|

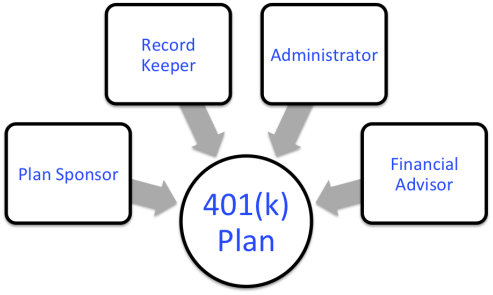

The concept of 401(k) retirement funding is simple enough but very few truly understand how their plan actually works and why they should care. New light has been shed on these employer sponsored retirement plans with the recent passing of the department of labors (DOL) fiduciary rule. When the rule goes into full affect over the next year or so, all financial advice provided to retirement plans will require “Fiduciary” best interests practices. It’s clear; the DOL’s intention was to increase transparency in an environment where so much is unclear. For many investors’ 401(k)’s represent the primary retirement funding vehicle. This column will attempt to decode their complex components in plain English. Plan Sponsor: Your Boss. The business owner at some point decided to establish a retirement plan for the benefit of their employees. Participants in the plan receive tax differed growth plus the added benefit of some percentage of employer matching contributions. The plan sponsor in turn gets a strong recruitment vehicle for attracting employees and tax deductions for plan contributions. Record Keeper: Tracks the assets in retirement plans. They do a lot of other things but their main role is to track how much money you have and where it is allocated. Lot’s of types of money goes into the plan. The record keeper tracks what are salary deferrals (pre-tax or post tax), employer matching contributions, profit sharing contributions, rollovers etc. Administrator: Their function is really the day-to-day operation of the plan including all paperwork, document filing, and testing to keep the plan compliant with all IRS non-discrimination requirements. Financial Advisor: Selects the investments that go into the plan, monitors them for necessary changes and provides oversight and ongoing evaluations of the record keeper and administrator so that the plan sponsor can focus on the business. Ok, so those are the players involved. Here’s where it gets confusing. The fees for these services are often blended together. One specific entity can act in multiple capacities and the cost of these services isn’t always explicitly stated. In most cases you have to dig deep to find out what you’re really paying, as there isn't always a separate invoice for each item. Whether paid by the employer, the employee of both, these costs are real. The trick is finding them. Here’s how.

408(b)(2) Fee Disclosure: Spells out the direct and indirect compensation paid to all service providers. Every plan has one of these documents. When the regulators passed this disclosure requirement a few year back, the intention was again transparency. While this is a great starting point, reading one of these things can look like hieroglyphics even to the trained eye. Nonetheless, it is solid reference for understanding the all in plan costs. It usually comes with the plans annual report which any HR department should have no trouble providing. Fund Expense Ratios: If you still can’t figure out your plans expenses, here’s where you’re most likely to find the smoking gun. When you enrolled in your 401(k) you likely made selections from the list of investment options available. Every single one of those options has expenses associated with it, as indicated by the internal expense ratio. Well, not that entire fee is for the operation of the fund. Some of it is often parceled out to other parties such as the record keeper or administrator. Additionally, I often see mutual fund share classes, which contain commissions or 12b-1 fees that end up going to the financial advisor attached to the plan. As mentioned previously, the DOL has focused its attention on the imprudence of adding commissionable products to retirement plans with the passing of the fiduciary rule requiring advisors to act in the best interest of the plan. In essence the fees for the service providers to the plan can be buried in the expenses of the very funds you select. This causes many participants to think they’re paying next to nothing for their 401(k) plans. Just because fees are difficult to see, doesn’t mean they don’t exist. While I firmly stand as a staunch advocate for transparency, the bundling of these costs isn’t necessarily a bad thing, given they're understandable and reasonable when compared to other plans that are similar to your own. 401(k)’s represent an estimated $4.4 trillion in retirement assets. For years the complexity associated with them has fueled the complacency of employers and employees. Today, I receive more questions than ever, as informed investors take a new interest in decoding their retirement plans. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.