|

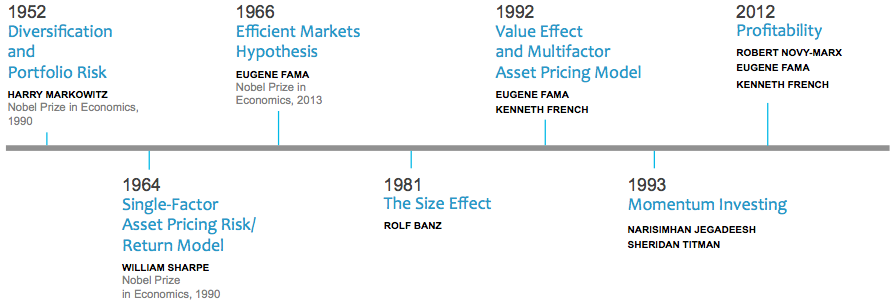

Feature Investopedia Column By Tim Baker It’s the most sought after information in the investment world: where do returns come from? “Expected return” represents the reward an investor can expect for the level of risk they’re willing to take. In truth, the pursuit of expected return really isn’t a search for return itself, but rather the reliable information that helps us to understand what determines it. The journey begins at the intersection of technology and financial science. Thanks to technology’s evolutionary ability to harness massive amounts of data, we know more today than we ever have. With so many ways to evaluate any particular company, the question is: which factors matter most, and which provide the most credible evidence across time, geography and asset class? The objective approach that financial science takes turns a blind eye to the name or even the reputation of any one company. It only cares about the search for reliable information that’s too concrete to dismiss. Over the last 60 years we’ve learned a lot about factors that influence expected return. Research has shown that over 90% of a diversified portfolio’s returns can be explained by its exposure to the market as a whole, to the relative size of the companies within the portfolio, and to their current market trading prices relative to the book value of all their assets. Where Do Returns Come From? Let’s break that down. Why do these factors help us understand where expected return comes from? Start with this simple premise. There are two primary ways to invest in any stock exchange-listed company. Buy equity (stock), or buy debt (bonds). Basically, both are loans where investors supply a company with capital. Your incentive lies with the belief that a return on investment is probable. The tradeoff is your acceptance of risk, for the chosen company’s acceptance of funding. Exposure to the market: So why are stocks riskier than bonds? Bond holders have priority claims at dissolution over stocks. All that means is if a company goes out of business, bond holders get paid first. Whatever’s left goes to the remaining stock holders. This is the generally accepted reason why stocks are riskier than bonds. Furthermore, it’s also the reason why investors should require a bigger potential reward for investing in them. Over the long history of capital markets, stocks have collectively outperformed bonds. Exposure to small-cap stocks: Investing in the market is reasonable for most investors if they are willing to accept the risk/reward tradeoff. Now, what specific types of companies exhibit higher levels of risk? Consider the following scenario: Two companies: Joe’s Coffee Shop and Starbucks both walk into a bank. Both would like to apply for the exact same loan. If I’m the bank owner, which company gets the lower interest rate on their loan? Starbucks of course! They have a longstanding business model with worldwide distribution and tremendous brand recognition. Joe’s Coffee Shop is a small, one-man operation that nobody’s ever heard of outside of a five mile radius. Reward for Risk It’s riskier to invest in the smaller company therefore; the bank should require a higher interest rate on the loan to Joe’s Coffee Shop. Investors have to be compensated for taking on the risk of investing in small companies versus big companies. Historically, the collective group of small company stocks has outperformed the collective group of large company stocks. They should. After all, they’re riskier. Exposure to value stocks: Regardless of the actual size of the company, what about the perceived value of the company? On one end of the spectrum there are “growth companies,” loosely defined as firms whose earnings have grown faster than other’s and are expected to continue to do so. On the other end lies “value companies,” often represented as depressed or out-of-favor businesses whose price is low relative to the company’s actual net worth. Because these value companies have a depressed price, they exhibit higher levels of risk for most investors. This uncertainty requires compensation. As a whole, the collective group of what are deemed value companies has historically outperformed the group of growth companies. They should. After all, they’re riskier. But diversification is still important! A diversified investment portfolio can eliminate the risk of any one particular company, country, sector or asset class from tanking an investor’s portfolio. There’s no such thing as a riskless stock or even a riskless investment. However, markets have historically rewarded different types of risk and therefore, risk helps to explain expected return. How Returns and Information Are Linked The search for expected return is the search for information itself. Unfortunately, not all leads are credible. The financial industry regularly rushes products to market citing new research without thoroughly understanding its validity. The research I’ve mentioned has been published for decades and has multiple Nobel Prize winners attached to it. Contrary to popular belief, there are very few “eureka” moments in the search for expected return. Today’s research more often than not stands on the shoulders of yesterday, building upon itself with incremental adjustments. For this reason, I generally recommend a healthy level of skepticism when the next big investment idea comes along. There’s a good chance it’s the same stuff we already know about just repackaged with attractive marketing. WealthShape’s pledge is we don’t believe anything until it is thoroughly tested in a lot of differed ways. That means weeding through all the research and then the massive number of funds claiming to apply the research to find optimal portfolio solutions.

