|

By Jack Waymire Paladin Registry  Perhaps you have read about a new Department of Labor regulation that mandates anyone who provides financial advice and services for retirement assets must be a fiduciary financial advisor. Retirement assets include qualified plans (401ks) and IRAs. What does this mean and how does it impact you? Fiduciary According to Wikipedia, a fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties (person or group of persons). Typically, a fiduciary prudently takes care of money or other assets for another person. Financial Advisor A financial advisor is a person or firm that is registered as a Registered Investment Advisor (firm) or Investment Advisor Representative (professional). This registration enables them to provide financial advice and services for fees. A financial advisor who holds one of these registrations is a fiduciary. Salesmen who claim to be financial advisors do not hold this registration. Ethical Standard Fiduciary is the highest ethical standard in the financial service industry. Financial advisors, who are fiduciaries, are required to put their clients’ financial interests first. Salesmen, who masquerade as financial advisors, are held to a lower ethical standard called suitability. They are supposed to make suitable recommendations, but this vague standard is very difficult to enforce. Warnings Selecting a financial advisor who is a fiduciary should be a simple task, but it is riskier than you might think for these five reasons:

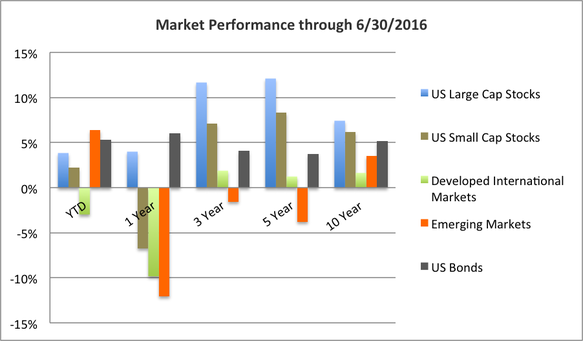

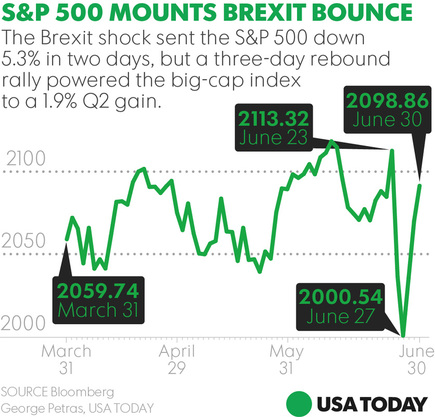

Protect Your Interests There are five easy rules that will help you select a fiduciary financial advisor. #1. Obtain written acknowledgement that the advisor is acting in a fiduciary capacity when providing financial advice and services. #2. Make sure the advisor is a Registered Investment Advisor or an Investment Advisor Representative. Ask for written verification. #3. Make sure the advisor is compensated with one or more of the three types of fees: Hourly, fixed, or asset-based (% of assets). #4. Make sure the advisor provides ongoing advice and services – for example performance measurement reports. #5. Go to FINRA.org/BrokerCheck to verify the advisor’s licensing, registrations, and compliance record. As stated in #1, get all of the information you require to make a selection decision in writing. When your future financial security is at stake, it pays to trust what you see and not what you hear. Verbal information is usually a sales pitch that is designed to impress you. Documented information is more reliable because you have a permanent record. Despite all the news coming from across the Atlantic, US stocks managed to turn in pleasantly positive numbers for the second quarter, with the S&P 500 returning 2.46%. US Small Cap stocks fared even better with gains of 3.79%. International Developed Markets were weak again, falling -1.05% for the quarter and Emerging Markets turned in a slightly positive .66%. Interest rates fell again in the second quarter of 2016 resulting in gains for Fixed Income Markets. Over the last three months the Barclays Aggregate Bond Index Increased by 2.21% and has climbed 6.00% for the last year through 6/30/16. Municipal Bonds also saw significant gains of 2.61% for the last three months and 7.65% over the last year. The turbulent end to the 2nd Quarter of 2016 is further evidence that the attempted timing of capital markets is never justified. The chart below indicates the brief but significant fluctuation in the S&P 500 from the June 23rd Brexit vote, to the June 30th quarter end. Remaining disciplined in the face of unpredictability has always been one of the strongest tenants of successful investing. If you're portfolio is broadly diversified with exposure to multiple countries, sectors, industries and asset classes, you've already done everything you can to minimize the effects of Brexit and other expected events. |

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.