|

Throughout 2017, the S&P 500 Index recorded 62 new closing highs in 251 days of trading. In the first three weeks of January 2018 alone, the index crossed 10 new record closing highs in 13 days of trading. With stock indices continuing to set new highs, does this mean negative returns for stocks are on the horizon? When addressing this question, it is helpful to keep the following in mind:

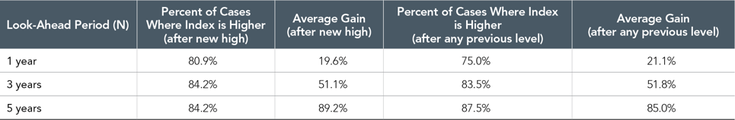

History can help illustrate this point and show us that a market index reaching an all-time high has not necessarily provided actionable information for investors. Exhibit 1. S&P 500 Index Total Return Highs Percent of cases where index is higher after monthly closing high vs. any monthly closing level January 1926–December 2017 For illustrative purposes only. Average gain is a simple average of all positive returns for the 1-, 3-, or 5-year periods analyzed. © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Exhibit 1 measures monthly closing levels of the S&P 500 Index from the beginning of 1926 to the end of 2017. Of the 1,103 months observed, almost one-third represented new closing highs for the index. This may not be surprising for some. Since markets generally tend to go up over time, new highs should be a relatively common occurrence. Considering this, it is worth posing the question: If prices increasing over time was a troubling development, what would be the point of investing at all? This data also shows that looking ahead on a one-, three-, and five-year basis, the percent of cases when the index was higher or lower after a new market high is about the same when compared to any other previous price level. In other words, positive and negative returns tended to make up a similar proportion of returns after the fact, regardless of whether a new high was reached or not. For example, for a three-year look-ahead period, the index was higher around 84% of the time both after hitting a new closing high as well as after any other previous level. Additionally, this data shows us that the average return experienced after those highs vs. any other level is also quite similar. For example, for the three-year look-ahead period, the average cumulative return after a new high was 51.1% vs. 51.8% for any other level. These results indicate that new index highs have historically not been useful predictors of future returns. Another reason investors should be cautious about reevaluating their approach at an all-time high is the potential opportunity cost of switching in and out of the market. Last year, the S&P 500 Index returned more than 20%, and yet 2017 started with three new market highs during the first 20 trading sessions.[1] The opportunity cost paid by investors reacting to the new highs by selling stocks could have been substantial. There is no reliable way to predict when stock returns will be positive or negative, and while the long-term average return of the US stock market[2] has been around 10% since 1926, year-to-year results often deviate markedly from the historical average.[3] Investors looking to capture what the equity markets offer over the long term are likely well served by sticking with their approach rather than making changes based on short-term noise. Conclusion The question of whether new market highs portend a fall in stocks can often be translated to another, more general question: “Is now a good time for me to be invested?” The evidence suggests that the current state of the market is not helpful in answering this question. Rather, an appropriate answer is highly dependent upon an investor’s unique situation and their risk and return objectives. For investors concluding stock market exposure is appropriate, a disciplined approach with a long-term view is likely a more prudent course of action than reacting to new market highs. Source: Dimensional Fund Advisors LP. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. Investors should talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their financial advisor prior to making any investment decision. [1]. S&P 500 Index data © 2018 Dow Jones Indices LLC, a division of S&P Global. All rights reserved. [2] As measured by the S&P 500 Index. [3]. For more on this topic, please see “The Uncommon Average” from October 2017. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.