|

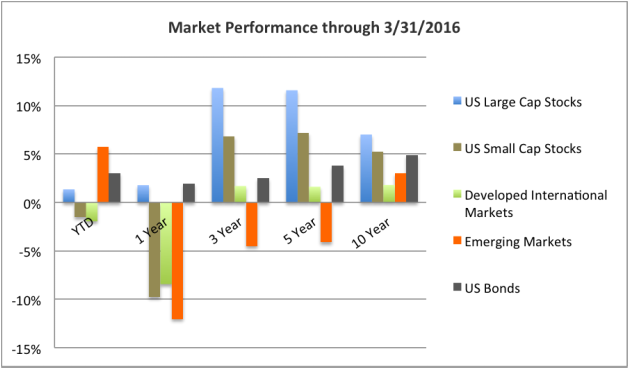

Following a rocky start to the New Year, most markets rebounded to end the first quarter of 2016 on a slightly positive note. The S&P 500 recovered during the last six weeks to post positive returns of 1.35% and emerging markets surged to a very strong opening quarter gaining 5.71%. US bonds also rallied with the Barclays Aggregate bond index up 3.03% for the quarter. US small companies and international developed markets finished in negative territory down -1.52% and -1.95% respectively. Markets faced serious headwinds at the tail end of 2015 due to slowing economic growth around the world. Combined with rising interest rates, a strong dollar, and falling commodities prices, we faced a perfect storm of factors that ticked off a stock market correction. However, after falling by as much as 10.5% earlier in 2016, the S&P 500 gained 6.8% in March. Given the roller coaster ride we've had this year, the recent gains are a testament to the resilience of investors. YTD=Year To Date performance through date listed above. Index Data: US Large Cap Stocks: S&P 500, US Small Cap Stocks: Russell 2000, Developed International Markets: MSCI World EX US Index, Emerging Markets: MSCI Emerging Markets Index, US Bonds: Barclays US Aggregate Bond Index Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.