|

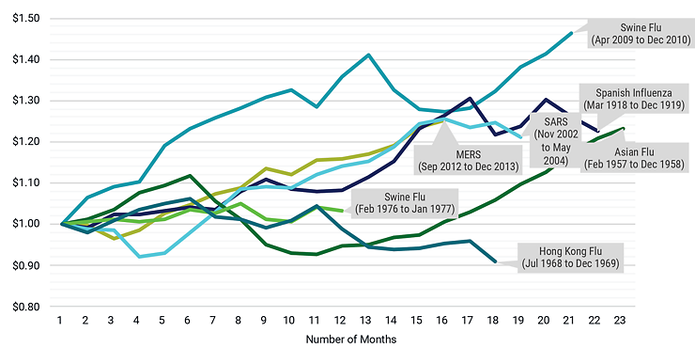

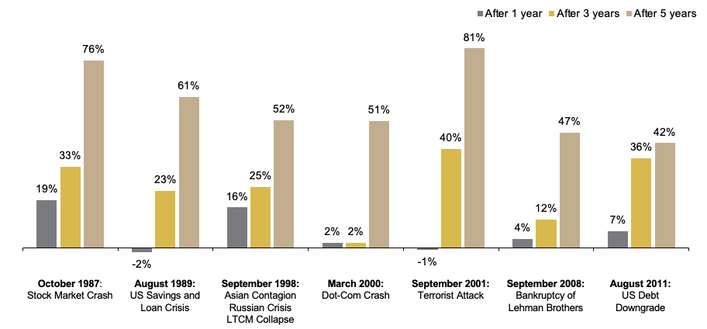

Over the past few weeks we've witnessed the global market reaction to uncertainty surrounding the coronavirus. The environment remains fluid with strongly positive and negative movements based on the latest developments. The situation can be unsettling both on a human level and from the perspective of how markets respond. The question is, what historical evidence do we have to provide rational guidance during times like these? At WealthShape, it is a fundamental principle that markets are designed to handle uncertainty, processing information in real-time as it becomes available. We see this happening when markets decline sharply, as they have recently, as well as when they rise. Such declines can be distressing to any investor, but they are also a demonstration that the market is functioning as we would expect. Market declines can occur when investors are forced to reassess expectations for the future. The expansion of the outbreak is causing worry among governments, companies, and individuals about the impact on the global economy. Apple announced earlier this month that it expected revenue to take a hit from problems making and selling products in China1. Australia’s prime minister has said the virus will likely become a global pandemic2, and other officials there warned of a serious blow to the country’s economy3. Airlines are preparing for the toll it will take on travel4. And these are just a few examples of how the impact of the coronavirus is being assessed. Growth of $1 During Outbreaks S&P 500 Composite Index Sources: Robert Shiller Data Collection at Yale University and Centers for Disease Control and Prevention. S&P 500® Composite Index does not include reinvested dividends. We plot the growth of $1 for the S&P 500® Composite Index in the months following the first reported cases of several outbreaks throughout history and show the ending value when the outbreak subsided. There is much uncertainty associated in determining the measurement periods and precise length of each outbreak. It’s impossible to disentangle the market effects of the outbreak itself from other economic forces. The sell-off across stock markets in recent days was attributed to fears surrounding the impact of the coronavirus but happens to coincide with valuation ratios on the high side relative to historical averages for equities. The market is clearly responding to new information as it becomes known, but the market is pricing in unknowns, too. As risk increases during a time of heightened uncertainty, so do the returns investors demand for bearing that risk, which pushes prices lower. We can’t tell you when things will turn or by how much, but our expectation is that bearing today’s risk will be compensated with positive expected returns. That’s been a lesson of past health crises, such as the Ebola and swine-flu outbreaks earlier this century, and of market disruptions, such as the global financial crisis of 2008–2009. Additionally, history has shown no reliable way to identify a market peak or bottom. These beliefs argue against making market moves based on fear or speculation, even as difficult and traumatic events transpire. The Market’s Response to Crisis Performance of a Balanced Strategy: 60% Stocks, 40% Bonds Cumulative Total Return This shows the performance of a balanced investment strategy following a few historical crises. Each crisis is labeled with the month and year that it occurred or peaked. The subsequent one-, three-, and five-year annualized returns start from the first day of the month following each crisis. Although a global investment strategy would have suffered losses immediately following most of these events, the financial markets recovered over time, as indicated by the positive five-year cumulative returns. Negative events such as these may tempt investors to flee the financial markets. But diversification and a long-term perspective can help investors apply discipline to ride out the storm. Conclusion In the mind of some investors, there is always a “crisis of the day” or potential major event looming that could mean the beginning of the next drop in markets. As we know, predicting future events correctly, or how the market will react to future events, is a difficult exercise. It is important to understand, however, that market volatility is a part of investing. To enjoy the benefit of higher potential returns, investors must be willing to accept increased uncertainty. A key part of a good long-term investment experience is being able to stay with your investment philosophy, even during tough times. Financial planning combined with a well‑thought‑out, transparent investment approach can help people be better prepared to face uncertainty and improve their ability to stick with their plan and ultimately capture the long-term returns of capital markets. Amid the anxiety that accompanies developments surrounding the coronavirus, decades of financial science and long-term investing principles remain a strong guide. Appendix

