|

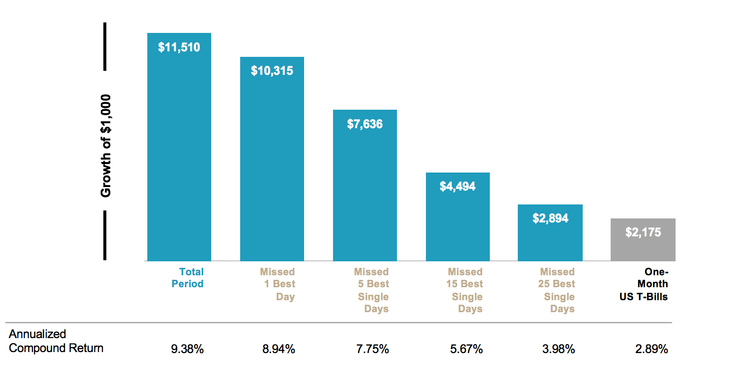

We're now 8 years removed from the market bottoms of 2009. March 9th has come to represent an anniversary of sorts - the day markets started moving in the right direction following a year’s worth of upheaval. As in previous years, this occasion will undoubtedly be marked by the usual onslaught of articles pontificating about how much steam this bull market has left in it. Yet, that repetitive angle, while tempting, seems to miss a critical point. In former editions of what feels like an annual March 8th bull market commentary I typically reference the length of this latest bull market and its place in history. I’ve always found a historical perspective more valuable than the fear mongering click bait produced by financial journalists desperately searching for retweets. Predictably, you'll get the "Is This Bull on its Last Leg?” or "Bear Market Ahead?" headlines designed to be more provocative than substantive, but I don’t begrudge anybody from making a living. After all, I myself had a momentary stint as a journalist a long time ago. I understand how hard it is to write new and engaging material on dry topics where the only time the masses pay attention is when the news isn't so welcoming. However, as a CERTIFIED FINANCIAL PLANNER™ professional my intuition tells me that there’s a more relevant angle to this story. Asking how much longer the current run can last is logical, but is it the right question? Perhaps the more applicable question should be: On the anniversary of this current bull market, should any long term investor care? Admittedly, it’s a loaded question because the premise applies only to long-term investors, a point to which I would argue “any monies invested in the stocks should presumably be for the long-term”, further defined as a period not less than at least five years. Still, a time frame of five, ten or even twenty years might not be the most accurate representation. For many of us an investment lifetime begins in our 20’s and can last long into retirement. These realizations suggest that looking at things through the lens of bull vs. bear markets really doesn’t make all that much sense providing you agree that over time markets reward long-term, disciplined investors. The impact of missing even just a few of the good days is well chronicled, and thereby suggests that time is the ally of the long-term investor and market timing the adversary. Bulls, bears and some perspective The usual definition of a bear market is when the stock’s decline by 20% from their peaks over a 2 month period. From the 1990’s till today the S&P 500 has gone from a long bull market to a momentary bear, back to a 5-year bull, leading up to the most recent bear market of 08 and finally arriving at our current 8-year bull market. That’s 5 changes in total, spanning the course of over 26 years. Long-term investors should accept the historical fact that markets fluctuate. None of us has to feel good about the prospect of any looming bear market. We need only to accept them as part and parcel to a greater end. In US dollars. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. S&P data provided by Standard & Poor’s Index Services Group. “One-Month US T- Bills” is the IA SBBI US 30 Day TBill TR USD, provided by Ibbotson Associates via Morningstar Direct. Data is calculated off rounded daily index values.

Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.