|

WealthShape founder Timothy Baker featured speaker on Investopedia Webinar. As people change jobs, one constant stays the same: the importance of rolling over your 401k properly into an IRA. Today’s workers may need to execute a rollover anywhere from 5 to 10 times in their working life, and there are many pitfalls to the process. This webinar will look at the primary reasons to properly manage a rollover and the increasing investment options. Rollovers should not only be seen as an opportunity to preserve hard-earned retirement money, but also as a chance to reduce fees and consolidate and diversify one’s portfolio.

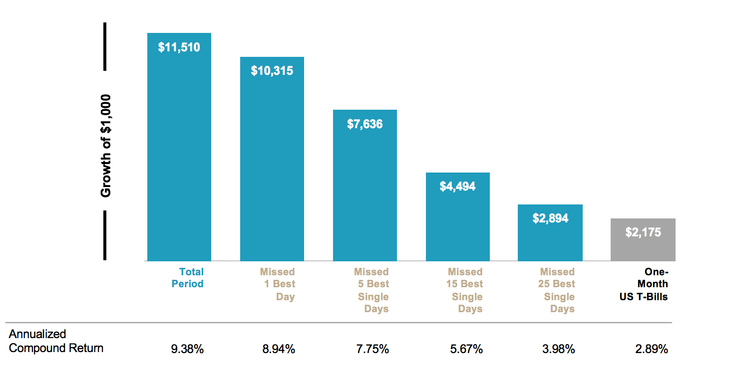

We're now 8 years removed from the market bottoms of 2009. March 9th has come to represent an anniversary of sorts - the day markets started moving in the right direction following a year’s worth of upheaval. As in previous years, this occasion will undoubtedly be marked by the usual onslaught of articles pontificating about how much steam this bull market has left in it. Yet, that repetitive angle, while tempting, seems to miss a critical point. In former editions of what feels like an annual March 8th bull market commentary I typically reference the length of this latest bull market and its place in history. I’ve always found a historical perspective more valuable than the fear mongering click bait produced by financial journalists desperately searching for retweets. Predictably, you'll get the "Is This Bull on its Last Leg?” or "Bear Market Ahead?" headlines designed to be more provocative than substantive, but I don’t begrudge anybody from making a living. After all, I myself had a momentary stint as a journalist a long time ago. I understand how hard it is to write new and engaging material on dry topics where the only time the masses pay attention is when the news isn't so welcoming. However, as a CERTIFIED FINANCIAL PLANNER™ professional my intuition tells me that there’s a more relevant angle to this story. Asking how much longer the current run can last is logical, but is it the right question? Perhaps the more applicable question should be: On the anniversary of this current bull market, should any long term investor care? Admittedly, it’s a loaded question because the premise applies only to long-term investors, a point to which I would argue “any monies invested in the stocks should presumably be for the long-term”, further defined as a period not less than at least five years. Still, a time frame of five, ten or even twenty years might not be the most accurate representation. For many of us an investment lifetime begins in our 20’s and can last long into retirement. These realizations suggest that looking at things through the lens of bull vs. bear markets really doesn’t make all that much sense providing you agree that over time markets reward long-term, disciplined investors. The impact of missing even just a few of the good days is well chronicled, and thereby suggests that time is the ally of the long-term investor and market timing the adversary. Bulls, bears and some perspective The usual definition of a bear market is when the stock’s decline by 20% from their peaks over a 2 month period. From the 1990’s till today the S&P 500 has gone from a long bull market to a momentary bear, back to a 5-year bull, leading up to the most recent bear market of 08 and finally arriving at our current 8-year bull market. That’s 5 changes in total, spanning the course of over 26 years. Long-term investors should accept the historical fact that markets fluctuate. None of us has to feel good about the prospect of any looming bear market. We need only to accept them as part and parcel to a greater end. In US dollars. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. S&P data provided by Standard & Poor’s Index Services Group. “One-Month US T- Bills” is the IA SBBI US 30 Day TBill TR USD, provided by Ibbotson Associates via Morningstar Direct. Data is calculated off rounded daily index values.

Ever ridden in a car with worn-out shock absorbers? Every bump is jarring, every corner stomach-churning, and every red light an excuse to assume the brace position. Owning an undiversified portfolio can trigger similar reactions. In a motor vehicle, the suspension system keeps the tires in contact with the road and provides a smooth ride for passengers by o setting the forces of gravity, propulsion, and inertia. You can drive a car with a broken suspension system, but it will be an extremely uncomfortable ride and the vehicle will be much harder to control, particularly in di cult conditions. row in the risk of a breakdown or running off the road altogether and there’s a real chance you may not reach your destination. In the world of investment, a similarly bumpy and unpredictable ride can await those with concentrated and undiversified portfolios or those who constantly tinker with their allocation based on a short-term rough patch in the markets. Of course, everyone feels in control when the surface is straight and smooth, but it’s harder to stay on the road during sudden turns and ups and downs in the market. And keep in mind the x for your portfolio breaking down is unlikely to be as simple as calling a tow truck. For that reason, the smart thing to do is to diversify, spreading your portfolio across different securities, sectors, and countries. That also means identifying the right mix of investments (e.g., stocks, bonds, real estate) that aligns with your risk tolerance, which helps keep you on track toward your goals. Using this approach, your returns from year to year may not match the top performing portfolio, but neither are they likely to match the worst. More importantly, this is a ride you are likelier to stick with. Just as drivers of suspension less cars change their route to avoid potholes, people with concentrated portfolios may resort to market timing and constant trading as they try to anticipate the top-performing countries, asset classes, and securities. Here’s an example to show how tough this is. Among developed markets, Denmark was number one in US dollar terms in 2015 with a return of more than 23%. But a big bet on that country the following year would have backfired, as Denmark slid to bottom of the table with a loss of nearly 16%.1 It’s true that the US stock market (by far the world’s biggest) has been a strong performer in recent years, holding the number three position among developed markets in 2011 and 2013, first in 2014, and sixth in 2016. But a decade before, in 2004 and 2006, it was the second worst-performing developed market in the world.1 Predicting which part of a market will do best over a given period is also tough. For example, while there is ample evidence to support why we should expect positive premiums from small cap, low relative price, and high profitability stocks, these premiums are not laid out evenly or predictably across the map. US small cap stocks were among the top performers in 2016 with a return of more than 21%. A year before, their results looked relatively disappointing with a loss of more than 4%. International small cap stocks had their turn in the sun in 2015, topping the performance tables with a return of just below 6%. But the year before that, they were the second worst with a loss of 5%.2 If you’ve ever taken a long road trip, you’ll know that conditions along the way can change quickly and unpredictably, which is why you need a vehicle that’s ready for the worst roads as well as the best. While diversification can never completely eliminate the impact of bumps along your particular investment road, it does help reduce the potential outsized impact that any individual investment can have on your journey. With sufficient diversification, the jarring effects of performance extremes level out. at, in turn, helps you stay in your chosen lane and on the road to your investment destination. Happy motoring and happy investing. 1. In US dollars. MSCI developed markets country indices (net dividends). MSCI data © MSCI 2017, all rights reserved.

2. In US dollars. US Small Cap is the Russell 2000 Index. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. International Small Cap is the MSCI World ex USA Small Cap Index (gross dividends). MSCI data copyright MSCI 2017, all rights reserved. Source: Dimensional Fund Advisors LP. Past performance is no guarantee of future results. There is no guarantee an investing strategy will be successful. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2017, all rights reserved. |

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.