|

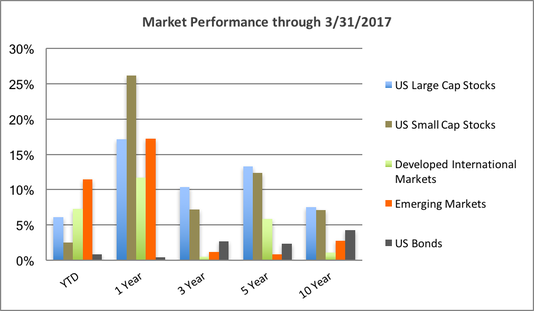

Three months into 2017 markets continued to build on the rally that began shortly after last November’s election. US large companies as measured by the S&P 500 gained 6%, developed foreign markets advanced nearly 7% and emerging markets led the way with over 11% for the quarter. US bonds were relatively flat despite the Fed following through on their promise to incrementally raise interest rates. March 9th marked the 8-year anniversary of the current bull market. It’s not the longest on record (1987-2000), nor is it the shortest. From the 1990’s up until today the S&P 500 has gone from a long bull market to a momentary bear, back to a 5-year bull, leading up to the most recent bear market of ‘08 and finally arriving at today’s bull market. That’s five changes in total, spanning the course of over 26 years. The unpredictable nature of capital markets isn’t news to long term investors, making the significance of the 8-year anniversary essentially a moot point.

Although republicans hold majorities in the house and senate, healthcare reform came and went prior to having a vote. It is yet to be seen when the topic will be revisited as tax reform appears more likely to be the next priority. If anything is predictable in Washington, it’s party gridlock. Until further details unfold, maintaining the status quo is still the best option as opposed to speculating on what may or may not happen. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.