|

What do attorneys, psychiatrists, tax & financial professionals all have in common? While it may feel like a punchline is coming, what I’m referring to is what they offer. Their primary product is intellectual capital, something intangible that we can’t necessarily feel or touch. Patients/clients are tasked with quantifying the value of it. The question is: How? I could argue the following insight is applicable to lots of professions, but coming from a guy who runs a wealth management firm, I’ll keep this commentary on the financial side of the spectrum. Numerous studies have been conducted in an attempt to broadly measure the monetary benefits of working with an advisor. Here, I’ll walk through a simple critical thinking exercise, purely designed to help investors make informed decisions. First, it’s important to point out the human element. Based on our experiences, we all have biases when it comes to interpreting value. Most of us possess situational skepticism’s thanks in part to a daily dosage of fly-by-night quick fixes, aimed at lightening our pockets. If you believe that all physiatrists are quacks, all lawyers are ambulance chasers, or all financial services professionals are salespeople, you probably have a preconception which will inevitably factor into how you value their advice. Personal Due Diligence: A Litmus Test for Seeking Financial Advice

Let’s break those down a bit further. Experience: The question really isn’t whether or not you can do it yourself. The question that’s more applicable is can you do it “well”? The biggest challenge I commonly see with do-it-yourself investors stems from understanding how and why financial planning and investment management are related. After analyzing thousands of portfolios through the years, here are some of the most common deficiencies in no particular order.

