|

In 2017, we were again reminded of the importance of following an investment approach based on discipline and diversification vs. prediction and timing. As we gear up for the new year, we can look at several examples during 2017 that provide perspective on what guidance investors may want to follow, or not follow, in order to achieve the long-term return the capital markets offer. NINE EXPERTS Each January, a well-known financial publication invites a group of experienced investment professionals to New York for a lengthy roundtable discussion of the investment outlook for the year ahead. The nine panelists have spent their careers studying companies and poring over economic statistics to find the most rewarding investment opportunities around the globe. Ahead of 2017, the authors of the publication’s report were struck by the “remarkably cohesive consensus” among the members of the group, who often find much to disagree about. Not one pro expressed strong enthusiasm for US stocks in the year ahead, two expected returns to be negative for the year, and the most optimistic forecast was for a total return of 7%. They also found little to like in global markets, citing “gigantic geopolitical issues,” including a Chinese “debt bubble” and a “crisis” in the Italian banking system. The excerpts below summarizing the panel’s outlook presented a less than optimistic view of the year ahead in January 2017. “This could be the year when the movie runs backwards: Inflation awakens. Bond yields reboot. Stocks stumble. Active management rules. And we haven’t even touched on the coming regime change in Washington.”1 The outcome of these predictions: Zero-for-four, although some might point out that at least they got the direction right regarding the inflation rate.