University of Chicago Booth Professor and Nobel prize winning economist Eugene Fama talks about the evolution of modern finance.

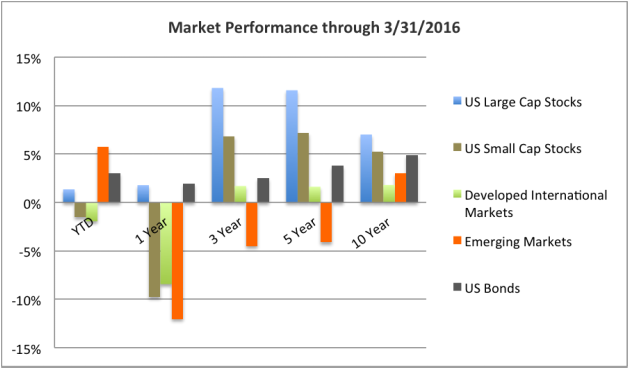

In the span of roughly 20 minutes the highly rated Mississippi offensive tackle, Laremy Tunsil dropped about 10 spots to the number 13 pick in the NFL draft. Moments before the draft began a video of Tunsil smoking an unknown substance from a bong surfaced on his twitter account. The tweet was deleted just minutes after posting but the damage was done. Some analysts estimate the incident may have cost him in the neighborhood of 7 million dollars in salary. However, there was more on display here than costly twitter images. What the draft also demonstrated, was the speed at which information travels, and the subsequent market re-pricing based on new developments. In essence, Tunsil’s draft stock went from an exceptional, can’t miss growth prospect to distressed undervalued gamble. In the weeks and months leading up to the draft, teams scrutinize over the most trivial details surrounding the athletic abilities, physical features and personal lives of potential draftees. 32 NFL franchises set the market for the 253 draft slots. Each team has its own unique set of needs with only a small talent pool to choose from. The consequences for missing with a boom or bust prospect are severe; often costing head coaches their jobs. Run-ins with the law, knee injuries and work ethic all represent elements of risk. While Laremy Tunsil began the draft as an asset many were willing to sacrifice a costly number one pick for, he quickly became a discounted value choice for the eager Miami Dolphins, who never expected him to be around by the 13th pick. On the field few questioned his athletic ability. As a three-year starter in college football’s toughest conference, he kept some of the nations best pass rushers at bay with his size and agility. Teams pay more for players with strong track records due to the expectations that consistent earnings, in the form of on field success, will persist. With Tunsil, the price teams were willing to pay changed in an instant because suddenly he became a heck of lot riskier. Time will tell is his transgressions were momentary lapses in judgment or demonstrations of deep seeded character flaws. In 3 years we’ll know if the 12 teams that passed on him dodged a bullet, or if the Dolphins landed a their next Pro Bowl player at a tremendous value. On Wednesday April 6th the department of labor (DOL) announced a new fiduciary standard of care for brokers who provide retirement advice. Prior to the announcement commission based brokers were held to a less stringent standard of care, requiring only that advice or product offerings be “suitable” as opposed to “in the best interest” of the client. Many fought this decision every step of the way suggesting smaller clients would be adversely affected and compliance costs would sky rocket due to the change. For registered investment advisors like WealthShape, the announcement amplifies the message we’ve always had. For us, solely acting in a client’s best interest was never in question because we’ve been doing it all along. Some believe that this rollout will take place with little fanfare, but not me. Over past few years, I’ve witnessed a change in the publics understanding of the complexities in the financial advisory landscape. Today, virtually all of the new clients coming to WealthShape come with a cursory understanding of the conflicted interests associated with product pushing brokers. You might say the industry was moving in the fiduciary direction anyway; the new rule just speeds up the process. Of course there are exceptions Best Interest Contract Exemption (BICE): Essentially, the same commissionable and conflicted interest practices that were permitted before are still permitted. Here’s the catch. The client must agree to a BICE contract, which provides appropriate disclosure and transparency about the products and compensation received. My only issue with this is that the contract is likely to get buried in the monotony of paperwork just like everything else. Therefore, it is really up to the public to educate themselves on what they’re actually signing. Why it all matters While I’m confident a great many investors eyes have been opened, I know that many are still in the dark on these concepts. This rule will be highly publicized in thousands of media outlets, but lets face it, the word “fiduciary” isn’t exactly a household term. At least now, when the topic turns to financial advice, a greater number of people will ask tougher questions. It’s too early to tell the long-term implications. Heck, with a new administration, the rule could even be overturned, although I think it would be a hard sell. Retirement advice and in particular, qualified plans such as 401k’s and 403b’s are likely to initially fall under a greater degree of scrutiny. Key parts of the rule don’t go into effect until April of 2017, followed by a transition period through January 1, 2018. All in, this paves the way for a greater standard of care. It demands more transparency from brokers and shines a light on the “suitability” vs. “fiduciary” delineation. There were caveats to the rule that I wasn’t the biggest fan of; the largest being it only applies to retirement accounts and not taxable investment accounts along with the best interest contract exemptions. However, while I and others like me believe a fiduciary standard should apply to all investment advice, this appears to be an important step in that direction. Following a rocky start to the New Year, most markets rebounded to end the first quarter of 2016 on a slightly positive note. The S&P 500 recovered during the last six weeks to post positive returns of 1.35% and emerging markets surged to a very strong opening quarter gaining 5.71%. US bonds also rallied with the Barclays Aggregate bond index up 3.03% for the quarter. US small companies and international developed markets finished in negative territory down -1.52% and -1.95% respectively. Markets faced serious headwinds at the tail end of 2015 due to slowing economic growth around the world. Combined with rising interest rates, a strong dollar, and falling commodities prices, we faced a perfect storm of factors that ticked off a stock market correction. However, after falling by as much as 10.5% earlier in 2016, the S&P 500 gained 6.8% in March. Given the roller coaster ride we've had this year, the recent gains are a testament to the resilience of investors. YTD=Year To Date performance through date listed above. Index Data: US Large Cap Stocks: S&P 500, US Small Cap Stocks: Russell 2000, Developed International Markets: MSCI World EX US Index, Emerging Markets: MSCI Emerging Markets Index, US Bonds: Barclays US Aggregate Bond Index Wealthshape Audio Insight Wealthshape Audio Insight

