|

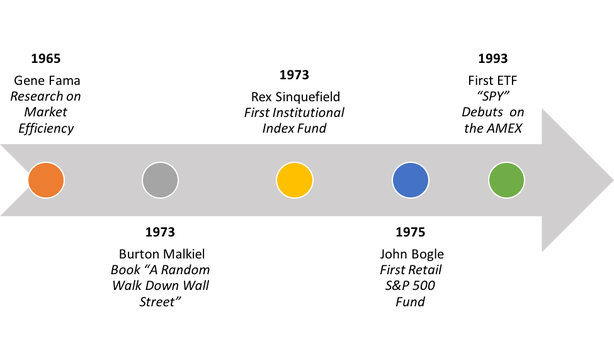

By now most informed investors are at the very least aware of the rationale behind index investing. It’s a simple argument really. Thanks to millions of buyers and sellers the market does a good job of translating information into prices. Indexers stay on the bench because they know the perils of playing the “find the next best stock” game. The evidence for buying and holding the index vs. attempting to beat it is long and well founded. There’s nothing new to this argument and maybe that’s the point. It’s been made for over 40 years. Vanguard founder John Bogle is perhaps the most vocal and consistent messenger. In fact, I might argue that he’s saved investors more money than any single financial persona in history due to the size and scope of the company he built. Here’s the problem. Few index investors understand that the same academics responsible for its groundbreaking research, see it as the maiden version of factor based investing. In the scientific community Eugene Fama is revered as the father of modern day finance. He won the Nobel prize in 2013, but he’s still probably not what you would consider a household name. His seminal work on market efficiency laid the foundation for the main argument that index investors make daily “It’s hard to beat the market…So just own it. When compared to other scientific areas of study, it’s fair to say that modern day financial science is a newer discipline, coming of age when we first began tracking securities prices with the help of computers. The discovery that stock prices tend to follow a random walk theory, moving independent of trends, may have been one of the first transcendent ideas to come from this research. Now, over 50 years later we know much more about empirical factors that help to explain where investment returns come from.

In 1992 Fama, along with colleague Kenneth French went on to publish one of the most widely sourced academic papers in all of finance. The “Fama-French Three Factor Model” documented the historical evidence behind the tendencies for stocks to outperform bonds, small companies to outperform large companies and value companies to outperform growth companies. Since then, academia has continuously searched to identify ways to improve upon what we already know about the movement of prices. Momentum and other factors that have rigorous academic backing embody these efforts. In 2017 “objectivity” is the common buzzword that gets thrown around all too lightly. Choosing to build a market cap weighted index portfolio doesn’t strike me as an objective approach to portfolio management given the decades of research compiled since the efficient markets hypothesis. Evidence and research aside, that doesn’t mean all strategies are created equal. The financial industry hasn’t done investors a lot of favors with the marketing of factor based investing and maybe that’s the reason it’s so grossly misunderstood. Smart beta, active indexing, and fundamental indexing are just a few of the invented alias’s. Any fund or strategy claiming the backing of empirical research should be carefully vetted for how the factor/factors are being targeted, fees and also how its inclusion interacts with the rest of the portfolio. It’s not bad or wrong to simply own the market, but I would argue that if you believe in index investing, you should believe in factor based investing if for no other reason than the initial architects of such research do. It represents the best empirical understanding we have of what drives investment performance. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.