|

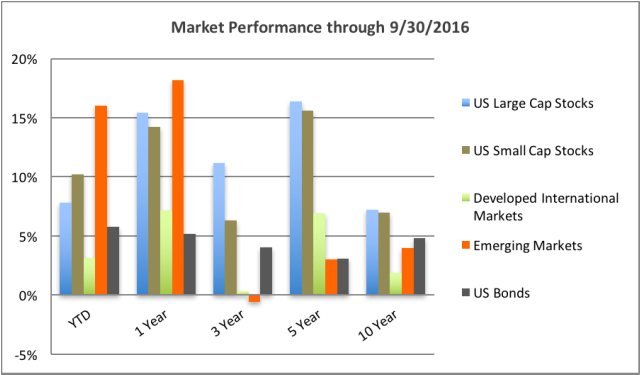

We’ve come to that time of the year when election news dominates the headlines and not much else. Through 9 months of 2016 markets have remained resilient notwithstanding speculation on interest rates, Brexit fallout and political scrutiny. Despite a flat month of September, it was a solid quarter for US large cap stocks as the S&P 500 saw gains of nearly 4%. Developed international markets made a major come back following this summer’s Brexit frenzy, advancing 6.4% to move into positive territory of the year. Emerging markets rallied the most, up 9% for the quarter with US bonds managing to turn in a small .5% gain. It wasn’t a terribly busy quarter as far as news was concerned. On September 21st, the Fed held a news conference to basically tell us that there was no news on interest rate moves as they elected to leave interest rates unchanged. To date, we have seen 23 press conferences and the Fed has raised interest rates a quarter of a percent. The lasts concluded with a “see you in December at the next press conference.” Get ready to be dominated by election hoopla. At times like these, it’s essential to remember that no matter your political persuasion, by and large, presidents have no control over financial markets. Simply too many variables exist to give credit or lay blame to one individual or even political party. The collective history of markets is the most important thing to focus on. The vast majority of investors have retirement goals that extend far past 4 or 8 years of a presidential administration that they don’t favor. The good news is, regardless of the applause or blame for economic conditions under any president, they only get to stick around for so long. YTD=Year To Date performance through date listed above. Index Data: US Large Cap Stocks: S&P 500, US Small Cap Stocks: Russell 2000, Developed International Markets: MSCI World EX US Index, Emerging Markets: MSCI Emerging Markets Index, US Bonds: Barclays US Aggregate Bond Index

All data is from sources believed to be reliable but cannot be guaranteed or warranted. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Diversification does not eliminate the risk of market loss. Investment risks include loss of principal and fluctuating value. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.