The Robo-Advisor movement with its simplicity, hi-tech efficiency, and low cost has gained the attention of the general investing public. Once thought of as a fad by traditional financial advisors, “Robo’s” have entered the mainstream and appear to be in it for the long run. It’s time investor’s start asking some important questions about what this means for their money. What are Robo Advisors? Most Robo Advisors like Betterment, Schwab Intelligent Portfolios, Wealthfront, FutureAdvisor, etc., operate similarly, walking you through a brief risk tolerance questionnaire that assigns you to a pre built model portfolio based on your answers. Given the fact that they all use passive, market tracking, index based ETF’s (Exchange Traded Funds) to build their portfolios; you’re likely to find the investment experience fairly similar across the board. This makes the differences between them harder to see for anyone trying to choose between providers. Is Robo-advice Advice at All? While there are great things coming out of this movement, investors need to recognize its limitations. Can something designed to offer turnkey automation always act in the specific best interests of each individual investor? To contrast with a similar movement in the law industry, even legal document platforms such as LegalZoom recognize their limitations; fully disclosing “they are not a law firm or a substitute for an attorney or law firm.” To discount the importance of human intervention is to suggest that an algorithm can provide all the necessary guidance to being a successful investor. Research has shown that one of the largest inhibitors to investor success is controlling their own emotions. Dalbar Inc. a Boston based research firm demonstrates the gap in performance based on the 20 year return of 9.22% for the S&P 500 compared to the average equity investor return of 5.02% through 2014. There are many factors that contribute to this performance gap, but behavior can’t be discounted. Most of these providers began gaining serious momentum after the 2008-2009 financial crisis. Betterment and Wealthfront were both founded 2008, Future Advisor in 2010 and Schwab Intelligent Portfolios in 2015. The over 6-year bull market to follow didn’t offer much of an emotional test to the discipline required of buy-and-hold investors. When markets go south, even subtle changes such as adjusting a portfolio to be more conservative until volatility passes can have a significant impact on long-term performance. What safety net exists to ensure decisions are being made based on long-term goals and not emotion? At the very least, the absence of quality human interaction adds some hurdles to the management of investor behavior. Are Robo's Fiduciaries? An advisor acting as a fiduciary is required to place the clients best interests above their own. This one’s tough to answer because it's hard to argue that an all ETF portfolio is the most appropriate vehicle for every investor. Therefore, is the Robo Advisor actually doing what’s in the best interest of each individual client? Even though they may suggest the reasoning for using ETF’s is due to the passive, low cost, research driven investment ideology, you could easily argue that Robo Advisors use them largely because they’re easy and inexpensive to trade. Furthermore, how are the ETF's objectively selected? For instance: are Schwab Intelligent Portfolios being completely objective when using underlying Schwab ETF’s in their portfolios? The same can be said of FutureAdvisor, a company owned by Blackrock that incorporates iShares ETF's. This isn’t a shot at the merits of ETF’s as either a good or bad investment vehicle. It’s a discussion focused on whether or not an all ETF asset allocation is most appropriate for every investor. Technology has always been about becoming more efficient and improving the quality of life. However, it’s important to remember that it has its limitations. I built WealthShape with the idea of reinventing the way quality investment advice is delivered. Technology plays a big role in what I do. The tough questions I’ve asked should be asked by anyone intending to hire a financial advisor, Robo or not. Eventually, if enough get answered, investors will be in a far better position to compare the benefits and drawbacks of each option. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, an advice and investment management firm built on reason and empirical evidence. WealthShape strives to be a market leader in factor-based investing by carefully designing advanced multiple provider portfolios delivered at a low cost to investors from all walks of life. Value stocks underperformed growth stocks by a material margin in the US last year. However, the magnitude and duration of the recent negative value premium are not unprecedented. This column reviews a previous period when challenging performance caused many to question the benefits of value investing. The subsequent results serve as a reminder about the importance of discipline. Measured by the difference between the Russell 1000 Growth and Russell 1000 Value indices, value stocks delivered the weakest relative performance in seven years. Moreover, as of year-end 2015, value stocks returned less than growth stocks over the past one, three, five, 10, and 13 years. Unsurprisingly, some investors with a value tilt to their portfolios are finding their patience sorely tested. We suspect at least a few will find these results sufficiently discouraging and may contemplate abandoning value stocks entirely. Total Return for 12 Months Ending December 31, 2015 Russell 1000 Growth Index 5.67% Russell 1000 Value Index −3.83% Value minus Growth −9.49% Before taking such a big step, let’s review a previous period when value strategies underperformed to gain some perspective. As many growth stocks and technology-related firms soared in value in the mid- to late 1990s, value strategies delivered positive returns but fell far behind in the relative performance race. At year-end 1998, value stocks had underperformed growth stocks over the previous one, three, five, 10, 15, and 20 years. The inception of the Russell indices was January 1979, so all the available data (20 years) from the most widely followed benchmarks indicated superior performance for growth stocks. To some investors, it seemed foolish for money managers to hold “old economy” stocks like Caterpillar (−3.1% total return for 1998) while “new economy” stocks like Yahoo! Inc. appeared to be the wave of the future (743% total return for 1998). Many value-oriented managers counseled patience, but for them the worst was yet to come. In 1999, growth stocks shone even brighter as value trailed by the largest calendar year margin in the history of the Russell indices—over 25%. Total Return for 1999 Russell 1000 Growth Index 33.16% Russell 1000 Value Index 7.36% Value minus Growth −25.80% In the first quarter of 2000, growth stocks bolted out of the gate and streaked to a 7% return while value stocks returned only 0.48%. As of March 31, 2000, value stocks had underperformed growth stocks by 5.61% per year for the previous 10 years and by 1.49% per year since the inception of the Russell indices in 1979. A Wall Street Journal article appearing in January profiled a prominent value-oriented fund manager who regularly received angry letters and email messages; his fund shareholders ridiculed him for avoiding technology-related investments. Two months later he was replaced as portfolio manager amidst persistent shareholder redemptions. With value stocks falling so far behind in the relative performance race, it seemed plausible that value stocks would need a lifetime to catch up, if they ever could. It took less than a year. By November 2000, value stocks had delivered modestly higher returns than growth stocks since index inception (21 years, 11 months). By month-end February 2001, value stocks had outperformed growth over the previous one, three, five, 10, and 20 years and since-inception periods. The reversal was dramatic. Over the period April 2000 to November, value stocks outperformed growth stocks by 26.7% and by 39.7% from April 2000 to February 2001. This type of result is not confined to the technology boom-and-bust experience of the late 1990s. Although less pronounced, a similar reversal took place following a lengthy period of value stock underperformance ending in December 1991. We can find similar evidence with other premiums: • From January 1995 to December 1999, the annualized size premium was negative by approximately 963 basis points (bps), amounting to a cumulative total return difference of approximately 113%. Within the next 18 months, the entire cumulative difference had been made up. • From January 1995 to December 2001, the annualized size premium was positive by approximately 157 bps. The moral of the story? Prices are difficult to predict at either the individual security level or the asset class level, and dramatic changes in relative performance can take place in a short period of time. While there is a sound economic rationale and empirical evidence to support our expectation that value stocks will outperform growth stocks and small caps will outperform large caps over longer periods, we know that value and small caps can underperform over any given period. Results from previous periods reinforce the importance of discipline in pursuing these premiums. Article by: Weston Wellington Vice President, Dimensional Fund Advisors ReferencesPui-Wing Tam, “A Fund Manager Sticks to His Values, Loses Customers,” Wall Street Journal, January 3, 2000.

