|

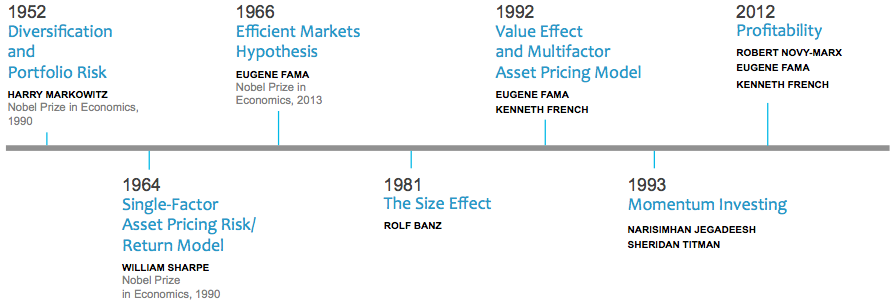

The popularity of index style investing has grown to all time highs. Now that investors have come to recognize it as an intelligent solution, we see the significant development of products marketed as “smart beta”. I get a lot of questions on the topic that goes by a variety of names including enhanced or fundamental indexing. Jargon aside; this column is an effort to put into context this evolution of index investing. Indexing has been around for over 40 years. The initial idea was a simple one. Identify all of the companies that are publicly traded, assemble a list, buy all those companies and weight their exposure based upon their overall footprint. It’s called market cap weighting or cap weighted indexing and it continues to be the largest methodology used today. Over time indexing evolved. Indexes expanded far past the familiar 500 largest companies in America represented by Standard and Poor’s S&P 500. When someone decided to use a different sorting method, (let’s call it non-market cap weighting) to build an index, we entered an era that today many reference as “smart beta.” First, I’m not sure if beta (a well know measure of volatility relative to the market) can work in the context of being “smart.” It’s not doing any thinking nor actively making decisions. It’s simply following the initial programming that it was created with. When you hear “smart beta” think filtered beta. The product creator has decided to sort or filter the index to gain a different type of exposure to the underlying companies. There are an endless number of possibilities, many of which have academic grounds and others that were created because, like many financial products, they’re easy to sell. Identifying which ones are viable can be difficult. Many target well know academic factors such as size, value or momentum. Let’s say that you believe in this research and want to build a value factor “tilt” (more jargon that simply means increased exposure) into your portfolio. Value can be defined with a variety of different metrics (low price-to-earnings, price-to-book, and price-to-sales ratios, and high dividend yields.) Here's where you run into a problem. Which one to use? If it makes sense to target a single factor, doesn’t it may make sense to target multiple factors? Some, such as momentum and value have historically been proven to work well together. However, attempting to blend two separate products to reap the reward may present a problem because of the different ways that the underlying index is defined. Therefore, to achieve the desired exposure, any argument for smart beta should be in the same context of how one fund interacts with the rest of the portfolio. To me “smart beta” isn’t really smart, its just non-market cap weighted indexing that’s been filtered or repackaged. However, that doesn’t mean it’s stupid. Stupid would be investing in fund marketed as “smart beta” because the fund company had a great pitch. We may as well get used to these discussions. Smart beta products are popular and there are tons more coming down the pike. It’s important to understand how one funds interacts with the rest of your portfolio. At Wealthshape it’s our job to filter this environment, separate the fluff, and deliver solutions that have the backing empirical research, not marketing. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life.

Imagine it’s the year 1999. You’re standing in an airport terminal waiting to depart on a three-hour flight. Fortunate to be in an early boarding group, you leisurely stroll down the jet way, greet the flight attendant and stow you carryon before settling into a window seat. Judging by the modest number of passengers waiting to board, you weigh the odds at about 50/50 that the single seat next to you goes unoccupied. After a long week you welcome the extra elbowroom and begin to make yourself comfortable. That is until you see one last out of breath passenger approaching. With several vacant seats available, the chances are still good. Passing row by row the odds shrink until a short teenage kid with a puffy orange vest claims the seat next to you. He introduces himself as Marty but you already recognized the famous “Back to The Future” time traveler. Disappointment turns to intrigue. Here we are at the turn of a new century and the kid sitting next you already knows what the future holds. Small talk ensues as the plane takes off and reaches cruising altitude. The hour’s pass with talk of flux capacitors and conflicts with Marty’s arch nemesis Biff Tannen. Finally, with 5 minutes left of the flight, you muster up the courage to ask the question that’s been on your mind ever since he sat down. Marty, what do the next 15 years look like and how should I invest? Doc Brown is always telling me to keep my mouth shut about the future “he says”, but ok, just this one time. Over the next 15 years you will witness a major tech bubble along with terrorist attacks on US soil and several others across Europe. Massive storms will cause damage to the Gulf and East coasts. The financial and real estate markets will collapse, and numerous European nations will have to be bailed out due to fiscal insolvency. Timeline is for reference. Marty refused to give specifics. Jan. ‘00–Y2K scare Mar. ‘00–Dotcom crash Sept. ‘01–9/11 Mar. ‘03–Iraq war Aug. ‘05–Katrina Feb. ‘07–Subprime mortgage Feb. ‘08–S&P 500 down 46% Jan. ‘10–Euro zone crisis Dec. ‘12–US home prices hit bottom; fiscal cliff worries The future timeline of terrible things that Marty describes instantly triggers your blood pressure to rise. “I guess the best thing to do is pull all of my money out of the stock market and sit on the sidelines for the next 15 years.” Marty shrugs his shoulders like any modern day teenager would, and gives you a halfhearted “ beats me” before exiting the plane, never to be seen again. This is where the story ends and rationality begins. Most people think that they need an accurate forecast about the future to be a successful investor. There’s always going to be traumatic events that impact financial markets in some way. Talk of bubbles and bailouts won’t cease because the capitalizing media is always waiting for the inevitable crisis waiting just around the corner. What should investors do knowing history is filled with market ups and downs? The answer is “don’t overreact to things that are out side of your control.” Markets are resilient and the evidence backs that up. Over the last 15 years from Jan 1, 1999 to Dec. 31, 2014 the S&P 500 returned an average 5.2% per year. The path to achieving success doesn’t require forecasting. It requires discipline. Sitting on the sidelines for fear of market reactions to events isn’t the answer. You can always find a reason not to invest. For long-term investors the best course of action is to recognize and accept the likelihood that unpredictable events will take place. Being rational during turbulent times isn’t expected to be easy but it beats the alternative. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.