|

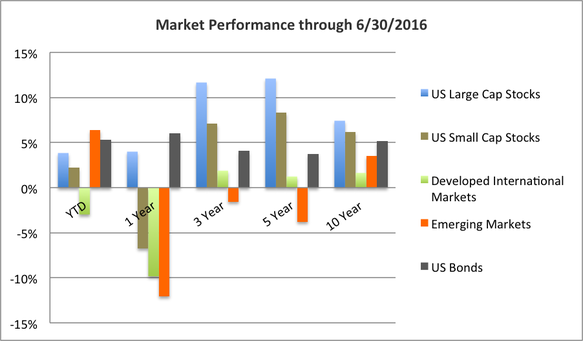

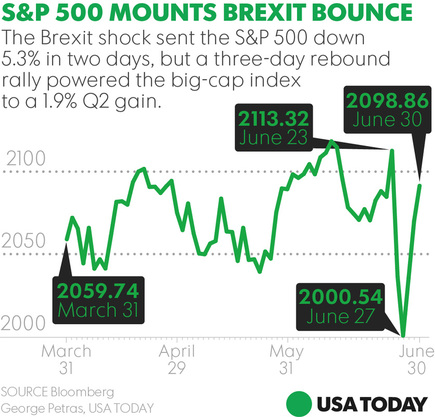

Despite all the news coming from across the Atlantic, US stocks managed to turn in pleasantly positive numbers for the second quarter, with the S&P 500 returning 2.46%. US Small Cap stocks fared even better with gains of 3.79%. International Developed Markets were weak again, falling -1.05% for the quarter and Emerging Markets turned in a slightly positive .66%. Interest rates fell again in the second quarter of 2016 resulting in gains for Fixed Income Markets. Over the last three months the Barclays Aggregate Bond Index Increased by 2.21% and has climbed 6.00% for the last year through 6/30/16. Municipal Bonds also saw significant gains of 2.61% for the last three months and 7.65% over the last year. The turbulent end to the 2nd Quarter of 2016 is further evidence that the attempted timing of capital markets is never justified. The chart below indicates the brief but significant fluctuation in the S&P 500 from the June 23rd Brexit vote, to the June 30th quarter end. Remaining disciplined in the face of unpredictability has always been one of the strongest tenants of successful investing. If you're portfolio is broadly diversified with exposure to multiple countries, sectors, industries and asset classes, you've already done everything you can to minimize the effects of Brexit and other expected events. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.