Paul J. Lim, “Oakmark Ousts Manager Sanborn,” New York Times, March 22, 2000. Standard & Poor’s Stock Guide, January 1999. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. A basis point (BP) is one hundredth of a percentage point (0.01%). There is no guarantee investing strategies will be successful. Investment risks include loss of principal and fluctuating value. Small cap securities are subject to greater volatility than those in other asset categories. Remember when the weather forecast used to be the most questionable news segment? Meteorologists sat just a step above soothsayers and fortunetellers on the ladder of credibility. In the epically bad movie “The Weather Man,” Nicolas Cage played a local Chicago weatherman who’s poor forecasting ability regularly resulted in milkshakes being thrown at him, as he walked down the street. Ironically, today’s weather forecast, while still difficult to predict, may actually be the hardest news there is. Top stories have always been sold to the public. Be it the paperboy on a street corner yelling, “read all about it” or the flashing breaking news internet icon, viewers, readers, and listeners are attracted by compelling headlines. What’s the biggest change over time? Shock value. Today’s news narrative places a higher value on being the first to report a story, than it does on the accuracy of its content. Headlines sell, and the more outrageous they are the better. Go back in time 10 years. You’ll likely find striking similarities between the look and feel of yesterday’s supermarket tabloids and today’s mainstream news. Financial media outlets are particularly abusive of such dramatization. Just look to the most recent market volatility to see the feeding frenzy of ominous headlines. Truly taking any to heart would make it difficult to leave the house in the morning. Many see the alarmist journalism for what it is, now numb to the “crying of wolf “ on a daily basis. However, if you beat a drum loud enough for a long enough period of time, an echo chamber of fiction can start feeling like reality. How sexy or action provoking is it to broadcast a calming message that everyone should remain disciplined? Stay the course and this too shall pass. Vanguard founder and legendary index investing guru John Bogle rarely gives the media any fear based promotional material. He may have said it best in a recent CNBC interview speaking on the topic or market volatility “Don’t do something, just stand there”. Sound advice but advice that doesn’t sell so well. Television knows that a viewer whose nerves aren’t frayed won’t be a viewer for long. Surveys consistently indicate that consumers are far more prone to listen, click, tune in or read, if the topic presents a clear and present danger to them. Market volatility provides that opportunity. I write on the topic as a simple reminder of the environment we live in. Being aware is the first step to combating it. The media will broadcast an avalanche of statistics that beckon credibility, followed by a hypothetical blame game that will undoubtedly include everything from bloodthirsty capitalists to a broken congress. Terms such as oversold will come from technical analyst’s who scream for relevance and a schizophrenic calling of the market bottom will change from day to day and even hour to hour. Your resolve when it comes to the noise should focus on factual evidence. Remember, by their very nature, markets tend to be volatile, a fact that hasn’t changed throughout history. Resiliency is another fact that’s remained constant. While ups and downs are to be expected, so is long term growth. Patient investors have historically been rewarded for remaining patient during volatile times. The media will always drag out current events, usually reflecting upon them, long after they have passed. Keeping your head and staying disciplined is the correct reaction even if it’s not always the easiest. Like anything else, these things run their course. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life.

