|

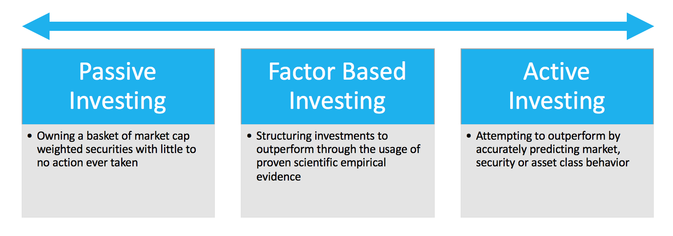

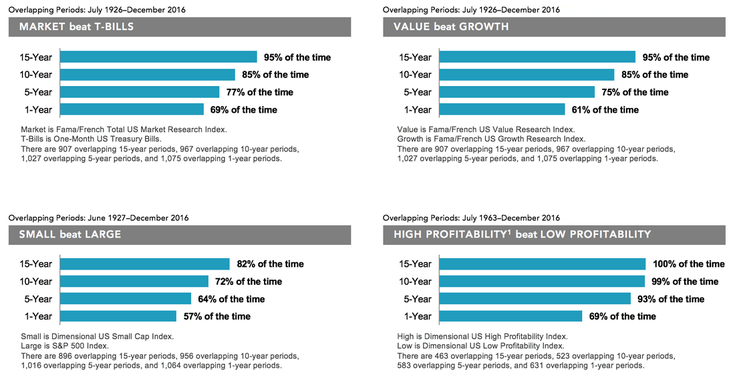

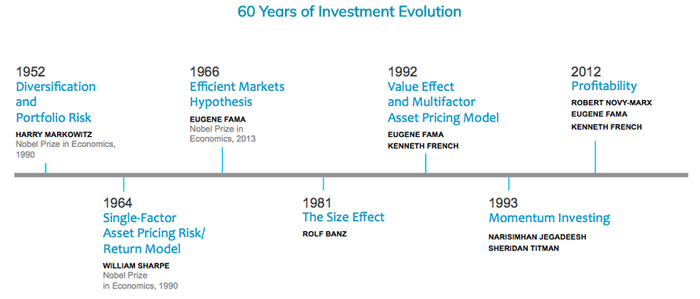

For decades we’ve known about the existence of factors that help to explain expected investment return. “Factor based investing” isn’t a new concept, but it is new to many investors. For one reason or another the terminology, which is widely recognized in financial academia, struggled to find mainstream adoption. Now, for the first time things are beginning to change. Unlike the relentless stream of jargon invented by the financial industry, factor based investing describes an investment approach that’s grounded in science, as opposed to many others which are created to support Wall Street sales pitches. The easiest way to understand factor based investing is to first think about investment management in a very basic sense of either passive or active. The two styles occupy separate ends of a decision spectrum which represents not only the level of activity, but also the type of activity. Factor based investing really sits at the intersection of passive and active management, but in order to truly understand it, we must further define the opposite ends of the spectrum. Pure Passive Index Investing A pure passive approach applies the most simplistic form of expected return predictability. The goal is to closely track the market index in order to replicate its performance while mitigating as many fees as possible throughout the process. Basically, buy it and hold it forever with virtually no activity or human intervention. The predominant passive indexing approach used today hasn’t evolved much over the last 40 years. Market cap weighting or cap weighted indexing assigns a company’s exposure in the index by its overall size in the marketplace. The number of outstanding shares times the share price gives us a company’s market cap, which is then used to determine what % of exposure it gets in the index. Therefore, the largest companies have a bigger impact on index performance than the smallest. For example: The S&P 500 index represents that largest 500 companies in the United States. Apple is just one company yet; it accounts for nearly 4% of the index. Conventional Active Investing Historically, we think about active investing in the context of predicting stock or asset class behavior based upon a number of fundamental or technical indicators. This type of forecasting places a high level of subjectivity in the hands of managers who are charged with making decisions that add value (or alpha as it’s known in the industry), above and beyond what the investor could have received had they invested in the passive index. The managers goal is to outperform. Doing so over long periods of time usually results in a fair amount of stardom and large fund inflows coming from return chasing investors. Passive index style investing has seen a significant popularity growth in recent years largely due to the evidence suggesting a failure of speculative active managers. Yet, it’s inaccurate to portray inactivity as a sound investment strategy based on this fact alone. Our understanding of capital markets and the factors that explain investment return has evolved significantly since the advent of index investing over 40 years ago. Every time a decision is made to adjust a portfolio in some way, even if the decision is to simply rebalance, the investor makes an active decision to move away from the pure passive end of the management spectrum. Factor Based Investing Factor based investing seeks to answer the question: What are the INTELLIGENT active and passive decisions that can be made to improve the risk/return profile of a portfolio? This is where financial science comes in. Factor based investors believe in making decisions based on the evidence reflected in large amounts of historical data. The conventional active investor believes in the possession of a superior skill or intellect which can be used to outsmart the market by seeing things others have missed. The issue with a conventional active approach is that at some stage in the decision making process, the outcome must be interpreted as a reasonable guess, hunch, or gut feeling. In contrast, a factor based approach is always able to reference the historical data and only the data as evidence of rational, thereby removing much of the subjective human element from the decision making process. Factor based investing positively pulls from both active and passive sides of the spectrum. Like passive, it