|

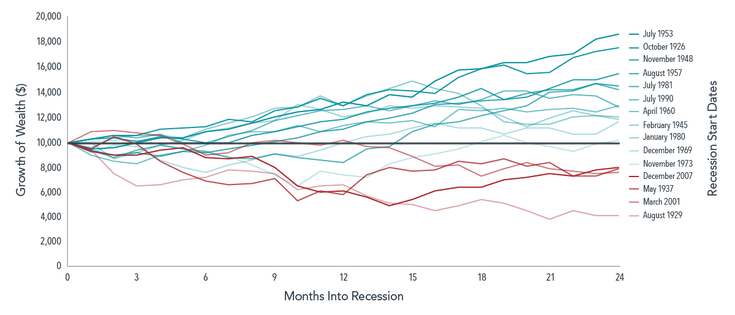

With activity in many industries sharply curtailed in an effort to reduce the chances of spreading the coronavirus, some economists say a recession is inevitable, if one hasn’t already begun.1 From a markets perspective, we have already experienced a drop in stocks, as prices have likely incorporated the growing chance of recession. Investors may be tempted to abandon equities and go to cash because of perceptions of recessions and their impact. But across the two years that follow a recession’s onset, equities have a history of positive performance. Data covering the past century’s 15 US recessions show that investors tended to be rewarded for sticking with stocks. Exhibit 1 shows that in 11 of the 15 instances, or 73% of the time, returns on stocks were positive two years after a recession began. The annualized market return for the two years following a recession’s start averaged 7.8%. Downturns, Then Upturns Growth of wealth for the Fama/French Total US Market Research Index Recessions understandably trigger worries over how markets might perform. But history can be a comfort for investors wondering whether now may be the time to move out of stocks. GLOSSARY

Fama/French Total US Market Research Index: The value-weighed US market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American Depositary Receipts. Sources: CRSP for value-weighted US market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced. FOOTNOTES 1Nelson D. Schwartz, “Coronavirus Recession Looms, Its Course ‘Unrecognizable,’” New York Times, March 21, 2020; Peter Coy, “The U.S. May Already Be in a Recession,” Bloomberg Businessweek, March 6, 2020. DISCLOSURES The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein. Past performance, including hypothetical performance, is not a guarantee of future results. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.