|

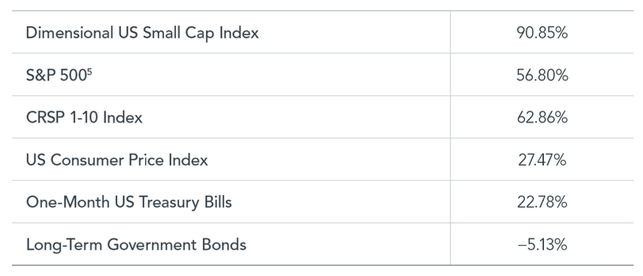

How quickly things change. Two years ago, the New York Times reported, “Federal Reserve officials are increasingly worried that inflation is too low and could leave the central bank with less room to maneuver in an economic downturn.”1 More recently, a Wall Street Journal article presented a sharply different view, with a headline that likely touched a raw nerve among investors: “Everything Screams Inflation.” The author, a veteran financial columnist, observed, “We could be at a generational turning point for finance. Politics, economics, international relations, demography and labor are all shifting to supporting inflation.”2 Is inflation headed higher? In the short term, it has already moved that way. With many firms now reporting strong demand for goods and services following the swift collapse in business activity last year, prices are rising—sometimes substantially. Is this a negative? It depends on where one sits in the economic food chain. Airlines are once again enjoying fully booked flights, and many restaurants are struggling to hire cooks and waiters. We should not be surprised that airfares and steak dinners cost more than they did a year ago. Or that stock prices for JetBlue Airways and The Cheesecake Factory surged over 150% from their lows in the spring of 2020.3 Do such price increases signal a coming wave of broad and persistent inflation or just a temporary snapback following the unusually sharp economic downturn in 2020? We simply don’t know. But future inflation is just one of many factors that investors take into account. The market’s job is to take positive information, such as exciting new products, substantial sales gains, and dividend increases, and balance it against negative information, like falling profits, wars, and natural disasters, to arrive at a price every day that both buyers and sellers deem fair. The future is always uncertain. But willingness to bear uncertainty is the key reason investors have the opportunity for profit. Let us assume for the moment that rising inflation persists into the future. Some investors might want to hedge against higher inflation, while others might see it as a market-timing signal and make changes to their investment portfolios. But for the market timers to do so successfully, they would need a trading rule that directs exactly when and how to revise the portfolio—“I’ll know it when I see it” is not a strategy. A trading rule based on inflation estimates, however, is just a market-timing strategy dressed in different clothes. A successful effort requires two correct predictions: when to revise the portfolio and when to change it back. It’s not enough to be negative on the outlook for stocks or bonds in the face of disconcerting information regarding inflation (or anything else). Current prices already reflect such concerns. To justify switching a portfolio, one needs to be even more negative than the average investor. And then outsmart the crowd once again when the time appears right to switch back. Rinse and repeat. The evidence of success in pursuing such timing strategies—by individuals and professionals alike—is conspicuous by its absence. To illustrate the problem, imagine it’s New Year’s Day 1979. The broad US stock market4 produced a positive return in 1978 but failed to keep pace with inflation for the second year in a row. Your crystal ball informs you that the next two years will see back-to-back double-digit inflation for the first time since World War I. What would you do? You have painful memories of 1974, when the inflation-adjusted total return for US stocks was –35.05%, among the five worst returns in data going back to 1926. We suspect many investors would sell stocks in anticipation of significantly lower security prices over the subsequent two years. The result? Most likely a failure to capture above-average returns from both the equity and size dimensions, as shown in Exhibit 1. Exhibit 1 Looking Up Cumulative return, January 1979–December 1980 Past performance is no guarantee of future results. Indices are not available for direct investment. Some of the recent concern regarding inflation appears linked to substantial increases in government spending and the US debt load. Determining the appropriate level of each is a contentious public policy issue, and we don’t wish to minimize its importance. But the news items in Exhibit 2 suggest these concerns are not new, and the expected consequences of these issues are likely already reflected in current prices. The future is always uncertain. But as economist Frank Knight observed 100 years ago, willingness to bear uncertainty is the key reason investors have the opportunity for profit.6 Investors will always have something to worry about, and the possibility of unwelcome or unexpected events should be addressed by the portfolio’s initial design rather than by a hasty response to stressful headlines in the future. Exhibit 2 Fears Through the Years All data is from sources believed to be reliable but cannot be guaranteed or warranted. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. No one should assume that any discussion or information contained in this material serves as a receipt of, or as a substitute for, personalized investment, tax or legal advice. Diversification does not eliminate the risk of market loss. Investment risks include loss of principal and fluctuating value. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Data Appendix 'Everything Screams Inflation.' How to Interpret Headlines FOOTNOTES 1. Jeanna Smialek, “Fed Officials Sound Alarm Over Stubbornly Weak Inflation,” New York Times, May 17, 2019. 2. James Mackintosh, “Everything Screams Inflation,” Wall Street Journal, May 5, 2021. 3. Sourced using Bloomberg security returns. Low for Cheesecake Factory was April 2, 2020, and low for JetBlue was March 23, 2020. 4. As measured by the CRSP 1-10 index. 5. S&P data © S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. 6. Frank H. Knight, Risk, Uncertainty and Profit (Boston and New York: Houghton Mifflin Co., 1921). 7. Headlines are sourced from various publicly available news outlets and are provided for context, not to explain the market’s behavior. This material is in relation to the US market and contains analysis specific to the US. 8. Jeanna Smialek, “Fed Officials Sound Alarm Over Stubbornly Weak Inflation,” New York Times, May 17, 2019. 9. James Mackintosh, “Everything Screams Inflation,” Wall Street Journal, May 5, 2021. 10. Sourced using Bloomberg security returns. Low for Cheesecake Factory was April 2, 2020, and low for JetBlue was March 23, 2020. 11. As measured by the CRSP 1-10 index. 12. S&P data © S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. 13. Frank H. Knight, Risk, Uncertainty and Profit (Boston and New York: Houghton Mifflin Co., 1921). 14. Headlines are sourced from various publicly available news outlets and are provided for context, not to explain the market’s behavior. This material is in relation to the US market and contains analysis specific to the US. INDEX DESCRIPTIONS DIMENSIONAL US SMALL CAP INDEX: Compiled by Dimensional from CRSP and Compustat data. Market-capitalization-weighted index of securities of the smallest US companies whose market capitalization falls in the lowest 8% of the total market capitalization of the eligible market. The eligible market is composed of securities of US companies traded on the NYSE, NYSE MKT (formerly AMEX), and Nasdaq Global Market. Exclusions: non-US companies, REITs, UITs, investment companies, and companies with the lowest profitability and highest relative price within the small cap universe. The index also excludes those companies with the highest asset growth within the small cap universe. Profitability is defined as operating income before depreciation and amortization minus interest expense divided by book equity. Asset growth is defined as change in total assets from the prior fiscal year to current fiscal year. The index has been retrospectively calculated by Dimensional and did not exist prior to March 2007. Accordingly, the results shown during the periods prior to March 2007 do not represent actual returns of the index. Other periods selected may have different results, including losses. The calculation methodology for the index was amended in January 2014 to include profitability as a factor in selecting securities for inclusion in the index. The calculation methodology for the index was amended in December 2019 to include asset growth as a factor in selecting securities for inclusion in the index. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services. UNITED STATES: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. |

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.