|

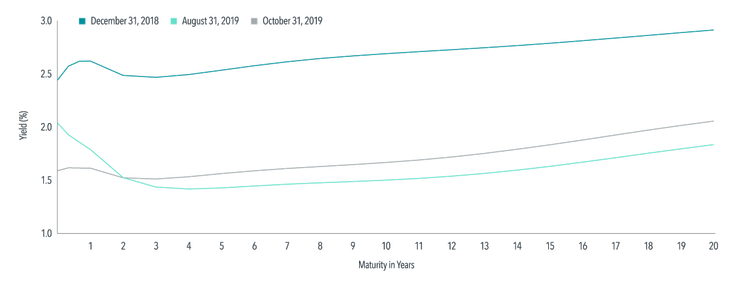

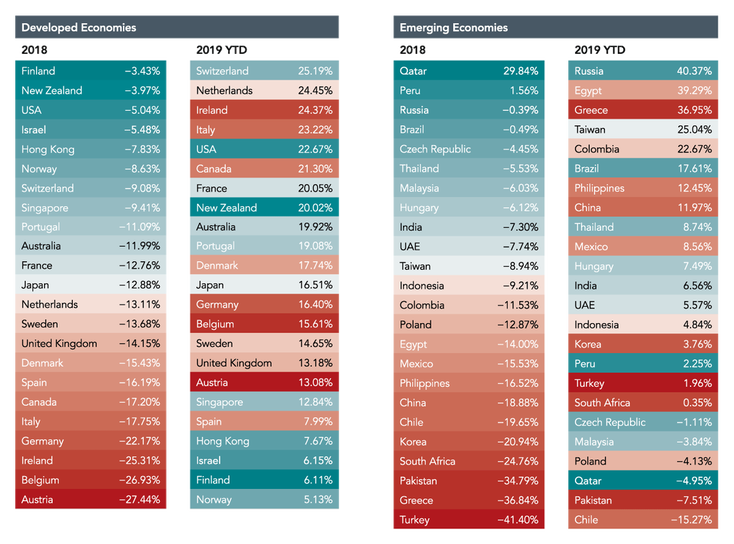

The year 2019 served up many examples of the unpredictability of markets. Interest rates that US policy makers expected to rise fell instead. American consumers’ confidence weakened as the year began, and news headlines broadcast fears of an economic slowdown. But investors who moved onto the sidelines may have missed the gains in the US stock market. As of the end of October, the S&P 500 was up more than 20% for the year on a total-return basis. That puts it on course for the best showing since 2013 should that gain hold through December. The Greek stock market swung from a 37% decline last year to a 37% advance this year. Outside the US, Greece—the site of an economic crisis so dire some expected the country to abandon the euro earlier this decade, and a country whose equity market lost more than a third of its value last year—has had one of the most robust stock market performances among emerging economies in 2019. On top of that, Greece issued bonds at a negative nominal yield, which means investors paid for the privilege of lending the government cash. Taken as a whole, it’s a reminder that the prediction game can be a losing one for investors. Exhibit 1: Shifting Curves Yields on US Treasuries of various maturities since the end of 2018 UP OR DOWN? A closer look at interest rates and the bond market shows just how unpredictable asset performance can be. Going into 2019, Federal Reserve officials expected economic conditions to support raising a key interest rate benchmark twice. Instead, policy makers lowered it three times. In the market for US Treasuries—where market participants set interest rates—the yield curve that tracks Treasuries inverted for the first time in more than 10 years, as seen in Exhibit 1. Some long-term yields fell below some short-term yields over the summer. What’s more, yields on medium- and long-term bonds were at historically low levels at the start of the year, but they fell even lower by the end of October. Investors who made moves based on the expectation yields would rise in 2019 may have been disappointed in how events ultimately transpired. Exhibit 2: Changes in the Ranks Performance of equity markets in 23 developed and 24 emerging economies TRADING PLACES Events weren’t any easier to anticipate in the global equity markets, where no evident link appears between markets that performed well last year and those that have excelled this year, as Exhibit 2 shows. Among the 23 developed market countries, only one country was a Top 5 performer for 2018 and 2019: the US. Last year’s strongest performing market— Finland—ranked 22nd this year through the end of October. Among emerging markets, Greece swung from a 37% decline last year to a 37% advance this year through the end of October. PERENNIAL WISDOM History has shown there’s no compelling or dependable way to forecast stock and bond movements, and 2019 was a case in point. Neither the mainstream prognostications nor the hindsight of recent strong performance predicted outcomes in 2019. Rather than basing investment decisions on predictions of which way debt or equity markets are headed, a wiser strategy may be to hold a range of investments that focus on systematic and robust drivers of potential returns. Investors who were broadly diversified across asset classes and around the globe were in a position to potentially enjoy the returns that the markets delivered thus far in 2019. Last year, this year, next year—that approach is a timeless one. All data is from sources believed to be reliable but cannot be guaranteed or warranted. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. No one should assume that any discussion or information contained in this material serves as a receipt of, or as a substitute for, personalized investment, tax or legal advice. Diversification does not eliminate the risk of market loss. Investment risks include loss of principal and fluctuating value. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Appendix Foresight Isn't 20/20 Shifting Yield Curves: Source: ICE BofAML fair value government spot yield. ICE BofAML index data © 2019 ICE Data Indices, LLC. Changes in the Ranks: Source: MSCI country indices (net dividends) in USD for each country listed. MSCI data © MSCI 2019, all rights reserved. 2019 YTD as of 10/31/19. Note: Emerging economies do not include Argentina and Saudi Arabia, which MSCI classified as frontier and standalone, respectively, prior to May 2019. 1. Based on readings from the Conference Board Consumer Confidence Survey and the University of Michigan Index of Consumer Sentiment. 2. Markets designated as developed or emerging by MSCI. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.