|

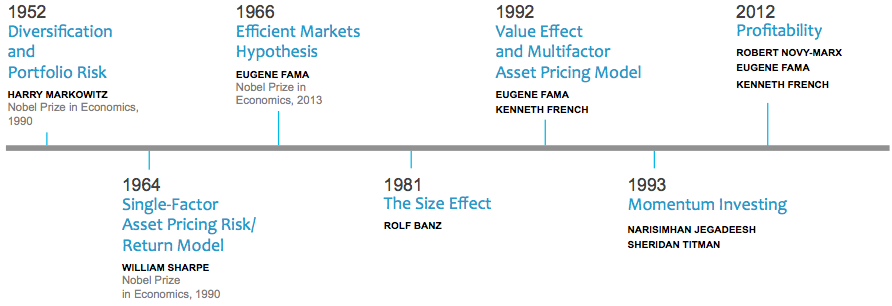

Lots of folks have heard me champion the cause for long term buy and hold investing. I freely acknowledge that on occasion this messaging gets slightly misinterpreted. Sometimes the passion of vehemently arguing against market timing and stock speculation can overshadow the massive body of research involved with portfolio evolution. To some the word passive in conjunction with investing is interpreted to mean stagnant, inactive or set it and forget it. Here’s why that characterization couldn’t be farther from the truth. The financial industry often refers to any type of buy and hold or index style investing as passive, a terminology I’ve come to loath even though admittedly I myself am guilty of regularly using it. In truth, the research and portfolio management done at WealthShape has perhaps as many active characteristics as it does passive. Securities research is a science similar to any other science that values data and evidence. Experimentation leads to a hypothesis, which is published, critiqued and ultimately judged by the freethinking world. If ideas are well founded, there’s a strong likelihood that products will be developed to capitalize on them. The growth of index investing The argument for passive investing stems from decades of research into financial markets and the imperfect but solid job they do of incorporating all available information into stock prices. Ironically, what many fail to recognize is that indexes were not initially created for the sole purpose of investing; they were invented to measure the skill of active traders. When it became painfully evident that stock pickers overwhelmingly failed to outperform, products were created to mirror the index. We’ve learned a lot over the last 60 years about factors that help to explain where investment returns come from. The standard market cap weighted methodology that’s applied to most indexing strategies has been significantly improved upon since it’s inception in the 1970’s, yet so many portfolios haven’t evolved with the research. Suggesting a market cap weighted basic index portfolio is good enough, flies in the face of enlightenment. Research is meant to build upon itself. While I won’t knock investors who choose such an approach, I will knock those who suggest it’s good enough. For the first half of the 20th century either was a good enough surgical anesthetic and asbestos was a good enough building material. All sciences strive to uncover evidence that helps to provide further understanding. Financial science strives to learn more about security prices and the forces that drive them. Your portfolio should evolve as research as research evolves. The Passive Investing vernacular really is a matter of semantics when you take into consideration the thousands of incremental decisions associated with investment selection, portfolio rebalancing and tax efficient application. WealthShape remains committed to the real life application of over 60 years of investment research. We believe our role is to take what financial science has given us, evaluate the strongest ideas and filter through thousands of solutions to find the best translation of those ideas. The result is broadly diversified portfolios that capture the power of naturally efficient markets and the factors that historically explain investment returns. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.