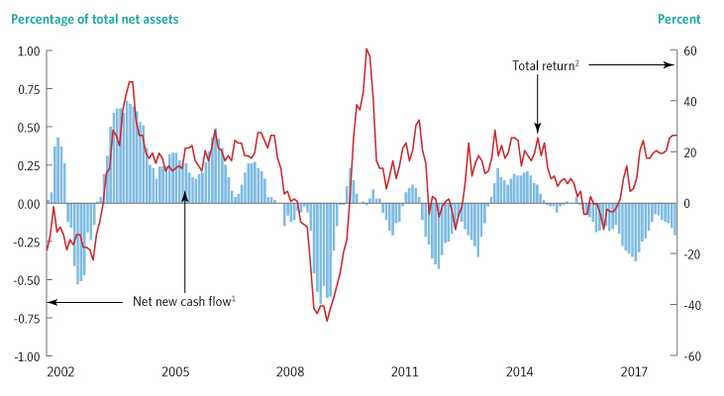

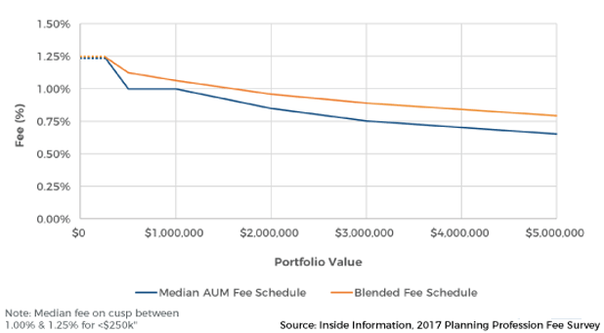

Time: Markets and investment vehicles are constantly evolving. Therefore, investment portfolios should evolve as well. We’re always learning more about expected return and where it comes from. As we do, investment providers are quick to adapt, offering solutions with incremental improvements. The problem is, there’s lots of them. At last check, there were around 7,000 mutual funds and over 2,000 ETF’s (Exchange Traded Funds) in existence. This underscores the importance of recognizing that financial planning isn’t a one-time thing but an ongoing event that requires adjustment with life events. Investments, taxation, insurance and estate planning all need to be working in concert. Collectively, this amounts to a lot more time than many realize, which often leads to a lack of attention. Desire: Does the on-going, in-depth examination of your financial situation interest you or not? If you don’t enjoy working on cars, you’re probably not keen on repairing your own transmission. The concept of hiring professionals in different capacities effectively allows us to spend time doing what we enjoy, or what we do best. Discipline: This goes way beyond the idea of having someone there to hold your hand. Yes, psychology plays a role. However, discipline runs deeper than simply resisting reactions to every market movement. We know it applies to investing, but it must also apply to financial planning. Purchasing a home, having a child, changing jobs, marriage, college, retirement etc. are life events that require sound financial adjustments. When it comes to managing your portfolio, the behavioral impact on investing is well documented. It’s easy enough to say, “disciplined investors have historically been rewarded for maintaining that discipline.” However, doing so requires not only a steady hand but also a dedicated understanding of capital markets and how a host of different scenarios affect your unique situation. We've been through around half a dozen bull and bear markets over the last 30 years. Needless to say, long-term investors are likely to experience a bunch of them over a lifetime. Net New Cash Flow to Equity Mutual Funds Typically Is Related to World Equity Returns Monthly, 2002-2017 Net new cash flow is the percentage of previous month-end equity mutual fund total net assets, plotted as a six-month moving average. The total return on equities is measured as the year-over-year percent change in the MSCI All Country World Daily Gross Total Return Index. Sources: Investment Company Institute, MSCl, and Bloomberg The history of mutual fund cash flows through the years paints a difficult picture for investor behavior. In 2008, we saw large outflows in equity mutual funds right around the bottom of the market. Subsequently, we saw positive cash flows in the ladder part of 2009 and into 2010 long after markets went into recovery mode. Remember the age old adage about being a successful investor “Buy Low, Sell High”? Well, the opposite often happens and emotional discipline is frequently the culprit. Contingency: Confidence in all of the above isn’t enough to ensure a favorable outcome. Many overlook the capacity of their heirs to make sound decisions in the event that they no longer can. Death, disability or incapacity impacts everyone. Prudence dictates an analysis of capable contingencies. Professional Due Diligence: Aptitude, Delivery, Services, Comparatives When weighing the value of financial advice, it’s critical to understand the substantial differences between types of financial advisors. Many lack the credentials or even legal authority qualify what they offer as advice in the first place. Brokers are not advisors and Fee-Based is not the same as Fee-Only. Here, I’ll focus on Fee-Only fiduciary advice, the industry standard for placing the clients’ interests first 100% of the time. Aptitude: This encompasses the combination of experience, education, and reputation. Experience: In finance, there’s little substitute for the seasoned experience an advisor receives through a variety of different market cycles and with a variety of different types of clients. Education: Undergraduate business degree’s and MBA’s demonstrate a commitment to education. Industry designations such as CFP® (Certified Financial Planner) or CFA (Chartered Financial Analyst) further indicate levels of expertise. Reputation: Any due diligence should begin with a baseline evaluation of regulatory history (run a background check). Also, look for specific examples of expertise. Many advisors are active contributors to media outlets. Read columns or interviews to get insight into their investment philosophy or planning approach. Tip: Start with the firm’s website. Services: Carefully understanding what’s included and what isn’t is essential because service offerings are all over the map. Does the advisor provide one-time financial planning services, ongoing investment management services, the combination of both? How much access do you have to professionals? What types of reports and online access do you receive? Delivery: How do you want to interact with an advisor? There’s a cost to doing business. Face to face interaction is costlier than email, phone or video. Therefore, it’s reasonable to expect a premium on face to face interaction. Comparatives: After determining what’s included and what isn’t you can then analyze the market rate for these services. Recent study Conclusion A comprehensive approach to quantifying value helps to diligently explore elements that often get overlooked. Investors should strive to understand themselves, their strengths and limitations before jumping straight into the evaluation of an advisory firm. Starting off with a basic Litmus test helps to solidify the rationale for seeking or not seeking advice. It’s about placing a timeline of personal due diligence in front of professional due diligence with the goal of making informed decisions. Comments are closed.

|

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.