerging markets, logged strong returns last year. The US bull market is 10 years old, and current headlines can give investors other reasons to worry about the future—for example, a pushback on globalization, the effects of climate change, the limits of monetary policy, the fate of Brexit, and the vagaries of the 2020 US presidential race. And those are merely the known unknowns. Looking ahead, who can say what the next 10 years will bring? The only certainty is the decade will have its own set of surprises. Here’s what we can learn from the past decade (and the ones that came before it): Despite all the change and uncertainty, the fundamentals of successful investing endured. Diversify across markets and asset groups to manage risks and pursue higher expected returns. Stay disciplined and maintain a long-term perspective. Take the daily news with a grain of salt and avoid reactive investment decisions based on fear or anxiety. Don’t try to predict future performance or time the markets. Instead, develop a sensible investment plan based on a strong philosophy—and stick with it. Investors who follow these principles can have a better financial journey in any decade. All data is from sources believed to be reliable but cannot be guaranteed or warranted. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. No one should assume that any discussion or information contained in this material serves as a receipt of, or as a substitute for, personalized investment, tax or legal advice. Diversification does not eliminate the risk of market loss. Investment risks include loss of principal and fluctuating value. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Appendix Exhibits 1,2 3,4 Past performance is not a guarantee of future results. Source: MSCI. In US dollars, net dividends. MSCI data © MSCI 2020, all rights reserved. Index is not available for direct investment. Performance does not reflect the expenses associated with management of an actual portfolio. S&P 500 Index data provided by Standard & Poor’s Index Services Group. Standard deviation is a statistical measurement of historical volatility. Market segment (index representation) as follows: US Stocks—Large Cap (Russell 1000 Index), Small Cap (Russell 2000 Index), Growth (Russell 3000 Growth Index), Value (Russell 3000 Value Index); Developed ex-US Stocks—Large Cap (MSCI World ex USA Index), Small Cap (MSCI World ex USA Small Cap Index), Value (MSCI World ex USA Value Index), Growth (MSCI World ex USA Growth Index); Emerging Markets Stocks—Large Cap (MSCI Emerging Markets Index), Small Cap (MSCI Emerging Markets Small Cap Index), Value (MSCI Emerging Markets Value Index), Growth (MSCI Emerging Markets Growth Index). Index returns are in US dollars, net of withholding tax on dividends. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2020, all rights reserved. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. 1. “Bull Market Shows Signs of Aging,” The Wall Street Journal, December 7, 2009. 2. Bloomberg Barclays Indices In USD. Growth stocks trade at a high price relative to a measure of fundamental value, such as book value or earnings. Value stocks trade at a low price relative to a measure of economic value, such as book value or earnings. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services. UNITED STATES: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. CANADA: January 6, 2020. These materials have been prepared by Dimensional Fund Advisors Canada ULC. Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Unless otherwise noted, any indicated total rates of return reflect the historical annual compounded total returns, including changes in share or unit value and reinvestment of all dividends or other distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. AUSTRALIA: This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This publication is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Any opinions expressed in this material reflect our judgment at the date of publication and are subject to change. IF YOU ARE A RETAIL INVESTOR IN THE UK, IRELAND, GERMANY OR THE NETHERLANDS, THIS DOCUMENT HAS BEEN PROVIDED TO YOU BY YOUR FINANCIAL ADVISER, WHO CAN HELP EXPLAIN ITS CONTENTS. Neither Dimensional Ireland Limited (DIL) nor Dimensional Fund Advisors Ltd. (DFAL), as applicable (each an “Issuing Entity,” as the context requires), give financial advice. You are responsible for deciding whether an investment is suitable for your personal circumstances, and we recommend that a financial adviser helps you with that decision. NOTICE TO INVESTORS IN SWITZERLAND: This is an advertising document. WHERE ISSUED BY DIMENSIONAL IRELAND LIMITED Issued by Dimensional Ireland Limited (DIL), with registered office 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. DIL is regulated by the Central Bank of Ireland (Registration No. C185067). Information and opinions presented in this material have been obtained or derived from sources believed by DIL to be reliable, and DIL has reasonable grounds to believe that all factual information herein is true as at the date of this document. DIL issues information and materials in English and may also issue information and materials in certain other languages. The recipient’s continued acceptance of information and materials from DIL will constitute the recipient’s consent to be provided with such information and materials, where relevant, in more than one language. WHERE ISSUED BY DIMENSIONAL FUND ADVISORS LTD. Issued by Dimensional Fund Advisors Ltd. (DFAL), 20 Triton Street, Regent’s Place, London, NW1 3BF. DFAL is authorised and regulated by the Financial Conduct Authority (FCA). Information and opinions presented in this material have been obtained or derived from sources believed by DFAL to be reliable, and DFAL has reasonable grounds to believe that all factual information herein is true as at the date of this document. DFAL issues information and materials in English and may also issue information and materials in certain other languages. The recipient’s continued acceptance of information and materials from DFAL will constitute the recipient’s consent to be provided with such information and materials, where relevant, in more than one language. RISKS Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful. Diversification neither assures a profit nor guarantees against loss in a declining market. |

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.