|

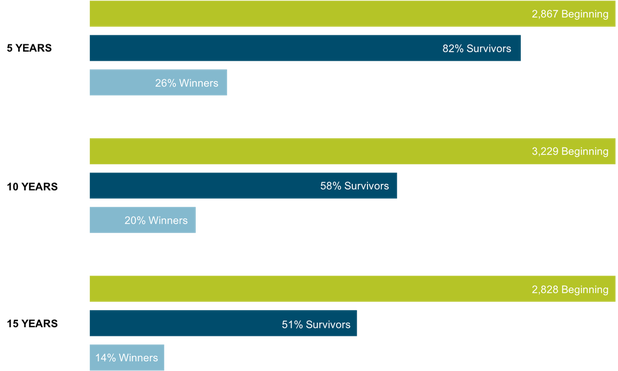

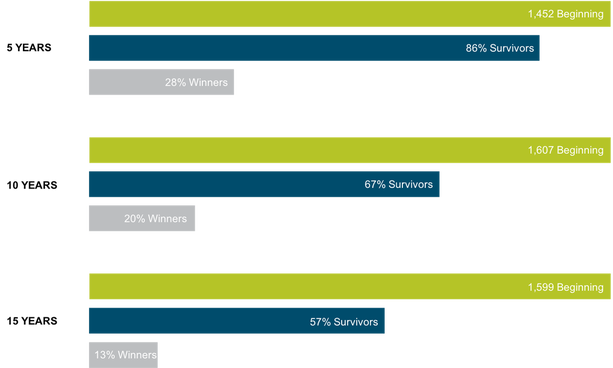

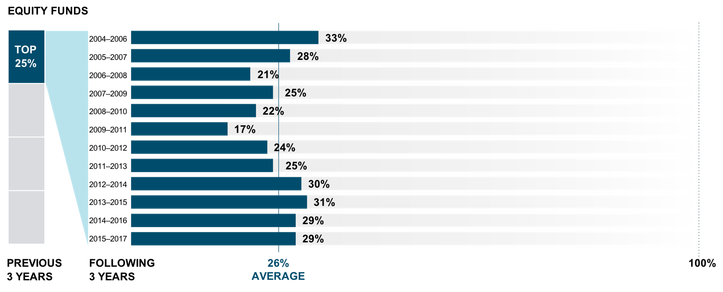

Few Equity Funds Have Survived and Outperformed Performance periods ending December 31, 2017 Disappearing Funds The size of the mutual fund landscape masks the fact that many funds disappear each year, often due to poor investment performance. Investors may be surprised by how many mutual funds become obsolete over time. About half of the equity and fixed income funds were no longer available after 15 years. Including these non-surviving funds in the sample is an important part of assessing mutual fund manager performance. The evidence suggests that only a low percentage of funds in the original sample were “winners”—defined as those that both survived and outperformed benchmarks. Both survival and outperformance rates tended to fall as the time horizon expands. For the 15‑year period through 2017, only 14% of equity funds survived and outperformed their benchmarks. Few Fixed Income Funds Have Survived and Outperformed Fixed income fund performance periods ending December 31, 2017 This chart shows survivorship and outperformance for fixed income funds. Their survival rates were similar to those of equities for the same 5-, 10-, and 15-year periods. Over time, a declining percentage of fixed income funds from the beginning sample survived, and only a fraction of those surviving funds delivered winning performance. For the 15-year period through 2017, only 13% of fixed income funds survived and outperformed their benchmarks. Past Performance Is Not Enough to Predict Future Results Percentage of funds that were top-quartile performers in consecutive three-year period The Search for Persistence Some investors may resort to using track records as a guide to selecting funds, reasoning that a manager’s past success is likely to continue in the future. Does this assumption pay off? The research offers evidence to the contrary. The exhibit shows that among funds ranked in the top quartile (25%) based on previous three-year returns, a minority also ranked in the top quartile of returns over the following three-year period. This lack of persistence casts further doubt on the ability of managers to consistently gain an informational advantage on the market. For example, in 2017, only 29% of equity funds were ranked in the top quartile of performance in their category in both the previous period (2012–2014) and subsequent period (2015–2017). Over the 12 years through 2017, top-quartile persistence of three-year performers averaged 26% for equity funds. Some fund managers might be better than others, but track records alone may not provide enough insight to identify management skill. Stock and bond returns contain a lot of noise, and impressive track records may result from good luck. The assumption that strong past performance will continue often proves faulty, potentially leaving many investors disappointed. Conclusion The results of this study suggest that investors are best served by relying on market prices. Investment methods based on a manager’s ability to outguess market prices have resulted in underperformance for the vast majority of mutual funds. Despite the evidence, many investors continue searching for winning mutual funds and look to past performance as the main criterion for evaluating a manager’s future potential. In their pursuit of returns, many investors surrender performance to high fees, high turnover, and other costs of owning the mutual funds. We believe the underperformance of most US mutual funds highlights an important investment principle: The capital markets do a good job of pricing securities, which intensifies a fund’s challenge to beat its benchmark and other market participants. When fund managers charge high fees and trade frequently, they must overcome high cost barriers as they try to outperform the market. Choosing a long-term winner involves more than seeking out funds with a successful track record, as past performance offers no guarantee of a successful investment outcome in the future. Moreover, looking at past performance is only one way to evaluate a manager. In the end, investors should consider other aspects of a mutual fund, such as underlying market philosophy, robustness in portfolio design, and attention to total costs, all of which are important to delivering a good investment experience and, ultimately, helping investors achieve their goals. Data Appendix

