|

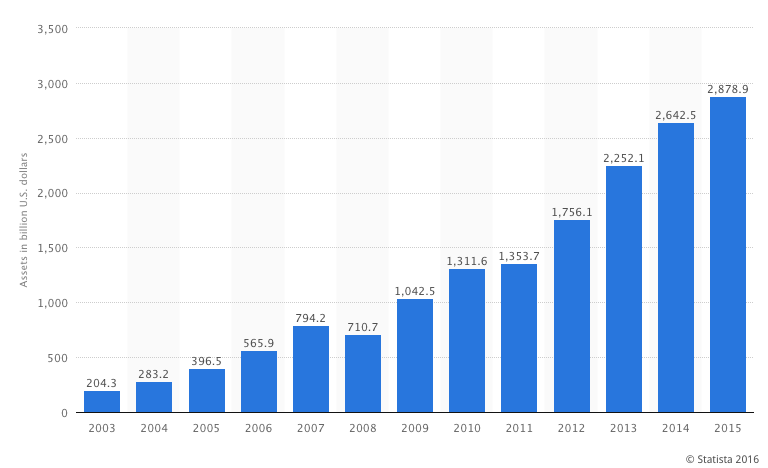

The Exchange Traded Fund marketplace has grown exponentially over the last 10 years. Almost 2,000 ETF’s are currently available with hundreds more in registration. In 2003, there was just over $200 billion dollars invested in these instruments. At the end of 2015 that number approached 3 trillion! Though many investors may be familiar with the features of ETF’s, few understand the mechanics behind how they work. It’s slightly complicated, but worth understanding. Here comes an ETF crash course. What are ETF’s? The first Exchange Traded Fund “SPY” was created by State Street Global Advisors in 1993. Today this basic S&P 500 index tracking ETF is still the largest on the market with over $180 billion in assets. Similar to mutual funds, Exchange Traded Funds offer investors a proportional share in a pool of stocks, bonds, or other assets. Unlike mutual funds, which are offered through a number of distribution channels, ETF’s trade throughout the day on the secondary market just like a stock. Hence the name “Exchange Traded.” Mutual funds use forward pricing, which simply means the underlying basket of securities has a Net Asset Value (NAV) that gets calculated once a day. So, when you decide to buy a mutual fund during the day, its price is going to be the NAV at the next computation. An ETF’s NAV changes throughout the day as the underlying stock or bond prices change. Their Key Selling Points

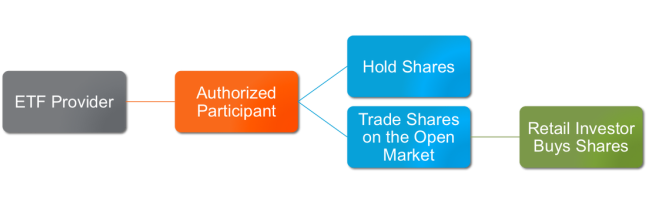

How do they really work? ETF’s gain exposure to the market through a process know as creation/redemption. It all starts with a ETF provider such as iShares, Vanguard, or State Street deciding to create a fund. They must then assemble the list of underlying securities held inside the product. ETF’s are index-tracking products, so usually the list comes from an index provider like Standard & Poor’s, Russell, MSCI, etc. The next step is to involve large institutional investors or market makers called authorized participants (APs). The APs role is to gather the list of underlying securities on the open market and deliver them back to the ETF provider. The provider then creates blocks know as creation units, generally in the amount of 50,000 shares per unit. Next, the ETF provider reengages the AP to place the units on the open market where retail investors can buy and sell shares. Supply and demand dictates whether units need to be created or redeemed. If units need to be redeemed, the process works the same way in reverse. The AP can remove shares from the market by purchasing enough underlying securities to form a creating unit, delivering it back to the ETF provider in exchange for the same value in the underlying securities of the fund. Wait a minute. Since ETF's trade like a stock throughout the day, doesn't that mean that prices could rise above the value of the underlying securities? The answer is yes. However, when this happens the AP has the ability to take action. If they see that an ETF is overpriced, the AP can purchase the underlying securities that make up the ETF and subsequently sell some of the ETF shares it holds on the open market. This process known as arbitrage represents a sort of a symbiotic relationship that keeps ETF share prices trading in line with the fund’s underlying NAV. The AP is motivated to take action because of the risk free profit they receive. The physical action of selling ETF shares can help to push current trading prices back in line with NAV. Both ETF and AP benefit. Why are ETF's tax efficient? A couple of reasons:

The creation redemption process allows the shareholders basis to remain intact. Owning a share is like owning your own fractional bundle of underlying securities that you can buy and sell on the open market. What’s the major difference from a mutual fund? When the fund manager decides to sell company XYZ, everyone sells it at the funds basis, and everyone shares in the capital gains or losses resulting from that sale. Things to Consider Investors often use them to speculate: I'm in favor of using ETF's in a buy and hold approach for disciplined investors. Unfortunately, their low cost and ease of trading make ETF's fashionable vehicles for market timing. It's the primary reason why most investors who invest in a specific ETF don't actually achieve the same level of overall return. Vanguard founder, John Bogle has been very vocal on the topic for years. In his own words, "We just haven't seen the collective ability to resist the urge to trade." In contrast, mutual funds don't eliminate this urge, but because they don't trade throughout the day, you could argue this behavior is less encouraged. Some do have turnover: Most ETF’s have very low turnover because frankly, most indexes have very low turnover. However, when it comes to bond ETF’s, because the turnover tends to be higher due to the maturity constraints of an underlying index, you tend to see more buying and selling. You don’t see a whole a lot of ETF’s producing capital gains, but when you do, they usually come from bond ETF’s. Additionally, we are starting to see some more elaborate indexes, such as momentum tracking indexes, which require frequent reconstitution in an effort to capture a never changing subset of underlying companies. The regular shuffling of companies in and out also increases turnover potentially throwing off capital gains to investors. The Reconstitution Effect: Admittedly, this is an issue for index investing in general, but since ETF's are most often public index tracking instruments, they may also be subject to the effect. In short, the goal of any index tracking fund is to track the underlying index as closely as possible. Therefore, when the index decides to add or subtract a company, so too must the fund. The issue is the fund publicly announces which companies are to be added and subtracted well in advance of doing so. The effect is increased trading volume in those companies to be added, thereby increasing the price at which the fund needs to buy them prior to it doing so. The same hold true for companies that are slated to exit the index. The fund may be forced to sell them at a depressed price due to heavier selling volume from investors in anticipation of the exit. Though this inherent inefficiency represents, what most academics consider, a modest return lag, it is certainly worth noting. What does the future hold for ETF's? While traditional open end mutual funds still have the lions share of assets it’s clear, exchange traded funds are widely popular. As more and more investors turn to index style investing partly due to the realization that the vast majority of active fund managers fail over long periods of time, my guess is their extraordinary growth will persist. The one thing that’s difficult to quantify is investor behavior. How much of the near $3 billion dollars invested in ETF’s is representative of buy and hold long-term investors? How much is represented by speculative day traders? Despite their popularity, few investors still really understand how ETF's work, what makes them tax efficient, how they are created, how they are redeemed, etc. I hope this column helps to further the understanding of these easily marketed products, their benefits, and drawbacks. At the end of the day, as with any investment vehicle, prudence should always dictate their usage. Building a well diversified portfolio from the thousands of solutions available requires a degree of skill, diligence and discipline no matter the instrument.

A big thanks to Investopedia for a great interview. Check out the short video below:

A discussion on the Federal Reserve's perceived impact on interest rates.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.