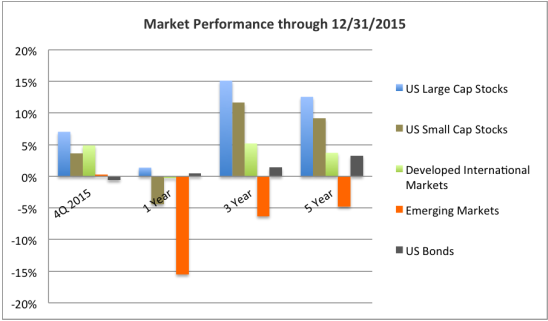

Running in place is perhaps the best way to sum up the market in 2015. It was a record year for the number of times that US stocks crossed the flat performance line, finishing with a slightly positive for US large companies. The up and down ride extended to small cap stocks and international developed markets, which both ended in negative territory. A slowdown in the Chinese economy largely impacted emerging markets, which struggled through most of the year. The US bond market managed to stay positive, anchoring many portfolios through a lackluster 2015. Important developments included a plunge in oil prices, the decrease in unemployment, and the first rise in interest rates in over seven years. Let's begin with one of the more significant changes, which was the tumbling price of oil. Drivers have no doubt noticed the difference at the pump over the last few months. At the start of 2015 a barrel of oil cost $53.45. Currently the price is breaking below $40.00 a barrel, thanks to enormous production by both the United States and Saudi Arabia. Slowdowns in international and emerging markets have also been a factor, decreasing the demand during a time of high production. Unemployment numbers were the next major development. The rate has been falling since the post recession peak of 10% in October of 09, to the most recent reading of 5%. At the beginning of 2015 they were at 5.7%, making the latest drop modest, but not insignificant. The numbers have now reached a lower noninflationary growth level, which is more consistent with historical norms. The last big event of 2015 took place when the Fed raised interest rates for the first time since the 2008 and 2009 financial downturn. The .25% rise up to .50% on the Federal funds rate has been expected for a long time. It was back in December of ‘08 when rates were placed at 0% in an effort to boost the economy after the housing collapse. This was a small first step, which will likely be followed by some gradual increases over the coming year. Generally speaking it’s a good sign for the economy, indicating that the Fed believes it has strengthened, sighting positive jobs and GDP growth. Historically, it’s very difficult to predict any stock market reactions to a rise in interest rates. Some would suggest that the market has been pricing this in for some time now, but as usual; we tend to see short term volatility surrounding events such as these. There are some potential consequences that could be deemed negative such as higher borrowing costs, or fluctuations in long term fixed income instruments. However, this isn’t a certainty. When the Fed raised interest rates in the mid 2000’s, long term rates didn’t go up. Former Fed Chair, Ben Bernanke suggested that it may have been due to savers in countries like China, that were sitting on lots of cash with few places to park it, so they picked the safest place they could find: US government debt. Whether you agree or disagree with this assertion, it does demonstrate that the Fed has a good amount of control over interest rates in the short term, but far less over the long term. Years like 2015 don’t always feel productive. Flat or negative returns never do. However, it’s important to keep in mind that the very nature of capital markets is to fluctuate, and for good reason. If markets only went up, with zero fluctuation, the reward for the investor would justly be smaller. Risk and return are indefinitely related. Our investment philosophy is one that takes into account the historical risk premiums associated with markets; engineering well diversified portfolios, which are prudently built for the long term. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life. Index data: US Large Cap Stocks: S&P 500, US Small Cap Stocks: Russell 2000, Developed International Markets: FTSE Developed ex US, Emerging Markets: FTSE Emerging Index, US Bonds: Barclays Aggregate US Bond

