|

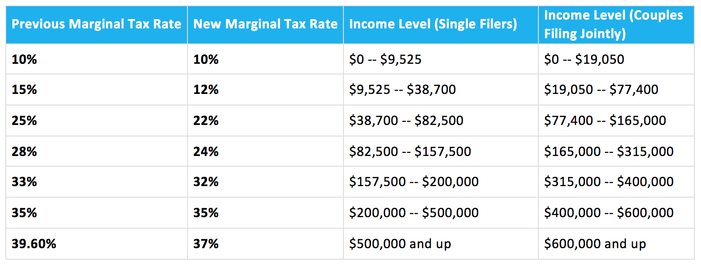

The last days of the year produced the most significant tax overhaul in decades, with far-reaching ramifications for most investors. Originally intended to be a simplification of the tax code, the bill turned out to be a series of tweaks and adjustments to both personal and corporate income taxes for 2018. While it is always advisable to consult your tax professional on these changes, here is a brief summary of how the bill impacts taxpayers.

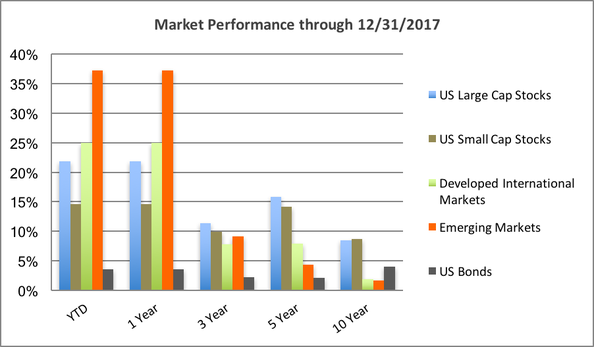

Market Summary News of tax reform didn’t overshadow another strong year for markets. Major equity asset classes around the globe all posted double digit gains. Emerging markets led the way +37.28% for the year. International Developed markets were up +25%. The S&P 500 posted another great year +21.83% and US small caps gained 14.65%. US Bond markets also fared reasonably well, turning in a positive 3.54% return. Last year around this time all the buzz was about the United Kingdom's vote to leave the European Union, the surprise election of Donald Trump, and how global markets would respond. One could have easily made the argument that such uncertainty would have had a negative impact. Now that the results are in, talk turns to whether stocks are overpriced or underpriced and how much longer this bull market can continue. The fact of the matter is, predicting the next bear market isn’t necessary for the success of long term diversified investors. Most of us will see numerous bull/bear market cycles throughout our investment lifetime (We’ve seen 5 changes in the last 27 years.) Things like behavioral discipline, rebalancing, and making intelligent financial planning decisions are always going to be far more important to long term success. WealthShape, LLC provides this communication as a matter of general information. No one should assume that any discussion or information contained in this material serves as a receipt of, or as a substitute for, personalized investment, tax or legal advice. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.