Equity Funds: The sample includes funds at the beginning of the 5-, 10-, and 15-year periods ending December 31, 2017. Survivors are funds that had returns for every month in the sample period. Winners are funds that survived and outperformed their respective Morningstar category index over the period. US-domiciled open-end mutual fund data is from Morningstar and Center for Research in Security Prices (CRSP) from the University of Chicago.. Fixed Income Funds: The sample includes funds at the beginning of the 5-, 10-, and 15-year periods ending December 31, 2017. Survivors are funds that had returns for every month in the sample period. Winners are funds that survived and outperformed their respective Morningstar category index over the period. US-domiciled open-end mutual fund data is from Morningstar and Center for Research in Security Prices (CRSP) from the University of Chicago. Past Performance and Future Results: At the end of each year, funds are sorted within their category based on their three-year total return. The tables show the percentage of funds in the top quartile (25%) of three-year performance that ranked in the top quartile of performance over the following three years. Example: For 2017, only 29% of equity funds were ranked in the top quartile of performance in their category in both the previous period (2012–2014) and subsequent period (2015–2017). US-domiciled open-end mutual fund data is from Morningstar and Center for Research in Security Prices (CRSP) from the University of Chicago. The Mutual Fund Landscape study is conducted by Dimensional Fund Advisors LP. US-domiciled open-end mutual fund data is from Morningstar and Center for Research in Security Prices (CRSP) from the University of Chicago. Equity fund sample includes the Morningstar historical categories: Diversified Emerging Markets, Europe Stock, Foreign Large Blend, Foreign Large Growth, Foreign Large Value, Foreign Small/Mid Blend, Foreign Small/Mid Growth, Foreign Small/Mid Value, Japan Stock, Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Miscellaneous Region, Pacific/Asia ex-Japan Stock, Small Blend, Small Growth, Small Value, and World Stock. For additional information regarding the Morningstar historical categories, please see “The Morningstar Category Classifications” at morningstardirect.morningstar.com/clientcomm/Morningstar_Categories_US_April_2016.pdf. Fixed income fund sample includes the Morningstar historical categories: Corporate Bond, High Yield Bond, Inflation-Protected Bond, Intermediate Government, Intermediate-Term Bond, Muni California Intermediate, Muni California Long, Muni Massachusetts, Muni Minnesota, Muni National Intermediate, Muni National Long, Muni National Short, Muni New Jersey, Muni New York Intermediate, Muni New York Long, Muni Ohio, Muni Pennsylvania, Muni Single State Intermediate, Muni Single State Long, Muni Single State Short, Short Government, Short-Term Bond, Ultrashort Bond, and World Bond. For additional information regarding the Morningstar historical categories, please see “The Morningstar Category Classifications” at morningstardirect.morningstar.com/clientcomm/Morningstar_Categories_US_April_2016.pdf. Index funds and fund-of-funds are excluded from the sample. Net assets for funds with multiple share classes or feeder funds are a sum of the individual share class total net assets. The return, expense ratio, and turnover for funds with multiple share classes are taken as the asset-weighted average of the individual share class observations. Fund share classes are aggregated at the strategy level using Morningstar FundID and CRSP portfolio number. Each fund is evaluated relative to the Morningstar benchmark assigned to the fund’s category at the start of the evaluation period. So, if, for example, a fund changes from Large Value to Large Growth during the evaluation period, then its return will still be compared to the Large Value category index. Surviving funds are those with return observations for every month of the sample period. Winner funds are those that survived and whose cumulative net return over the period exceeded that of their respective Morningstar category index. Loser funds are funds that did not survive the period or whose cumulative net return did not exceed their respective Morningstar category index. Index data provided by Bloomberg Barclays, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices. Bloomberg Barclays data provided by Bloomberg. MSCI data © MSCI 2018, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. FTSE fixed income indices © 2018 FTSE Fixed Income LLC, all rights reserved. S&P and Dow Jones data © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. Indices are not available for direct investment. Their performance does not reflect the expenses associated with management of an actual portfolio. Mutual fund investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost. Diversification neither assures a profit nor guarantees against a loss in a declining market. There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.