|

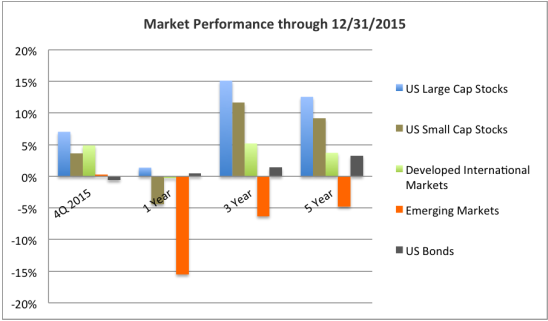

Running in place is perhaps the best way to sum up the market in 2015. It was a record year for the number of times that US stocks crossed the flat performance line, finishing with a slightly positive for US large companies. The up and down ride extended to small cap stocks and international developed markets, which both ended in negative territory. A slowdown in the Chinese economy largely impacted emerging markets, which struggled through most of the year. The US bond market managed to stay positive, anchoring many portfolios through a lackluster 2015. Important developments included a plunge in oil prices, the decrease in unemployment, and the first rise in interest rates in over seven years. Let's begin with one of the more significant changes, which was the tumbling price of oil. Drivers have no doubt noticed the difference at the pump over the last few months. At the start of 2015 a barrel of oil cost $53.45. Currently the price is breaking below $40.00 a barrel, thanks to enormous production by both the United States and Saudi Arabia. Slowdowns in international and emerging markets have also been a factor, decreasing the demand during a time of high production. Unemployment numbers were the next major development. The rate has been falling since the post recession peak of 10% in October of 09, to the most recent reading of 5%. At the beginning of 2015 they were at 5.7%, making the latest drop modest, but not insignificant. The numbers have now reached a lower noninflationary growth level, which is more consistent with historical norms. The last big event of 2015 took place when the Fed raised interest rates for the first time since the 2008 and 2009 financial downturn. The .25% rise up to .50% on the Federal funds rate has been expected for a long time. It was back in December of ‘08 when rates were placed at 0% in an effort to boost the economy after the housing collapse. This was a small first step, which will likely be followed by some gradual increases over the coming year. Generally speaking it’s a good sign for the economy, indicating that the Fed believes it has strengthened, sighting positive jobs and GDP growth. Historically, it’s very difficult to predict any stock market reactions to a rise in interest rates. Some would suggest that the market has been pricing this in for some time now, but as usual; we tend to see short term volatility surrounding events such as these. There are some potential consequences that could be deemed negative such as higher borrowing costs, or fluctuations in long term fixed income instruments. However, this isn’t a certainty. When the Fed raised interest rates in the mid 2000’s, long term rates didn’t go up. Former Fed Chair, Ben Bernanke suggested that it may have been due to savers in countries like China, that were sitting on lots of cash with few places to park it, so they picked the safest place they could find: US government debt. Whether you agree or disagree with this assertion, it does demonstrate that the Fed has a good amount of control over interest rates in the short term, but far less over the long term. Years like 2015 don’t always feel productive. Flat or negative returns never do. However, it’s important to keep in mind that the very nature of capital markets is to fluctuate, and for good reason. If markets only went up, with zero fluctuation, the reward for the investor would justly be smaller. Risk and return are indefinitely related. Our investment philosophy is one that takes into account the historical risk premiums associated with markets; engineering well diversified portfolios, which are prudently built for the long term. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life. Index data: US Large Cap Stocks: S&P 500, US Small Cap Stocks: Russell 2000, Developed International Markets: FTSE Developed ex US, Emerging Markets: FTSE Emerging Index, US Bonds: Barclays Aggregate US Bond

Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.