strongly agrees with the idea that attempting to time the market is routinely impossible. Unlike a pure passive indexing, factor based investing recognizes the evolution in our understanding of capital markets and factors that help to explain investment returns. Thus, it actively structures investments in the optimal way to compensate investors for taking risks that are historically worth taking. The supporting evidence Factors such as the following help to explain the reward investors receive for the amount of exposure they maintain to the MARKET as a whole, VALUE companies, SMALL companies and HIGH PROFITABILITY companies. The data going as far back as the 1920’s is reveals these effects which exist not only in domestic markets as listed below, but also across geography and asset classes around the globe. As time elapses over different 1,5,10 and 15 year periods, we begin to see the undeniable effect. Historical Performance of Factors over Rolling Periods These examples make a strong case for structuring portfolios in a manner to target some specific factors. However, one point that’s often left out of the discussion is the importance of diversification. If the research is interpreted to suggest that due to the historical likelihood of value stocks outperforming growth and small to outperform large, a portfolio should therefore ONLY own small and value companies, it has been sorely misinterpreted. The diversification benefits of owning a large number of companies which fall across the growth, value and size spectrum, in addition to fixed income is of critical importance to most investors in order to reduce overall portfolio volatility. Research Pioneers In its purest form factor based investing holds true to objective ongoing research that turns a blind eye to the name or even reputation of any single company. Pioneers of this movement such as Nobel Laureates Harry Markowitz, William Sharpe, Eugene Fama and Kenneth French are unlikely household names to the average investor, but they’re undoubtedly giants of modern finance. They, along with forward thinking industry titans like Vanguard’s Jack Bogle and Dimensional Fund Advisor’s David Booth have helped make the practical application of empirical research possible. The current level of activity and new product development has never been higher. Perhaps the most important thing to understand about factor based investing is that today’s research stands on the shoulders of yesterday. “Eureka” moments are few and far between with most new developments coming in the form incremental improvements to well-founded ideas. I would issue a word of caution, and even a healthy level of skepticism of the financial industry which regularly rushes products to market, citing new research, without fully understanding its validity. Remember, Nobel Prizes don’t grow on trees. Factor based investing isn’t purely active and it isn’t purely passive but a marriage of intelligent research backed ideas from both disciplines. It’s about taking what financial science has given us, evaluating the strongest ideas and filtering through thousands of solutions to find the best translation of those ideas. It used to be a strategy reserved only for the wealthy sophisticated few. Today, I can proudly say that with the help of firms like WealthShape investors from all walks of life have access to evidence based investment solutions that are built on reason, not speculation. *Historical Performance of Factors over Rolling Time Periods Information provided by Dimensional Fund Advisors LP. Indices are not available for direct investment. Past performance is not a guarantee of future results.1. Profitability is a measure of current profitability, based on information from individual companies’ income statements. In US dollars. Based on rolling annualized returns using monthly data. Rolling multiyear periods overlap and are not independent. This statistical dependence must be considered when assessing the reliability of long-horizon return differences. “One-Month Treasury Bills” is the IA SBBI US 30 Day TBill TR USD, provided by Ibbotson Associates via Morningstar Direct. Dimensional Index data compiled by Dimensional. Fama/French data provided by Fama/French. The S&P data is provided by Standard & Poor's Index Services Group. Eugene Fama and Ken French are members of the Board of Directors for and provide consulting services to Dimensional Fund Advisors LP. Index descriptions available upon request. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.