on a consistent basis. FOUR SURPRISES

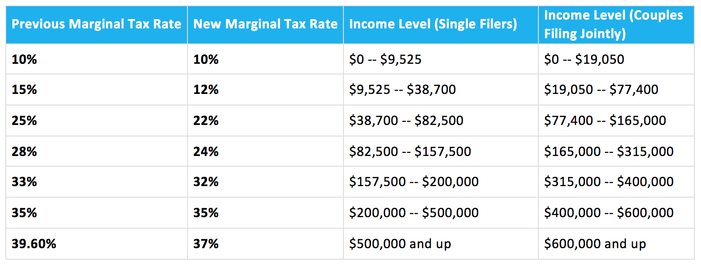

THE MILLION DOLLAR BET Last year saw the conclusion of a 10-year wager between Warren Buffett, chairman of Berkshire Hathaway Inc., and Ted Seides, a New York hedge fund consultant. Seides responded to a public challenge issued by Buffett in 2007 regarding the merits of hedge funds relative to low-cost passive vehicles. The two men agreed to bet $1 million on the outcome of their respective investment strategies over the 10-year period from January 1, 2008, through December 31, 2017. Buffett selected the S&P 500 Index, Seides selected five hedge funds, and the stakes were earmarked for the winner’s preferred charity. The terms were revised midway through the period by converting the sum invested in bonds to Berkshire Hathaway shares, so the final amount is reported to be in excess of $2.2 million. The 10-year period included years of dramatic decline for the S&P 500 Index (–37.0% in 2008) as well as above-average gains (+32.4% in 2013), so there was ample opportunity for clever managers to attempt to outperform a buy-and-hold strategy through a successful timing strategy. For fans of hedge funds, however, the results were not encouraging. For the nine-year period from January 1, 2008, through December 31, 2016, the average of the five funds achieved a total return of 22.0% compared to 85.5% for the S&P 500 Index.12 (Results for 2017 have not yet been reported.) Having fallen far behind after nine years, Seides graciously conceded defeat in mid-2017. But he pointed out in a May 2017 Bloomberg article that in the first 14 months of the bet, the S&P 500 Index declined roughly 50% while his basket of hedge funds declined less than half as much. He suggested that many investors bailed out of their S&P 500-type strategies in 2008 and never participated in the recovery. Hedge fund participants, he argued, “stood a much better chance of staying the course.” Seides makes a valid point—long run returns don’t matter if the strategy is abandoned along the way. And there is ample evidence that some mutual fund investors sold in late 2008 and missed out on substantial subsequent gains. But do hedge funds offer the best solution to this problem? We think educating investors about the unpredictability of capital market returns and the importance of appropriate asset allocation will likely prove more fruitful than paying fees to guess where markets are headed next. A hypothetical global diversified allocation of 60% equities and 40% fixed income13 still outperformed the hedge fund basket over the same nine years (56.6% vs. 22.0% in total returns). Over any time period some managers will outperform index-type strategies, although most research studies find that the number is no greater than we would expect by chance. Advocates of active management often claim that this evidence does not concern them, since superior managers can be identified in advance by conducting a thorough assessment of manager skills. But this 10-year challenge offers additional evidence that investors will most likely find such efforts fail to improve their investment experience. EXPECT THE UNEXPECTED Financial markets surprised many investors in 2017, but then again they have a long history of surprising investors. For example, from 1926–2017, the annualized return for the S&P 500 Index was 10.2%. But returns in any single year were seldom close to this figure. They fell in a range between 8% and 12% only six times in the last 92 years but experienced gains or losses greater than 20% 40 times (34 gains, six losses). Investors should appreciate that many times realized returns may be far different from expected returns. For a number of investors, 2017 was a paradox. The harder they tried to enhance their results by paying close attention to current events, the more likely they failed to capture the rate of return the capital markets offered. New Year’s resolution: Keep informed on current events as a responsible citizen. Let the capital markets decide where returns will be generated. APPENDIX Article By Weston Wellington- Vice President, Dimensional Fund Advisors Dimensional 60/40 Balanced Strategy Index Rebalanced monthly. For illustrative purposes only. The balanced strategy index is not a recommendation for an actual allocation. All performance results are based on performance of indices with model/backtested asset allocations; the performance was achieved with the benefit of hindsight; it does not represent actual investment strategies, nor does it reflect fees associated with investing. Actual results may vary significantly. The underlying Dimensional indices of the balanced strategy index have been retrospectively calculated by Dimensional Fund Advisors LP and did not exist prior to their inceptions dates. Other periods selected may have different results, including losses. Backtested index performance is hypothetical, is not actual performance and is provided for informational purposes only. Backtested performance results assume the reinvestment of dividends and capital gains. Additional information is available upon request. 1. Lauren R. Rublin, “Stocks Could Post Limited Gains in 2017 as Yields Rise,” Barron’s, January 14, 2017. 2. Inflation data © 2018 and earlier, Morningstar. All rights reserved. Underlying data provided by Ibbotson Associates via Morningstar Direct. 3. As measured by the MSCI All Country World IMI Index (net dividends). 4. Adam Shell, “How Will Stocks Make Out in 2017?” USA TODAY, December 24, 2016. 5. S&P data © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. 6. As measured by the MSCI Korea IMI Index (net dividends). MSCI data © MSCI 2018, all rights reserved. 7. Jonathan R. Laing, “China’s Debt Addiction Could Lead to Financial Crisis,” Barron’s, November 5, 2016. 8. As measured by the MSCI China IMI Index (net dividends). MSCI data © MSCI 2018, all rights reserved. 9. Neal E. Boudette, “Car Sales End a 7 Year Upswing, With More Challenges Ahead,” New York Times, January 3, 2018. 10. Steven Russolillo, “Yellow Flag Waves Over Auto Stocks,” Wall Street Journal, January 4, 2017. 11. Ford Motor, General Motors, and Fiat Chrysler returns provided by Bloomberg Finance LP. 12. Hedge fund data from Chairman’s Letter, Berkshire Hathaway Inc. 2016 annual report. 13. Global diversified allocation is the Dimensional 60/40 Balanced Strategy Index. Indices cannot be invested into directly. See Appendix for index description. Past performance is no guarantee of future investment results S&P data © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Past performance is no guarantee of future investment results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Diversification does not eliminate the risk of market loss. There is no guarantee an investment strategy will be successful. Any specific stock reference is provided for illustrative purposes only and is not a recommendation of any specific security. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. The last days of the year produced the most significant tax overhaul in decades, with far-reaching ramifications for most investors. Originally intended to be a simplification of the tax code, the bill turned out to be a series of tweaks and adjustments to both personal and corporate income taxes for 2018. While it is always advisable to consult your tax professional on these changes, here is a brief summary of how the bill impacts taxpayers.

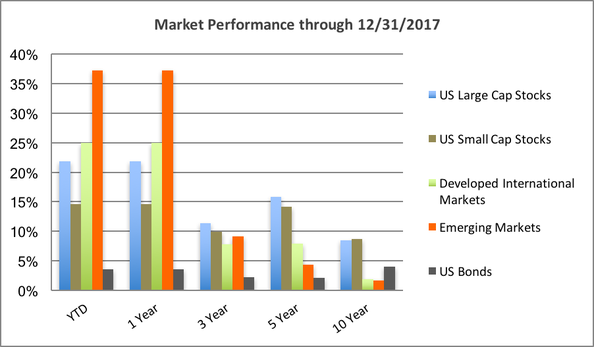

Market Summary News of tax reform didn’t overshadow another strong year for markets. Major equity asset classes around the globe all posted double digit gains. Emerging markets led the way +37.28% for the year. International Developed markets were up +25%. The S&P 500 posted another great year +21.83% and US small caps gained 14.65%. US Bond markets also fared reasonably well, turning in a positive 3.54% return. Last year around this time all the buzz was about the United Kingdom's vote to leave the European Union, the surprise election of Donald Trump, and how global markets would respond. One could have easily made the argument that such uncertainty would have had a negative impact. Now that the results are in, talk turns to whether stocks are overpriced or underpriced and how much longer this bull market can continue. The fact of the matter is, predicting the next bear market isn’t necessary for the success of long term diversified investors. Most of us will see numerous bull/bear market cycles throughout our investment lifetime (We’ve seen 5 changes in the last 27 years.) Things like behavioral discipline, rebalancing, and making intelligent financial planning decisions are always going to be far more important to long term success. WealthShape, LLC provides this communication as a matter of general information. No one should assume that any discussion or information contained in this material serves as a receipt of, or as a substitute for, personalized investment, tax or legal advice. |

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.