The popularity of index style investing has grown to all time highs. Now that investors have come to recognize it as an intelligent solution, we see the significant development of products marketed as “smart beta”. I get a lot of questions on the topic that goes by a variety of names including enhanced or fundamental indexing. Jargon aside; this column is an effort to put into context this evolution of index investing. Indexing has been around for over 40 years. The initial idea was a simple one. Identify all of the companies that are publicly traded, assemble a list, buy all those companies and weight their exposure based upon their overall footprint. It’s called market cap weighting or cap weighted indexing and it continues to be the largest methodology used today. Over time indexing evolved. Indexes expanded far past the familiar 500 largest companies in America represented by Standard and Poor’s S&P 500. When someone decided to use a different sorting method, (let’s call it non-market cap weighting) to build an index, we entered an era that today many reference as “smart beta.” First, I’m not sure if beta (a well know measure of volatility relative to the market) can work in the context of being “smart.” It’s not doing any thinking nor actively making decisions. It’s simply following the initial programming that it was created with. When you hear “smart beta” think filtered beta. The product creator has decided to sort or filter the index to gain a different type of exposure to the underlying companies. There are an endless number of possibilities, many of which have academic grounds and others that were created because, like many financial products, they’re easy to sell. Identifying which ones are viable can be difficult. Many target well know academic factors such as size, value or momentum. Let’s say that you believe in this research and want to build a value factor “tilt” (more jargon that simply means increased exposure) into your portfolio. Value can be defined with a variety of different metrics (low price-to-earnings, price-to-book, and price-to-sales ratios, and high dividend yields.) Here's where you run into a problem. Which one to use? If it makes sense to target a single factor, doesn’t it may make sense to target multiple factors? Some, such as momentum and value have historically been proven to work well together. However, attempting to blend two separate products to reap the reward may present a problem because of the different ways that the underlying index is defined. Therefore, to achieve the desired exposure, any argument for smart beta should be in the same context of how one fund interacts with the rest of the portfolio. To me “smart beta” isn’t really smart, its just non-market cap weighted indexing that’s been filtered or repackaged. However, that doesn’t mean it’s stupid. Stupid would be investing in fund marketed as “smart beta” because the fund company had a great pitch. We may as well get used to these discussions. Smart beta products are popular and there are tons more coming down the pike. It’s important to understand how one funds interacts with the rest of your portfolio. At Wealthshape it’s our job to filter this environment, separate the fluff, and deliver solutions that have the backing empirical research, not marketing. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life.