The Markets Response to Crisis In US dollars. Represents cumulative total returns of a balanced strategy invested on the first day of the following calendar month of the event noted. Balanced Strategy: 12% S&P 500 Index, 12% Dimensional US Large Cap Value Index, 6% Dow Jones US Select REIT Index, 6% Dimensional International Value Index, 6% Dimensional US Small Cap Index, 6% Dimensional US Small Cap Value Index, 3% Dimensional International Small Cap Index, 3% Dimensional International Small Cap Value Index, 2.4% Dimensional Emerging Markets Small Index, 1.8% Dimensional Emerging Markets Value Index, 1.8% Dimensional Emerging Markets Index, 10% Bloomberg Barclays Treasury Bond Index 1-5 Years, 10% FTSE World Government Bond Index 1-5 Years (hedged), 10% FTSE World Government Bond Index 1-3 Years (hedged), 10% ICE BofAML 1-Year US Treasury Note Index. Assumes monthly rebalancing. For illustrative purposes only. S&P and Dow Jones data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. ICE BofAML index data © 2019 ICE Data Indices, LLC. FTSE fixed income indices © 2019 FTSE Fixed Income LLC. All rights reserved. Bloomberg Barclays data provided by Bloomberg. Dimensional indices use CRSP and Compustat data. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Not to be construed as investment advice. Returns of model portfolios are based on back-tested model allocation mixes designed with the benefit of hindsight and do not represent actual investment performance. See “Balanced Strategy Disclosure and Index Descriptions” pages in the Appendix for additional information. 1Apple, February 17 press release https://www.apple.com/newsroom/2020/02/investor-update-on-quarterly-guidance/ 2Ben Doherty and Katharine Murphy, “Australia Declares Coronavirus Will Become a Pandemic as It Extends China Travel Ban,” The Guardian, February 27, 2020. https://www.theguardian.com/world/2020/feb/27/australia-declares-coronavirus-will-become-a-pandemic-as-it-extends-china-travel-ban 3Ben Butler, “Coronavirus Threatens Australian Economy Reeling from Drought and Fires,” The Guardian, February 5, 2020. https://www.theguardian.com/business/2020/feb/05/coronavirus-threatens-australian-economy-reeling-from-drought-and-fires; Ed Johnson, “Australia Says Economy to Take ‘Significant’ Hit from Virus,” https://www.bloomberg.com/news/articles/2020-02-05/australia-says-economy-to-take-significant-hit-from-virus 4Alistair MacDonald and William Boston, “Global Airlines Brace for Coronavirus Impact,” The Wall Street Journal, February 26, 2020.https://www.wsj.com/articles/germanys-lufthansa-makes-cuts-as-it-braces-for-coronavirus-impact-11582712819 Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.