|

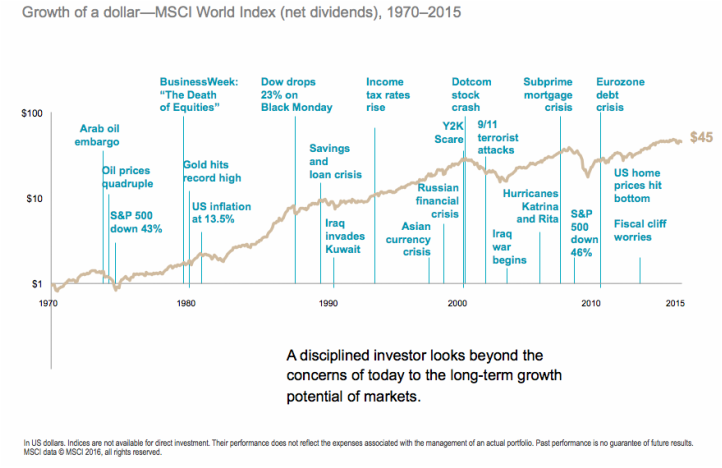

Remember when the weather forecast used to be the most questionable news segment? Meteorologists sat just a step above soothsayers and fortunetellers on the ladder of credibility. In the epically bad movie “The Weather Man,” Nicolas Cage played a local Chicago weatherman who’s poor forecasting ability regularly resulted in milkshakes being thrown at him, as he walked down the street. Ironically, today’s weather forecast, while still difficult to predict, may actually be the hardest news there is. Top stories have always been sold to the public. Be it the paperboy on a street corner yelling, “read all about it” or the flashing breaking news internet icon, viewers, readers, and listeners are attracted by compelling headlines. What’s the biggest change over time? Shock value. Today’s news narrative places a higher value on being the first to report a story, than it does on the accuracy of its content. Headlines sell, and the more outrageous they are the better. Go back in time 10 years. You’ll likely find striking similarities between the look and feel of yesterday’s supermarket tabloids and today’s mainstream news. Financial media outlets are particularly abusive of such dramatization. Just look to the most recent market volatility to see the feeding frenzy of ominous headlines. Truly taking any to heart would make it difficult to leave the house in the morning. Many see the alarmist journalism for what it is, now numb to the “crying of wolf “ on a daily basis. However, if you beat a drum loud enough for a long enough period of time, an echo chamber of fiction can start feeling like reality. How sexy or action provoking is it to broadcast a calming message that everyone should remain disciplined? Stay the course and this too shall pass. Vanguard founder and legendary index investing guru John Bogle rarely gives the media any fear based promotional material. He may have said it best in a recent CNBC interview speaking on the topic or market volatility “Don’t do something, just stand there”. Sound advice but advice that doesn’t sell so well. Television knows that a viewer whose nerves aren’t frayed won’t be a viewer for long. Surveys consistently indicate that consumers are far more prone to listen, click, tune in or read, if the topic presents a clear and present danger to them. Market volatility provides that opportunity. I write on the topic as a simple reminder of the environment we live in. Being aware is the first step to combating it. The media will broadcast an avalanche of statistics that beckon credibility, followed by a hypothetical blame game that will undoubtedly include everything from bloodthirsty capitalists to a broken congress. Terms such as oversold will come from technical analyst’s who scream for relevance and a schizophrenic calling of the market bottom will change from day to day and even hour to hour. Your resolve when it comes to the noise should focus on factual evidence. Remember, by their very nature, markets tend to be volatile, a fact that hasn’t changed throughout history. Resiliency is another fact that’s remained constant. While ups and downs are to be expected, so is long term growth. Patient investors have historically been rewarded for remaining patient during volatile times. The media will always drag out current events, usually reflecting upon them, long after they have passed. Keeping your head and staying disciplined is the correct reaction even if it’s not always the easiest. Like anything else, these things run their course. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life.

Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.