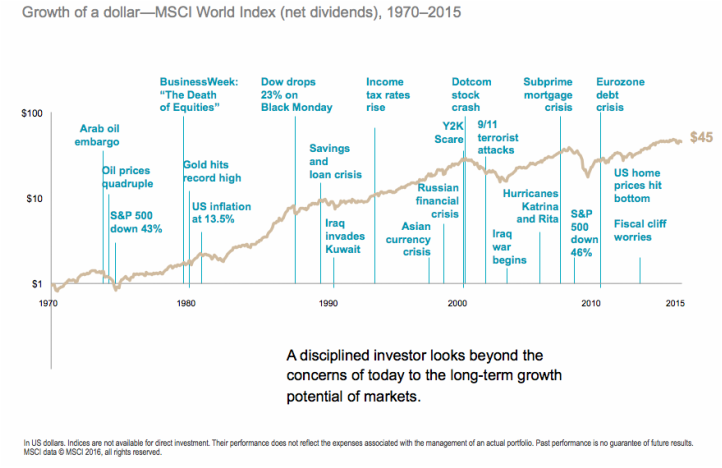

Imagine it’s the year 1999. You’re standing in an airport terminal waiting to depart on a three-hour flight. Fortunate to be in an early boarding group, you leisurely stroll down the jet way, greet the flight attendant and stow you carryon before settling into a window seat. Judging by the modest number of passengers waiting to board, you weigh the odds at about 50/50 that the single seat next to you goes unoccupied. After a long week you welcome the extra elbowroom and begin to make yourself comfortable. That is until you see one last out of breath passenger approaching. With several vacant seats available, the chances are still good. Passing row by row the odds shrink until a short teenage kid with a puffy orange vest claims the seat next to you. He introduces himself as Marty but you already recognized the famous “Back to The Future” time traveler. Disappointment turns to intrigue. Here we are at the turn of a new century and the kid sitting next you already knows what the future holds. Small talk ensues as the plane takes off and reaches cruising altitude. The hour’s pass with talk of flux capacitors and conflicts with Marty’s arch nemesis Biff Tannen. Finally, with 5 minutes left of the flight, you muster up the courage to ask the question that’s been on your mind ever since he sat down. Marty, what do the next 15 years look like and how should I invest? Doc Brown is always telling me to keep my mouth shut about the future “he says”, but ok, just this one time. Over the next 15 years you will witness a major tech bubble along with terrorist attacks on US soil and several others across Europe. Massive storms will cause damage to the Gulf and East coasts. The financial and real estate markets will collapse, and numerous European nations will have to be bailed out due to fiscal insolvency. Timeline is for reference. Marty refused to give specifics. Jan. ‘00–Y2K scare Mar. ‘00–Dotcom crash Sept. ‘01–9/11 Mar. ‘03–Iraq war Aug. ‘05–Katrina Feb. ‘07–Subprime mortgage Feb. ‘08–S&P 500 down 46% Jan. ‘10–Euro zone crisis Dec. ‘12–US home prices hit bottom; fiscal cliff worries The future timeline of terrible things that Marty describes instantly triggers your blood pressure to rise. “I guess the best thing to do is pull all of my money out of the stock market and sit on the sidelines for the next 15 years.” Marty shrugs his shoulders like any modern day teenager would, and gives you a halfhearted “ beats me” before exiting the plane, never to be seen again. This is where the story ends and rationality begins. Most people think that they need an accurate forecast about the future to be a successful investor. There’s always going to be traumatic events that impact financial markets in some way. Talk of bubbles and bailouts won’t cease because the capitalizing media is always waiting for the inevitable crisis waiting just around the corner. What should investors do knowing history is filled with market ups and downs? The answer is “don’t overreact to things that are out side of your control.” Markets are resilient and the evidence backs that up. Over the last 15 years from Jan 1, 1999 to Dec. 31, 2014 the S&P 500 returned an average 5.2% per year. The path to achieving success doesn’t require forecasting. It requires discipline. Sitting on the sidelines for fear of market reactions to events isn’t the answer. You can always find a reason not to invest. For long-term investors the best course of action is to recognize and accept the likelihood that unpredictable events will take place. Being rational during turbulent times isn’t expected to be easy but it beats the alternative. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life.

