|

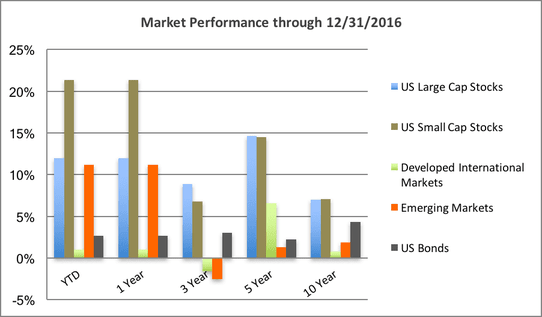

2016 will go down as a year marked by the United Kingdom's vote to leave the European Union and the United States' surprise election of Donald J. Trump as president. From an investment perspective, it was a positive year for virtually every major asset class. US small cap stocks led the way gaining over 20% in 2016, much of which came in the 4th quarter. US large cap stocks also posted double digit returns, coming in at 11.9% for the S&P 500. With fears of China’s economic slowdown subsiding, Emerging Markets advanced over 11%, US bonds were up over 2% and International Developed markets surged in the month of December to a modest annual gain of 1%. Interest rates were on the move with 10-year Treasury yields falling as low as 1.36% in July; only to reverse course, ending the year at 2.45%. The Fed raised rates last month for the first time in a year, with the likelihood of two or three more hikes expected in 2017. It seems like a long time ago, but at this time last year, the news was the tumbling price of oil. Crude touched bottom back in February, sliding all the way to the mid-$20s, the culmination of an uninterrupted 19-month slide. Since then the price of oil has more than doubled. There’s been much talk about legislative changes to tax policies in 2017. Until further details unfold, it’s best to wait rather than speculate on what may or may not happen. It was in 2008 when then Senator Obama actively campaigned on a sun setting of the Bush era tax cuts, only to extend them throughout his presidency. 2016 reminds us that we all need to operate with a healthy level of skepticism when consuming the news. We witnessed two historic political surprises that a vast majority of media prognosticators never saw coming. The constant siren of absolute certainty spewing from the mouths of pundits makes it more difficult than ever to separate speculation from reality. The good news is; an accurate forecast of the future isn’t a requirement for being successful investors. Like countless other examples throughout history, disciplined investors were rewarded in 2016. Financial markets are complex instruments, but the way they operate is fairly straightforward. They don’t choose which news to disseminate, they react positively or negatively to the collective body of information. YTD=Year To Date performance through date listed above. Index Data: US Large Cap Stocks: S&P 500, US Small Cap Stocks: Russell 2000, Developed International Markets: MSCI EAFE Index, Emerging Markets: MSCI Emerging Markets Index, US Bonds: Barclays US Aggregate Bond Index

Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.