|

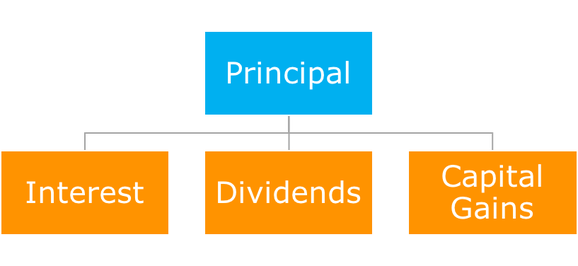

I get a lot of questions about income distribution during retirement. How much can I take? How should my assets be positioned? What types of assets produce the most income? Total return income planning is a holistic approach that takes into consideration your entire portfolio, focusing on the primary drivers of investment growth. The Determinants of Return Obviously, we want our investment to grow over time. The principal we contribute, either initially or periodically through the years serves as the basis for future growth. Return on investment is determined by the combination of interest received from fixed income instruments (bonds, cd’s, money market accounts), stock profit sharing (otherwise known as dividends) and lastly by the gains or appreciation in value. When the time comes to begin generating income from investments, a total return approach looks holistically at the entire picture to systematically deliver an ongoing income stream. Income Requirements First, it’s essential to determine how much income is required, a question that cannot be answered without financial planning/analysis. In one form or another, it begins with figuring out expenses and cost of living during retirement. Next, comes integrating any recurring income from social security, pensions, annuities, etc. The difference between those two numbers represents a basic estimate of the income replacement needed from other investments. The simplicity of this example should not understate the potentially significant impact of things like taxation, inflation, and other estate planning considerations. The next question: Can the principal value of my portfolio plus its future growth through interest, dividends and capital appreciation (i.e. total return) make up the difference? Answer: “It depends.” Total return income planning incorporates a future expected rate of return to a portfolio which is further defined as “all investment accounts and their overall allocation to equity/stock and fixed income/bonds.” Lots of considerations come into play such as the total value, the equity to fixed income ratio; risk/return characteristics etc. Behavior can also have an impact on returns. Therefore, none of these points matter if the portfolio doesn’t fit with the investor's risk tolerance. The Act of Creating Income To supplement the need for income, cash is made available on a periodic basis (usually monthly, quarterly, or annually), by placing trades in one or a variety of the accounts. Tax efficiency is often stressed when determining whether the funds come from Traditional IRA’s, 401(k)’s, Roth IRA’s, taxable Individual/Joint Brokerage accounts or a combination thereof. The process of creating an ongoing income stream continues by following the same steps to replenish the funds needed for living expenses. It’s important to remember that today’s money won’t buy the same amount of goods/services as it will 10 years from now. Therefore, funds not required for current living expenses are efficiently left to grow in order to satisfy future inflation-adjusted income needs. Conclusion Growth and income may be the two most ambiguous financial terms that get thrown around. Total return essentially represents the most holistic incorporation of both. It provides the flexibility for both tax efficient distribution and unforeseen income needs. It also presents the opportunity to reduce cost, as opposed to many accurately maligned investment products containing multiple layers of hard-to-find fees and expenses. All data is from sources believed to be reliable but cannot be guaranteed or warranted. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. No one should assume that any discussion or information contained in this material serves as a receipt of, or as a substitute for, personalized investment, tax or legal advice. Diversification does not eliminate the risk of market loss. Investment risks include loss of principal and fluctuating value. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.