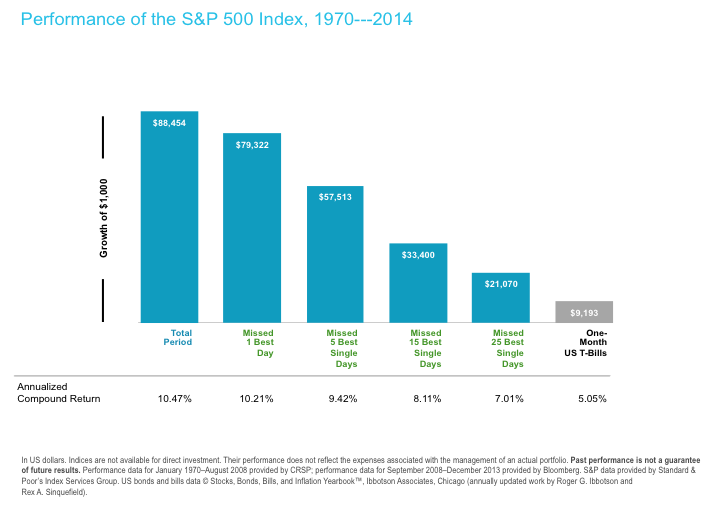

Gamblers are the lifeblood of a casino industry eager to provide a wagering outlet. And why shouldn’t they be? Conventional wisdom tells us “the house always wins.” It’s precisely the reason casinos exist. They’ve studied the evidence and know the most likely outcome. Despite the well-known statistics working against the probability of success, gambling maintains the allure of hungry patrons. The question is: When it comes to investing, who do you have more in common with, the gambler or the house? Choosing to Play the Game From an investment perspective, playing the game involves some form of speculation. It could be timing the market, picking stocks, selecting the next great fund manager, or a combination thereof. With all the above choices, the participant must be willing to accept the odds, which are heavily stacked against them. To be successful in timing the market, you have to make two correct decisions. When do I get out and when do I get back in? Essentially, you’re attempting to predict the news; something that by definition is unpredictable, or else lets face it, it wouldn’t be news. Similar to flipping a coin, each guess is 50/50. That’s the problem with market timing. It’s not good enough to be right once; you have to be right time and time again. The double whammy is being wrong at the worst possible time, like when the market is soaring and you’re sitting on the sidelines. Missing only a few days can have a dramatic impact. What about selecting someone to speculate for you? Unfortunately, research has shown that professional active fund managers fare no better. Paraphrasing a Nobel Prize winner when referencing the around 80% of active managers who underperform the index, Eugene Fama remarked, “It’s the hardest thing for people to accept, that active investment management doesn’t work.” Why? "If active managers win, it has to be at the expense of other active managers. And when you add them all up, the returns of active managers have to be literally zero, before costs. The good ones might be good or they might be lucky. The bad ones might be bad or they might be unlucky. We can't really tell the difference.”

Choosing the House Fully aware of the odds, many wisely choose not play the game, instead putting their faith in the idea that millions of investors are smarter than any single investor. Everybody has some information. The function of the markets is to collect that information, evaluate it, and get it incorporated into prices. In order to beat the market, an investor would have to believe that price was wrong. Therefore, millions of others are collectively wrong. This "if you can't beat the market, why not just buy it" mentality has lead to the dramatic growth of index investing. Indexing has come a long way since it’s inception back in the 1970’s. Oddly enough indexes weren’t even invented to actually be invested in. They were initially created to measure the success of active managers against a standardized benchmark. It was only after time passed that we realized how many managers struggled to outperform. Today, there are thousands of index-oriented products in the mutual fund and ETF variety for investors to choose from. It is worth noting that “the house always wins” investment approach isn’t suggesting that YOU will always win. All markets go through rough patches, fluctuating up and down over the years. Choosing the house doesn’t eliminate that risk. It simply reduces the risk that comes from choosing to play the game. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life. WealthShape isn't a traditional investment advisory firm. It's an idea that came about after years of observation, logic and experience. At various points in my career I've worked as an advisor, consultant, portfolio manager, and vice president for institutional money management firms with billions of dollars in assets under management. It's these experiences that brought about the vision for WealthShape. Investors deserve access to the combination of high quality advice and institutional grade investment solutions that are backed by financial science, not speculation. WealthShape delivers these services while upholding the highest fiduciary responsibility in the industry.

There is so much that the public doesn't understand about the financial industry. Brokers, Advisors, Wire houses, Custodians: all industry titles that most individuals can't tell the difference between. Fee's and expertise: what am I paying, and for what? These are the questions that the world is now waking up to and our goal is to lead the way. A couple of things that every investor should know: 1. An advisor is not an advisor in its truest form unless he or she provides fee based fiduciary advice. Those other guys are called "brokers". They receive commissions on the products they sell and have no responsibility to you other than to make sure that the product they are selling is suitable. 2. It is critical to understand how your money is invested. If the jargon gets too technical, ask questions. Most people spend more time deciding on the features they want in a new car than they do understanding the investment philosophy behind their hard earned money. 3. Costs matter. Insist on transparency. It's been my experience that if you don't know what you are paying, you're often paying the most. The finance industry has a lot of ways to disguise fees. Some come in the form of commissions, upfront sales charges or internal expenses that are often wrapped together. These are basic but powerful ideas that I have been vocal about for over a decade. At WealthShape our influences come from evidence and academia. We are dedicated to ongoing research and its application to the real world. It's what drives the evolution of our investment strategies. The research we put our faith in is subject to rigorous peer review. It's published, critiqued, and scrutinized by the world. Our pledge is to make high quality advice and high quality investment solutions available to everyone. Let the movement begin. Timothy Baker, CFP® is the Founder and CEO of Wealthshape LLC, a firm built on the belief that investment advice should rely on long term, proven academic evidence and everyone should have access to it. Wealthshape engineers advanced, institutional grade portfolios that are responsibly delivered at a low cost to investors from all walks of life. |

By Tim Baker, CFP®Advice and investment design should rely on long term, proven evidence. This column is dedicated to helping investors across the country, from all walks of life to understand the benefits of disciplined investing and the importance of planning. Archives

December 2023

|

|

Phone: 860-837-0303

|

Message: [email protected]

|

|

WINDSOR

360 Bloomfield Ave 3rd Floor Windsor, CT 06095 |

WEST HARTFORD

15 N Main St #100 West Hartford, CT 06107 |

SHELTON

One Reservoir Corporate Centre 4 Research Dr - Suite 402 Shelton, CT 06484 |

ROCKY HILL

175 Capital Boulevard 4th Floor Rocky Hill, CT 06067 |

Home I Who We Are I How We Invest I Portfolios I Financial Planning I Financial Tools I Wealth Management I Retirement Plan Services I Blog I Contact I FAQ I Log In I Privacy Policy I Regulatory & Disclosures

© 2024 WealthShape. All rights reserved.