|

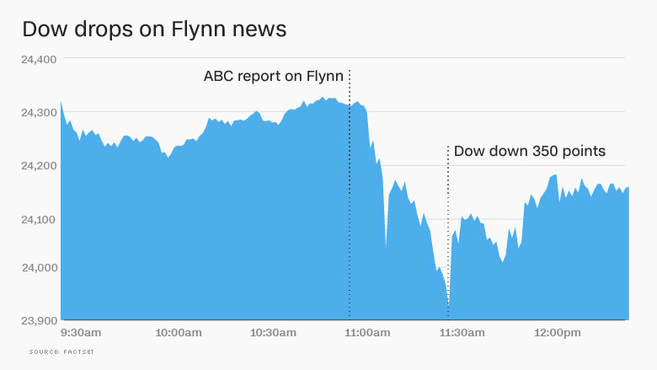

The most powerful driving force behind free and open capital markets has historically been the dissemination, consumption and interpretation of news. Since the inception of public news consumption, misinformation has been an issue. Different terminology comes and goes, “fake news” being the latest label, magnified by the president’s usage of it. Today, in an era when fact checking through multiple sources seems low on the list of journalistic priorities, have we reached a point where an impact can be felt from the publication of fake news? Recently, ABC News anchor Brian Ross reported that former National Security Advisor Michael Flynn was prepared to testify that during the campaign Donald Trump had personally directed him to make contact with Russians. Following his on-air statement, ABC News tweeted about the report which subsequently received 25,000 retweets. As you can imagine, word began spreading like wildfire to most of the major media outlets, many crediting ABC News for breaking the story. However, there was one minor problem. It happened to be false. Effects came quickly as investors and by extension financial markets began interpreting the future implications of this new development. Ross’s live TV broadcast took place at approximately 11:00 AM eastern time, by 11:30 the Dow Jones Industrial Average reacted sharply, falling around 350 points. Interestingly enough Michael Flynn wasn’t the days only headline news. December 1st also included initial signals that the much talked about tax reform bill had enough votes to pass in the Senate. By market close, the Dow had recovered most of the day’s losses finishing just 41 points lower than the previous day. It wasn’t until later that day when ABC issued an apology in addition to suspending Ross 4 weeks for his inaccurate reporting:

"We deeply regret and apologize for the serious error we made yesterday. The reporting conveyed by Brian Ross during the special report had not been fully vetted through our editorial standards process," ABC said in a statement. "As a result of our continued reporting over the next several hours ultimately we determined the information was wrong and we corrected the mistake on air and online." Fortunately, or unfortunately we live in a 24-hour news cycle. With the current volume of sensationalized, half-baked journalism out there, it’s understandable for markets to react irrationally at times. The events of December 1st are a reminder that short-term volatility or “noise” as the pundits like to call it, is often a factor when news is being interpreted. In this instance, markets reversed course quickly, incorporating the newly released information into prices. Headlines often jolt us, perhaps even more regularly than we care to admit. Does fake news impact the market? The answer would have to be yes…but then again, all varieties of news from stone cold factual journalism to supermarket tabloids have an impact. It’s critical to remember that although noise exists, markets tend to get things right over time. We should use these cases as opportunities to reflect on the larger body of evidence that supports disciplined long-term investing over emotional short-term speculation. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.