|

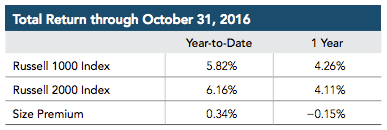

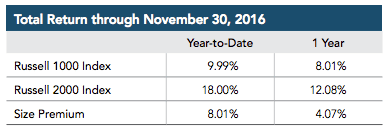

By Weston Wellington Vice President, Dimensional Fund Advisors In the days immediately following the recent US presidential election, US small company stocks experienced higher returns than US large company stocks. This example helps illustrate how the dimensions of expected returns can appear quickly, unpredictably, and with large magnitude. Average returns for US small company stocks historically have been higher than the average returns for US large company stocks. But those returns include long periods of both strong and weak relative performance. Investors may attempt to enhance returns by increasing their exposure to small company stocks at what appear to be the most opportune times. Yet this effort to time the size premium can be frustrating because the most rewarding results often occur in an unpredictable manner. A recent paper1 by Wei Dai, PhD, explores the challenges of attempting to time the size, value, and profitability premiums.2 Here we will keep the discussion to a simpler example. As of October 31, 2016, small company stocks had outpaced large company stocks for the year-to-date by 0.34 percentage points. To the surprise of many market observers, the broad stock market rose following the US presidential election on November 8, with small company stocks outperforming the market as a whole. In the eight trading days following the US presidential election, the small cap premium, as measured by the return difference between the Russell 2000 and Russell 1000, was 7.8 percentage points. This helped small company stocks pull ahead of large company stocks year-to-date, as of November 30, by approximately 8 percentage points and for a full one-year period by approximately 4 percentage points. This recent example highlights the importance of staying disciplined. The premiums associated with the size, value, and profitability dimensions of expected returns may show up quickly and with large magnitude. There is no guarantee that the size premium will be positive over any period, but investors put the odds of achieving augmented returns in their favor by maintaining constant exposure to the dimensions of higher expected returns. The size premium is determined by calculating the difference between the Russell 2000 Index, which represents small company stocks, and the Russell 1000 Index, which represents large company stocks. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

1. Wei Dai, “Premium Timing with Valuation Ratios” (white paper, Dimensional Fund Advisors, September 2016). 2. Size premium: the return difference between small capitalization stocks and large capitalization stocks. Value premium: the return difference between stocks with low relative prices (value) and stocks with high relative prices (growth). Profitability premium: The return difference between stocks of companies with high profitability over those with low profitability. Past performance is no guarantee of future investment results. There is no guarantee an investing strategy will be successful. Small cap securities are subject to greater volatility than those in other asset categories. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.