|

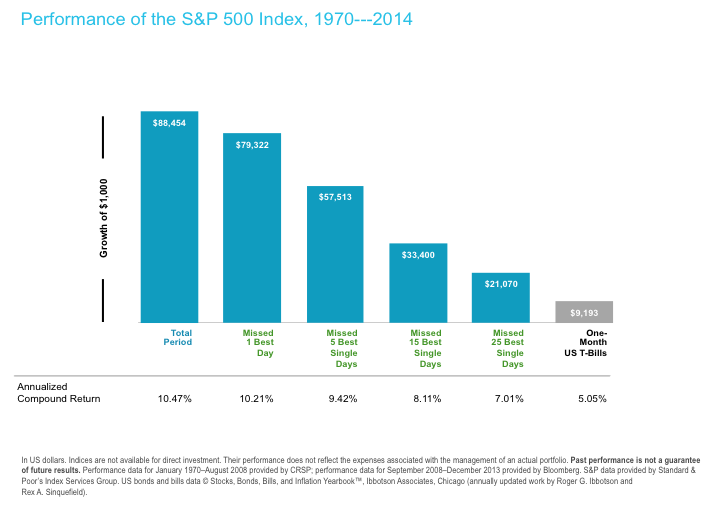

Gamblers are the lifeblood of a casino industry eager to provide a wagering outlet. And why shouldn’t they be? Conventional wisdom tells us “the house always wins.” It’s precisely the reason casinos exist. They’ve studied the evidence and know the most likely outcome. Despite the well-known statistics working against the probability of success, gambling maintains the allure of hungry patrons. The question is: When it comes to investing, who do you have more in common with, the gambler or the house? Choosing to Play the Game From an investment perspective, playing the game involves some form of speculation. It could be timing the market, picking stocks, selecting the next great fund manager, or a combination thereof. With all the above choices, the participant must be willing to accept the odds, which are heavily stacked against them. To be successful in timing the market, you have to make two correct decisions. When do I get out and when do I get back in? Essentially, you’re attempting to predict the news; something that by definition is unpredictable, or else lets face it, it wouldn’t be news. Similar to flipping a coin, each guess is 50/50. That’s the problem with market timing. It’s not good enough to be right once; you have to be right time and time again. The double whammy is being wrong at the worst possible time, like when the market is soaring and you’re sitting on the sidelines. Missing only a few days can have a dramatic impact. What about selecting someone to speculate for you? Unfortunately, research has shown that professional active fund managers fare no better. Paraphrasing a Nobel Prize winner when referencing the around 80% of active managers who underperform the index, Eugene Fama remarked, “It’s the hardest thing for people to accept, that active investment management doesn’t work.” Why? "If active managers win, it has to be at the expense of other active managers. And when you add them all up, the returns of active managers have to be literally zero, before costs. The good ones might be good or they might be lucky. The bad ones might be bad or they might be unlucky. We can't really tell the difference.”

Choosing the House Fully aware of the odds, many wisely choose not play the game, instead putting their faith in the idea that millions of investors are smarter than any single investor. Everybody has some information. The function of the markets is to collect that information, evaluate it, and get it incorporated into prices. In order to beat the market, an investor would have to believe that price was wrong. Therefore, millions of others are collectively wrong. This "if you can't beat the market, why not just buy it" mentality has lead to the dramatic growth of index investing. Indexing has come a long way since it’s inception back in the 1970’s. Oddly enough indexes weren’t even invented to actually be invested in. They were initially created to measure the success of active managers against a standardized benchmark. It was only after time passed that we realized how many managers struggled to outperform. Today, there are thousands of index-oriented products in the mutual fund and ETF variety for investors to choose from. It is worth noting that “the house always wins” investment approach isn’t suggesting that YOU will always win. All markets go through rough patches, fluctuating up and down over the years. Choosing the house doesn’t eliminate that risk. It simply reduces the risk that comes from choosing to play the game. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.