|

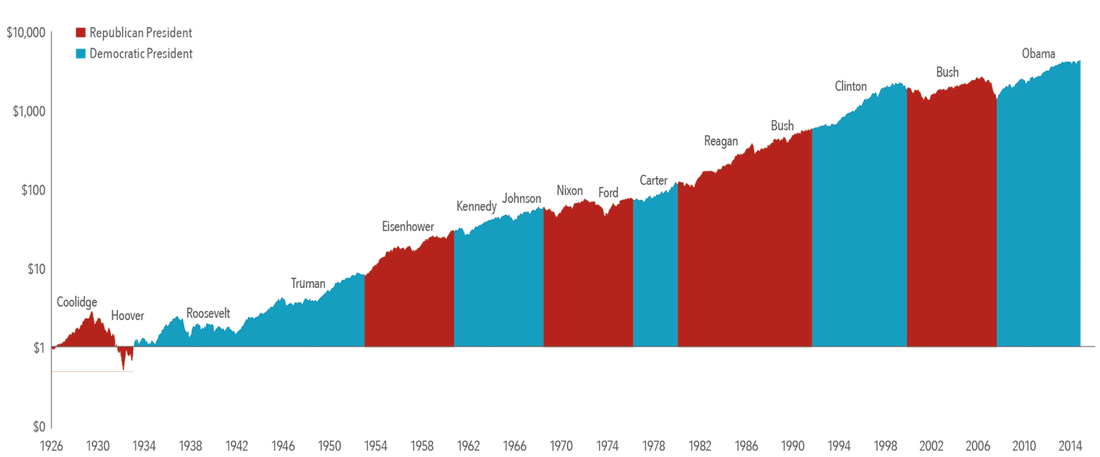

Someone once told me that people vote with their wallets. If that’s truly the case, then whatever a person’s political persuasion happens to be, it’s likely the one they believe best suits their financial needs. In an election year you’ll find no shortage of opinions on the impact that one party’s candidate will have on your investments. The Clinton camp will cite strong US market performance during Bill’s presidency as evidence to suggest Hillary is capable of delivering similar results. Trump supporters will point to Donald’s real estate success and business acumen to demonstrate his abilities. The question on the minds of investors is: Do I need to worry if my candidate doesn’t win? Growth of a Dollar Invested in the S&P 500: January 1926–June 2016 Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group. The Markets Financial markets are complex instruments, but the way they operate is fairly straightforward. They don’t choose which news to disseminate, they react positively or negatively to the collective body of information. Politicians will inevitably take credit when the news is favorable and deflect blame when it doesn’t support their narrative. For this reason, tying a single economic policy to market performance is an inadequate measurement of success. Even if sweeping changes in the tax code or regulatory environment take place, the impact can take years to play out. During the 2008-09 downturn there was plenty of blame to go around. Financial institutions took most of the heat due to the irresponsible sale of mortgage backed securities worsened by the impact of being highly leveraged. Credit rating agencies didn’t escape responsibility when they failed to appropriately categorize the quality of various financial instruments. Deregulation at the hands of politicians was not overlooked. Many felt this environment was ripened for catastrophe when Bill Clinton signed the 1999 repeal of the Glass-Steagall Act, which was initially designed to limit the abilities of commercial banks and investment firms from crossing over into each other’s business’s. Decades earlier some could point to the relaxing of lending standards through the 1977 Community Reinvestment Act, which was meant to encourage commercial banks to help meet the needs of borrowers with moderate to low incomes. The simple truth is too many variables exist to attach responsibility to one political party or another because market expansions and recessions are never the result of a single decision. The one major agreement is there is no agreement. Silver Lining for Investors No Matter Your Candidate History has shown that if we look back to 1948, the likelihood of seeing 4 years of negative market returns is far-off. In fact, it’s only happened twice. (Nixon and Bush 43) During both periods the US economy was in a severe recession and as demonstrated above, it would be tough to tie either administration’s specific economic policies to the return of the S&P 500. By and large, presidents have no control over financial markets. If any term comes to mind that’s indicative of a presidents impact it would likely be “victim of circumstance.” The collective history of markets is the most important thing to focus on. Since 1948 the S&P 500 has averaged double digit annualized returns. The vast majority of investors have retirement goals that extend far past 4 or 8 years of a presidential administration that they don’t favor. The good news is, regardless of the applause or blame for economic conditions under any president, they only get to stick around for so long. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.