|

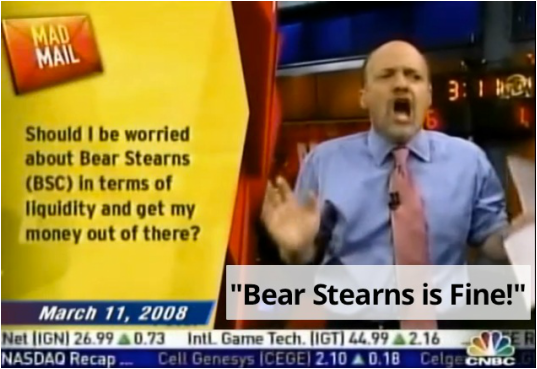

A few days ago a working study was released talking about CNBC Mad Money host Jim Cramer’s inability to beat the market as measured by the S&P 500 over the last 15 years. It’s hardly the first time someone has taken a shot at him. I suspect it coincided with the timely release of the movie “Money Monster” where George Clooney plays a character said to be inspired by Cramer. The popular show which began in 2005 has included segments such as “Am I diversified”, Lightening Round” and “Pick of the week”. I get his shtick and have even been told by folks who know Jim that he’s an incredibly nice guy. What continues to boggle my mind is this: in spite of all the evidence, some viewers still look to the show for advice. In his own words Cramer defines “mad money” as the money one “can use to invest in stocks ... not retirement money, which you want in 401K or an IRA, a savings account, bonds, or the most conservative of dividend-paying stocks.” The intention here isn’t to smear Jim Cramer or his popular show. There are certainly instances when sound logic is displayed. He’s openly suggested individuals should refrain from choosing actively managed mutual funds, sighting their underperformance vs. standard benchmarks over long periods of time. Unfortunately sound advice doesn’t keep viewers entertained for long. Setting aside the overly dramatic antics that dominate the show, have viewers actually benefitted from his expertise? According to the study just released out of the Wharton School of Business at the University of Pennsylvania, Cramer’s Action Alerts Plus portfolio has underperformed the S&P 500 index in terms of total cumulative returns since its 2001. The portfolio he co-manages is a buy/sell strategy found on the financial website he started. The site also features a subscription service, which includes an exclusive Cramer market commentary. You be the judge as to whether he helps or hinders investor behavior. I lean towards the latter, but give the guy credit for his high energy and entertainment value. Obviously he’s the main reason for the shows popularity. However, CNBC isn’t in the investment business. They don’t directly generate revenue from investment management or even advice. That comes from advertisers. Naturally, a larger viewing audience helps their cause. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.